All the financial sub-sectors recorded decline in their growth rates in the immediate past fiscal year (FY 2019-20). The sub-sector (monetary intermediation) had the worst time in many years.

Overall the financial sector's contribution to the gross domestic product (GDP), however, dropped only nominally during the period under review.

The ongoing Covid-19 pandemic did cause disruptions to the sector in the final quarter of the year. But loan scams, soaring non-performing loans (NPLs), problems with interest rates and low demand for funds from the private sector, among others contributed to the substantial decline in the growth of the financial sector, according to experts.

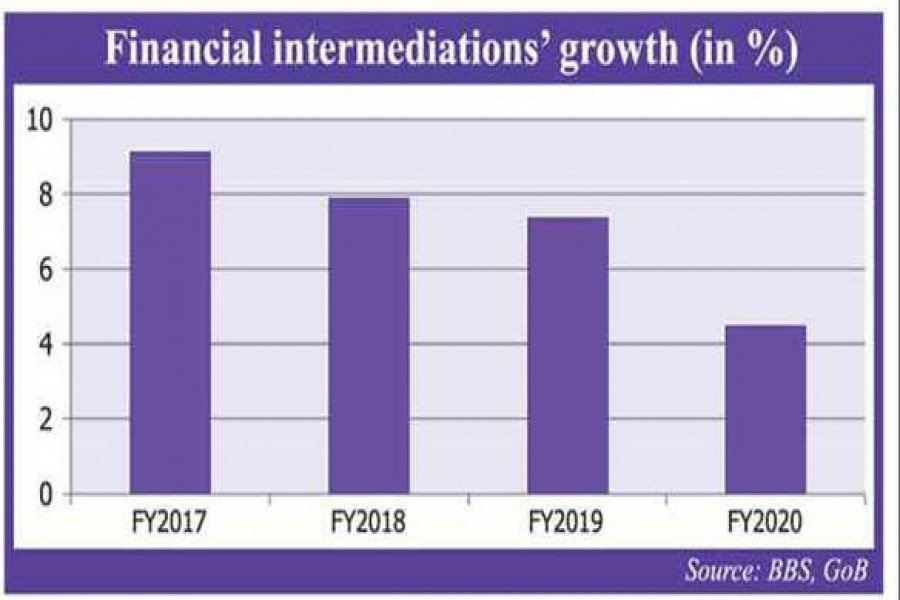

According to the Bangladesh Bureau of Statistics (BBS) data, the financial sub-sector's growth dipped to 4.46 per cent in FY 2020 from that of 7.38 per cent in FY 2019.

Its contribution to GDP was 3.39 per cent in FY 2020, which was 3.42 per cent in FY 2019.

The economists said the ongoing coronavirus pandemic hit hard the banking sector transactions in the last quarter of FY 2020, but the sector's growth should not have dropped by such a big margin.

The service sector's growth also dropped by 1.46 percentage points to 5.32 per cent in the FY 2020. But the same in the financial intermediation sub-sector fell sharply by 2.92 percentage points.

Economist Dr Ahsan H Mansur told the FE that the overall economic scenario had not been that satisfactory during the last three years.

"Declining export and import, falling revenue receipts, lower credit flow, higher NPLs, and bad condition of the capital market are the major reasons for the fall."

With erosion in people's confidence in the financial sector, the economy did fail to expand at the expected rate over the years, Dr Mansur, also Executive Director of the Policy Research Institute, told the FE.

Had the government been able to good governance following the scams involving the Hall-mark, Bismillah Group, Crescent Shoes, Farmers' Bank, and the central bank's reserve heist etc, public engagement in the financial market would have increased further.

Since the previous scams were not addressed properly, many people could not keep their trust on the banks, which has been reflected in their annual growth trend over the last three years, he added.

Dr Sajjad Zohir, Executive Director of the Economic Research Group, said the GDP calculation is an accounting exercise, measuring value additions from market-based economic activities in a year.

"Generally GDP in financial services closely follows the size of activities in real sectors, production and trade. Since GDP growth in Bangladesh's real economy decreased last year, it was expected that GDP growth in financial sector would also decline during that year."

He also added that poor loan recovery in the banking sector may have led to huge write-offs that reduced financial assets, without necessarily reducing income in that sector by same proportion.

Current policy to push credit under the stimulus packages without guarding against risk may further undermine performance of the banking sector, he added.

The FE analysis has found that the GDP growth at the financial intermediations had started experiencing the decline since FY 2018, which also persisted until FY 2020.

In FY 2017, performance of the banking sub-sector was the best in recent years, as it expanded at 9.12 per cent rate from that of 7.74 per cent in FY 2016, the BBS data showed.

Growth rate of the insurance sub-sector also recorded a fall by 0.91 percentage points to 4.05 per cent in FY 2020 from that of 4.96 per cent in the previous fiscal.

Similarly, growth rate of the other financial auxiliaries sub-sector also dropped by 2.07 percentage points to 9.48 per cent in last fiscal compared to that of 11.55 per cent in FY 2019.