The government ought to adopt a balanced instead of expansionary approach in preparing the upcoming budget, as fiscal space keeps narrowing, economists and experts said Thursday.

According to them, the pressure builds up as the public expenditure has been going up rapidly with uptrend in net foreign borrowing but revenue is not increasing with that speed. It shrinks government capacity to pay.

Under such circumstances, they suggested lessening public expenditure through rationalising subsidy with a call to make a balanced budget, focusing more on the execution of existing projects instead of taking new ones to avert the risk of time and cost overruns.

The suggestions and observations came at a Financial Express-Policy Research Institute (PRI) dialogue on the national budget for Financial Year (FY) 2022-2023, held at the PRI conference room.

PRI chairman Dr Zaidi Sattar moderated the discussion, titled 'Resource mobilisation for sustainable growth'. In the event, the FE made a keynote presentation on the state of revenue and worries on the fiscal front.

PRI executive director Dr Ahsan H. Mansur told the meet that revenue is not increasing with the speed of the country's economic growth and the dissimilarity has concerned them.

He feels that the country might go for high risk if it implements too many projects with the lesser collection of revenue.

Giving some statistics, he said the net foreign borrowing rose to over Tk 970 billion in FY'21 from around Tk 50 billion in FY'15.

"The trend is not so good," he told the meet.

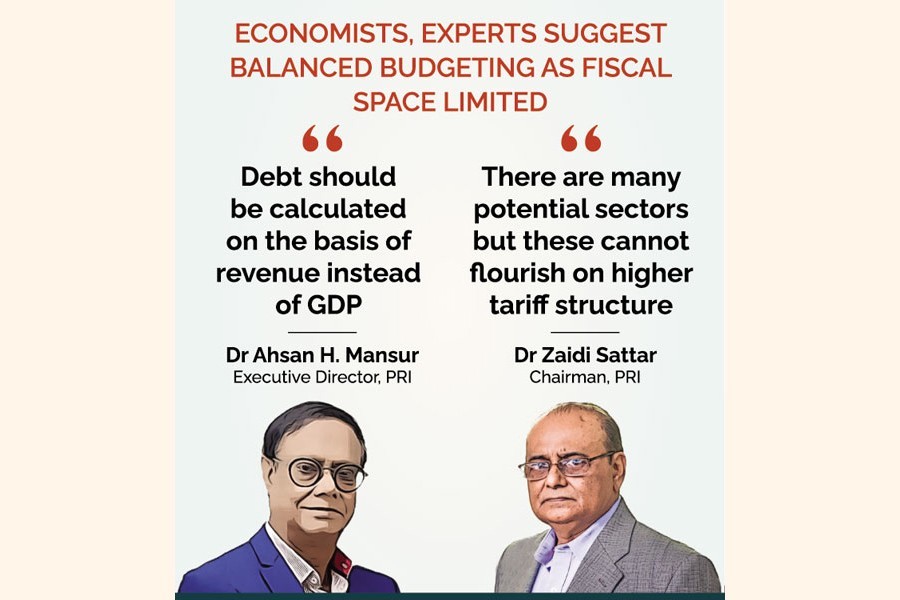

Dr Mansur said the debt should be calculated in proportion to revenue instead of GDP (gross domestic product). He said the capacity of the government to pay and the capacity of the economy to pay are two different things.

"There is a possibility of becoming bankrupt if the government does not have money. Bangladesh government does not have the money," he said.

Expressing his concern over growing interest and subsidy bills coupled with wage and pension benefits, he said the subsidy would cross Tk 1.0 trillion, which is equivalent to one-fifth of the budget.

"The government is relentlessly increasing its expenses without thinking of its consequences," he said, with a suggestion of rationalisation of the subsidy.

Former finance adviser of a caretaker government Dr A. B. Mirza Azizul Islam notes that the average rate of poverty reduction keeps falling over the last 5 years while the regional disparity both in terms of income and poverty incidence continues to widen.

"What is important is to expand social safety-net coverage and what is more important is to create employment opportunities," he said.

Highlighting the importance of raising revenue, he said there are people who qualify for paying tax but did not. "It needs to be addressed. Supplying receipt to customers also needs to be ensured to prevent the tendency of VAT dodging."

Talking about concern of projects becoming time-and cost- overrun, Dr Islam said there is a huge gap between financial setting of the approved projects and actual allocation.

"So, the projects which are supposed to be completed in five years end in 10 or 12 years because of inadequate allocation that leads to time-and cost overrun. Now, we need to see how these issues are addressed."

PRI chairman Dr Zaidi Sattar said there are many potential sectors like RMG but these cannot flourish due to the higher tariff structure, which encourages entrepreneurs to concentrate on domestic market because of higher profit margin.

He was suggesting rationalisation of the tariff structure for making the country a truly export-led one.

Bangladesh Institute of Development Studies (BIDS) research director Dr Monzur Hossain said the number of projects keeps increasing but the allocation continues squeezing. It takes too much time to complete a project.

"Under various challenges, we should not go for expansionary budgetary option, we should take a balanced approach with full attention on the existing projects instead of new ones," he said.

Dr Hossain was favouring continuation of the subsidy considering various challenges.

PRI director Dr Ahmad Ahsan said Bangladesh needs to be cautious in managing macroeconomic factors to avert any economic crisis.

He was recommending transparent review of the public projects to ensure quality of the investment.

Former member of Bangladesh Tariff Commission Dr Mostafa Abid Khan said the name of customs collectorate changed into customs commission but role of customs officials still remains as a collector, which is unexpected.

He said the customs officials pay high attention to preventing under-invoicing as it causes revenue shortfall but they did not look at the over-invoicing although it leads to capital flight.

"They (customs) should pay serious attention to over- invoicing issue," he added.

Former NBR member Farid Uddin said the revenue board passes most of its time on revenue collection. It does not give enough time on policy enforcement.

"It should be separated as it is contradictory," he said.

Professor at the Department of Economics, the University of Dhaka, Dr Bazlul Haque Khondker said the country cannot properly utilise the blessings of the demographic dividend as the number of unemployed youth is on the rise.

"We cannot create decent jobs for them," he added.

"Half of the population constitutes women but this segment needs to be well-integrated in the budget. We should give serious focus on them in the budget," he suggests.

FE Editor Shamsul Huq Zahid gave vote of thanks to the participating guests in the discussion.

The FE keynote, presented by FE planning editor Asjadul Kibria, says that the NBR should opt for research-based taxation instead of traditional strategy.

"The NBR should focus on revising the price of lower-and middle segment of cigarettes that accounts for more than 70 per cent of total consumption."

It says the poor who have limited access to healthcare facilities have been smoking most as the lower-and middle segment of cigarettes remained cheaper. It suggested raising price of low segment cigarettes to help the NBR mobilise increased volume of revenue.

It says there is need for reduction in VAT on construction materials before prices go out of control and in the interest of booming real-estate sector.

The FE presentation suggests the corporate tax for mobile- phone operators should be 25 per cent for listed and 32 per cent for non-listed ones.

It says the NBR should continue reforms, including digitization.

The FE, however, notes that supply-chain disruption emerged as a serious problem for the economy.

"Global inflation hike and Ukraine war have added a new dimension."

It notes that the rise in inflation and war in Ukraine cast cascading impact on commodity prices in particular.

As such, the NBR and the central bank may intervene as a measure of managing the rising inflation.

[email protected] and [email protected]