The strength of the automotive industry will play a major role in Japan's continued trade growth, say the findings of the Global Trade Barometer released on Wednesday by DHL, the world's leading logistics company.

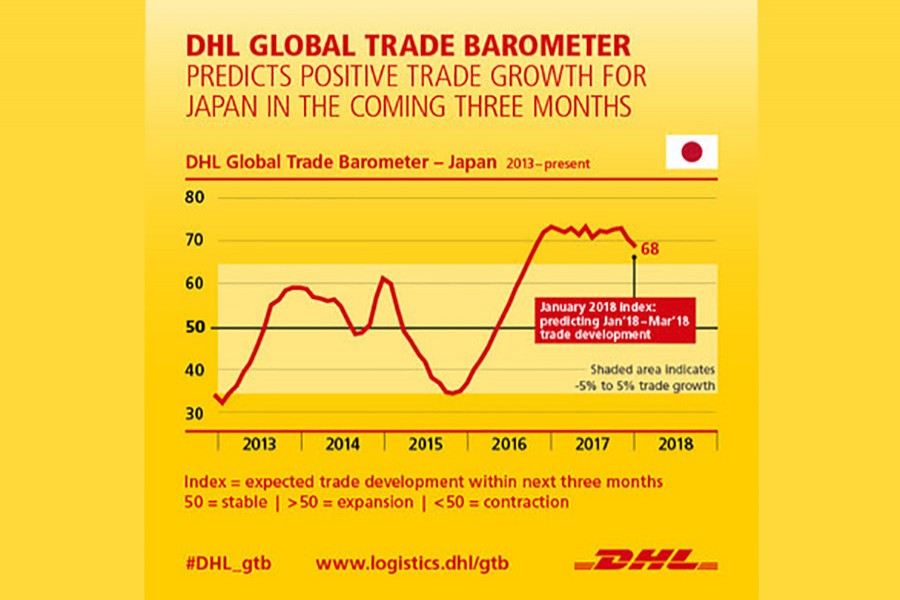

The first ever Global Trade Barometer, an early indicator of global trade developments calculated using Artificial Intelligence, Big Data and predictive analytics, predicts that Japan's near-term trade growth will remain positive, albeit less than recent months due to an expected slowdown in global automotive demand.

It found that land vehicles and their parts, along with industrial raw materials, continue to have the greatest impact on Japan's growth trajectory, with both sectors expected to continue growing, although at slightly lower rates, in the first three months of 2018.

"The results of the DHL Global Trade Barometer justify cautious optimism for Japan's short-term economic prospects, in line with industrial output showing recent signs of positivity[2] and Japan's overall GDP continues to grow,[3]" said Charles Kaufmann, President/Representative Director -- Japan K.K, CEO, North Asia, Head of Value Added Services -- Asia Pacific, DHL Global Forwarding.

"However, Japan's economic future remains largely tied to its automotive industry. Businesses in Japan will continue to benefit while as automaker sales continue to rise, but they should be wary about the potential flow-on effects of a longer-term downturn in automotive demand worldwide."

The impact of the automotive industry will be felt most keenly in Japan's air trade, which is expected to slow slightly -- yet remain strongly positive -- as a direct result of weaker automotive demand. However, the Barometer suggests that air freight's growth will continue to significantly outpace that of ocean freight, which remains stable thanks to sustained imports of commodities and industrial materials.

"Japan's auto exports have risen significantly over the past two years,[4] so it's no surprise that the sector may show some signs of cooling as global demand plateaus," added Charles Kaufmann. "What's promising is that demand for basic and industrial raw materials remains stable, suggesting that Japanese manufacturers across the board are well-placed to consolidate and grow their market positions internationally.

And with relatively strong outlook for other value-added sectors like technology, capital equipment & machinery and consumer fashion, Japan's economy appears to be on track to greater diversification, even as the automotive industry continues to power its path to medium-term growth."

Developed jointly by DHL and Accenture, the Global Trade Barometer provides a quarterly outlook on future trade, taking into consideration the import and export data of seven large economies: China, South Korea, Germany, India, Japan, the United Kingdom, and the United States, according to a Media Outreach-sent press release.

Together, these countries account for 75 per cent of world trade, making their aggregated data an effective bellwether for near-term predictions on global trade. The Global Barometer, which assesses commodities that serve as the basis for further industrial production, predicts that global trade will continue to grow in the next three months, despite slight losses in momentum.