Economists and business leaders on Tuesday unequivocally criticised the existing budgetary provision for legalising 'black money' and said the opportunity is biased against the honest taxpayers.

They also urged the government to frame a 'pandemic-focussed' budget for the upcoming fiscal year (FY) rather than being obsessed with the GDP growth data.

There should be substantial allocations for vaccination, new poor, micro, cottage, small and medium industries and tax incentives for luring investment in key economic sectors, they said.

They made the observations and suggestions at a virtual pre-budget webinar titled 'Macro Economy: Expectation from National Budget 2021-22'. The Institute of Chartered Accountants of Bangladesh (ICAB) and the Economic Reporters' Forum (ERF) organised the event jointly.

Dr Mashiur Rahman, economic affairs adviser to the Prime Minister, attended the webinar as the chief guest.

Senior economists, presidents of major trade bodies, researchers and accounting professionals took part in the discussion, moderated by former president of ICAB Mr Humayun Kabir.

ICAB president Mahmudul Hasan Khushru delivered the welcome speech while vice presidents Sidhartha Barua and Md Abdul Kader Joaddar, and council member of ICAB Mohammad Forkan Uddin also spoke at the webinar.

Dr Mashiur Rahman said reforms in the financial and revenue sectors need to be carried out throughout the year while tax collection should be increased in line with the market value of goods and services.

He also suggested people not to depend only on the government for health services that are running at full capacity.

Dr Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue (CPD), said the government should now concentrate more on spending in the priority sectors only rather than thinking about the budget deficit.

"It is unfortunate that we are neither able to earn nor spend," he added.

He laid emphasis on employment generation and providing benefits to the domestic manufacturing sectors by revisiting the import benefits.

"Some in-built weaknesses remained since the pre-Covid period. Those include poor revenue mobilisation and sluggish investment," Rahman said.

Dr Rahman also suggested reinstating 30 per cent highest tax rate for individual taxpayers and discontinuing the black money whitening scheme.

He said that the well-off section of the society got the benefit of reduction of highest tax rate by 5.0 per cent which is an anti-equity measure.

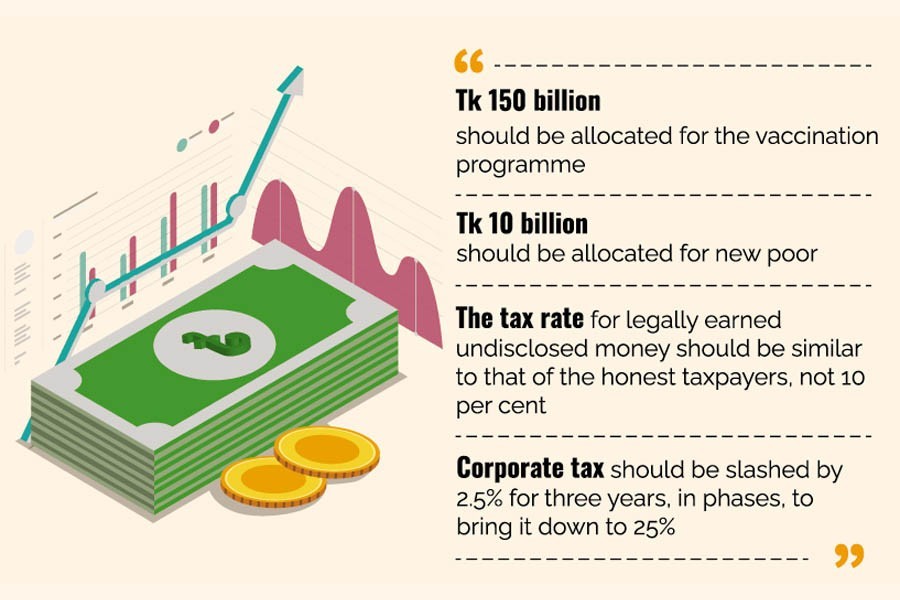

Dr Ahsan H Mansur, executive director of the Policy Research Institute (PRI), felt that at least Tk 150 billion should be allocated for the vaccination programme.

He also suggested extending support to develop the capacitates of domestic industries on vaccination.

Strategic investment is also required to ensure vaccination supply, he added.He proposed allocation of Tk 10 billion for the new poor.

The government should focus on reforms rather than imposing huge revenue target which is not achievable, he said, adding thatspending the allocation is necessary to reap benefit.

He wanted the government to be practical while setting the revenue target and said the deficit in the next budget could be raised to 7.0 to 8.0 per cent for the sake of higher spending.

Dr Selim Raihan, executive director of South Asian Network on Economic Modeling (SANEM), said that the erosion of business confidence is an alarming sign as the recovery of SMEs remained slow.

He said that exports in some destinations and remittances were increasing, but the growth of those two sectors has some multiplier effect.

The country will not be able to come out of the crisis unless it implements the budget properly, he added.

Metropolitan Chamber of Commerce and Industry (MCCI),Dhaka president NihadKabir said the allocations of budgetary resources for various sectors in the budhget has remained almost unchanged over the years.

"We see some changes in the budget numbers. But the destination of the taxpayers' money remain unclear," she added.

The SMEs sector needs policy support so that they get access to the stimulus packages, she added.

Large industries got benefit of the stimulus package, but the government should tag the condition of employment generation with their package to thwart job cut, she said.

The economy would rebound if the government prioritises on cottage and small industries, she added.

She was highly critical of the provision of legalising black money by paying only 10 per cent tax. " We pay tax at the rate of 32 per cent. We don't like this unfair and unjust provision", she said.

Dhaka Chamber of Commerce and Industry (DCCI) presidentRizwan Rahman said the most part of the stimulus packages has reached the medium scale industries, depriving the cottage industries of their due.

He said the government should give a target to the NBR for expanding the tax net rather than setting target for revenue collection.

On black money, he said the illegally earned money should not get the opportunity to legalise by paying lower rate of taxes.

Rather a penal tax at the rate of 10 per cent needs to be added to the normal tax rates for legalising illegally-earned money, he said.

Mr Rahman said the government could consider attracting investment of undisclosed money in health, bond market and infrastructure.

He demanded reduction of corporate tax at a progressive slashing by 2.5 per cent for three consecutive years to bring it down to 25 per cent.

Bangladesh Garment Manufacturers and Exporters Association (BGMEA) president Faruque Hassan demanded keeping the tax rate stable for five to 10 years to help the sector stay competitive.

He pointed out that the recovery from the pandemic impact was taking longer time, affecting the export of goods.

He said the SMEs were in most vulnerable condition now."We hope that there would be specific direction and allocation for the sector in the upcoming budget," he added.

Rupali Chowdhury, president of the Foreign Investors Chamber of Commerce and Industry (FICC), said the existing corporate tax rate is higher than that of the profit level of the businesses.

She demanded withdrawal of the minimum tax as it is charged on businesses irrespective of their incurring lossesor making profits.

She said that the effective tax rate becomes 50 per cent in some cases for corporate tax payers due to different withholding taxes.

Abul Kasem Khan, chairperson of Business Initiative Leading Development (BUILD) and former president of the DCCI, suggested the government to maintain the growth of goods consumption through providing 'consumption incentives'.

"The production will fall if consumption declines and it will ultimately affect employment," he added.

Masrur Reaz, chairperson of the Policy Exchange of Bangladesh, said the government should allocate 1.0 per cent of GDP for the low income group of people to help them survive in this pandemic.

Dr Nazneen Ahmed, senior research fellow at the Bangladesh Institute of Development Studies (BIDS), suggested the government to arrange part-time employment opportunities for the people in urban areas.

Bangladesh Association of Software and Information Services (BASIS) president Syed Almas Kabir, former president of the American Chamber of Commerce and Industry (AmCham)Aftab-ul Islam, and former adviser to the past caretaker government Rasheda K Chowdhury, among others, spoke at the programme.