Some macroeconomic and fiscal challenges surface on the Bangladesh economic front, including the fast-growing balance-of-payments (BoP) deficit, economists at a review meet Tuesday cautioned.

A government minister echoed some of their concerns and all stressed addressing the problems immediately, failing which the situation could go "out of control".

Dr Ahsan H. Mansur, executive director at the Policy Research Institute of Bangladesh (PRI), said let alone the BoP, the fiscal side is also facing some troubles, including squeezing tax-to-GDP ratio.

He finds subsidy bill growing significantly in recent months while the annual development programme (ADP) schemes now being prepared on borrowed money.

"The pressing issues need to be addressed immediately, within months, even within the weeks, and should be done forcefully. Otherwise, situation will go out of control," Dr Mansur said while speaking on the state of Bangladesh economy in 2021 at a discussion titled 'After the pandemic onslaught-economy on strong recovery path'.

He finds BoP pressure building up, as the 'kerb' market remained up while the central bank has been depreciating its currency gradually.

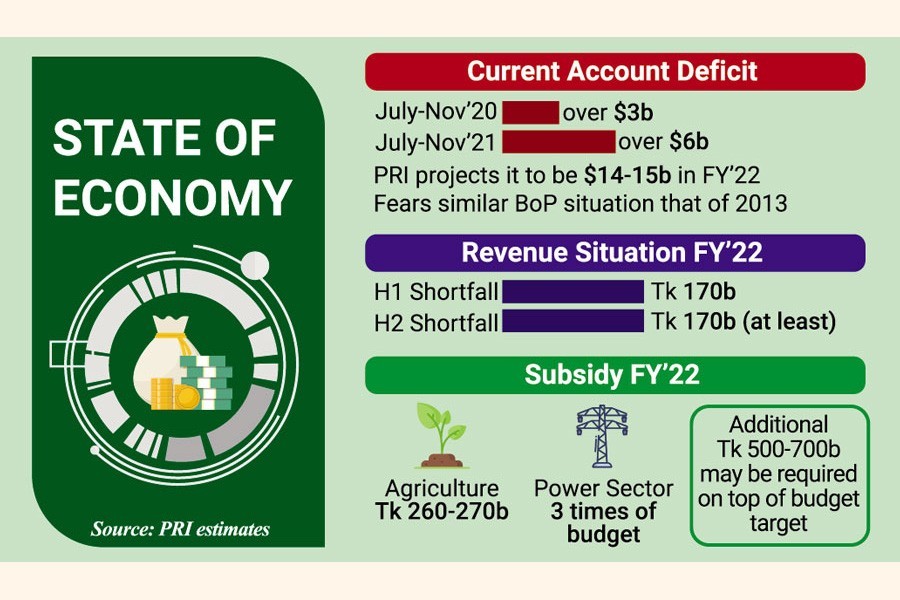

"The current-account deficit now has recorded $6.0-billion plus in five months of the fiscal year while it was $3.0-billion plus during the same period a year before," he says about one of the macroeconomic imbalances.

He also points out that import is increasing at a rate of 54 per cent while export is growing at a much smaller pace. The remittance inflow is declining, in another factor of disproportion in balance- of-payments sheet.

Dr Mansur, who had worked at the IMF as division chief, predicts: "If this trend continues, the current-account deficit will be in the range of $14 billion to $15 billion."

He posed a question under such situation: Who will fund it?

He further foresees that the NBR revenue receipts may fall by Tk 350 billion. "We have already had Tk 170-billion shortfall in the first half of the fiscal year so in another six months it will fall at least by another Tk 170 billion."

On subsidy bill, the economist says agriculture subsidy will be enhanced at least three times to Tk 260 billion to Tk 270 billion while the power subsidy will be up three times of the budgetary target.

"To my calculation, an additional Tk 500 billion to Tk 700 billion will be required for the subsidy bills."

Turning to borrowings-funded ADP, the PRI executive director finds ADPs now being fully funded with borrowings - either from domestic or external debt markets.

"It may be 60 per cent or 70 per cent, if not 100 per cent," Dr Mansur commented.

In a flashback on a similar situation of the BoP, in 2013, Dr Mansur suggests Bangladesh Bank should be proactive now, too, as during the 2013 situation. A meeting with the central bank, then, had suggested Tk 10-a-day depreciation to come to grips with the situation.

On inflation challenge, Dr Mansur describes this as a global phenomenon, difficult to manage.

He says people should not panic over the omicron variant rather, he suggests, the economy should be kept open by maintaining proper health protocols.

PRI organised the programme on virtual platform. Planning Minister MA Mannan joined it as chief guest. PRI chairman Dr Zaidi Sattar presented keynote paper.

Ms Waseqa Ayesha Khan MP joined the function as a special guest. Another special guest was President of the Foreign Investors Chamber of Commerce and Industry (FICCI) and chief executive officer of Standard Chartered Bank Bangladesh Mr Naser Ezaz Bijoy.

President of Dhaka Chamber of Commerce and Industry Rizwan Rahman, president of Bangladesh Garment Manufacturers and Exporters Association Faruque Hassan and former BKMEA president and managing director of Plummy Fashion Md Fazlul Hoque spoke at the programme.

BIDS research director Dr Monzur Hossain and SANEM research director Dr Sayema Haque Bidisha were distinguished panellists.

While delivering speech as chief guest, Planning Minister Mr Mannan said many, including the IMF, have been giving claps for the economic performance of Bangladesh. But he has a premonition that the country's economy may face a "trap-like situation" in the long run.

The planning minister believes the growth or stimulus or policy support to industries needs to be assessed properly.

"I, as an amateur, feel doubt whether the country could fall into trap like some economies of Latin America, even some of East Asian economies," he tells the audience in virtually ringing the alarm bell about downside risks.

He sees need for a far-reaching effect assessment.

"GED [general economic division] will do-you can also assess."

BIDS research director Dr Monzur Hossain noted that the remittance inflow was better when the informal or illegal channels were closed during the pandemic.

On higher exports, he attributes the trade growth to global trend as the opening up of the western economies has created demand for Bangladesh clothing.

"The most worrying situation of the economy is poor collection of revenues despite the opening up of the economy," he says.

Dr Bidisha noted that child marriage spiked during the covid period. She suggests some of the social-safety programmes may be attached condition of reducing the dropout in education, and nutrition.