China’s economy cooled again in October, with industrial output, fixed asset investment and retail sales missing expectations as the government extended a crackdown on debt risks and factory pollution.

Beijing is already in the second year of a campaign to reduce high levels of debt as authorities worry that riskier lending practices, especially in the real estate sector, could imperil the economy.

Data on Tuesday suggested policy makers are making progress in defusing financial risks by weaning China off its years-long addiction to cheap credit, and signalled moderating growth over the next few quarters.

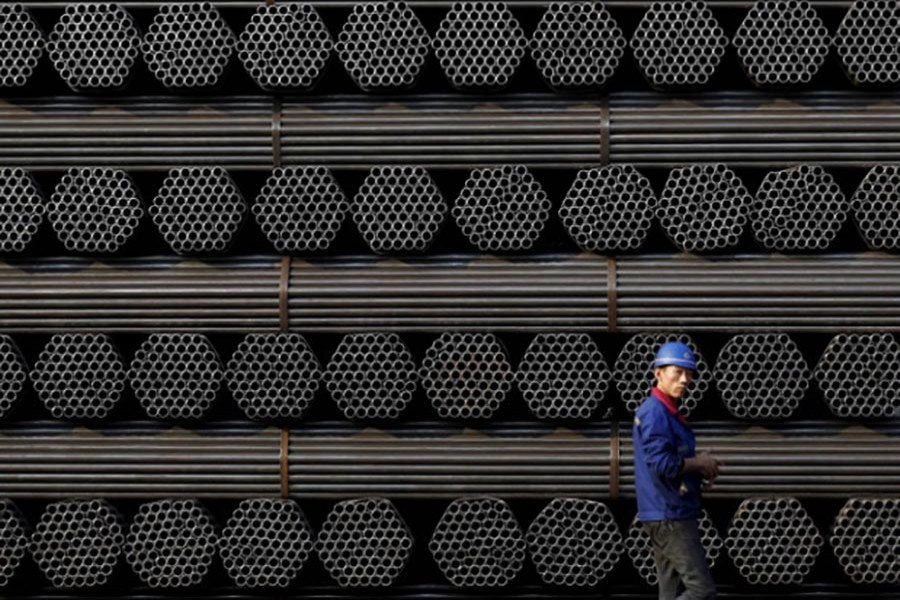

Industrial output rose 6.2 per cent year-on-year in October, the National Bureau of Statistics (NBS) said, missing analysts’ estimates of a 6.3 per cent gain and lagging a 6.6 per cent increase in September.

Fixed-asset investment growth also slowed to 7.3 per cent in the January-October period, from 7.5 per cent in the first nine months. Analysts had expected an increase of 7.4 per cent.

In the property sector, where authorities have tightened rules to flush out speculative financing that has helped drive a two-year boom, sales and new construction starts fell in October, reports Reuters.

Property investment growth also cooled to 5.6 per cent in October year-on-year, from 9.2 per cent in September, Reuters calculated from National Bureau of Statistics data out on Tuesday.