Bangladesh would seek revision of the deals involving the Indian line of credit (LoC)-II and III as some of the provisions prove to be barriers to the smooth implementation of relevant projects, officials said on Monday.

The request is likely to be made at the next review meeting, they said.

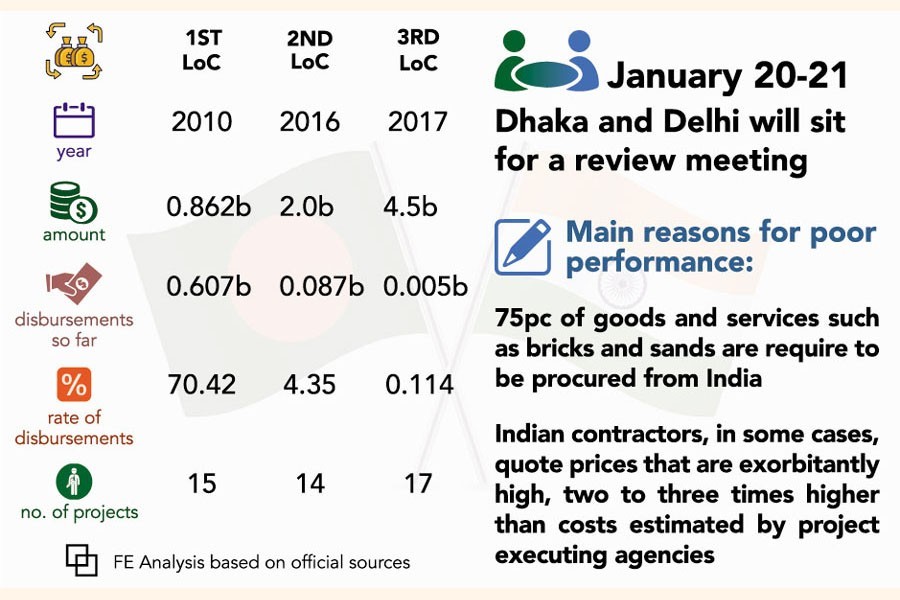

Dhaka and Delhi will hold a tri-partite meeting virtually on January 20-21 aiming to overcome the obstacles to the implementation of the India- supported projects.

A Joint Secretary of the Economic Relations Division (ERD) would lead the Bangladesh side while his counterpart at the Indian External Affairs Ministry would join from New Delhi.

Project Directors (PDs) and representatives from the relevant authorities, including the Indian financier EXIM Bank will also take part in the meeting.

"Bangladesh at the last secretary-level review meeting, held on January 03 last, had demanded the revision of the LoC agreements. In the upcoming meeting, we will try to convince them about our demands," said a senior ERD official.

Bangladesh has taken up 14 projects under the $2.0 billion LoC-II and 17 other under the $4.5 billion LoC-III.

The Bangladesh government had signed an agreement with Indian EXIM Bank for the $2.0 billion LoC-II in March 2016 and the $4.5 billion LoC-III in October 2017.

Meanwhile, most of the 15 projects under the $862 million worth LoC-I have been completed, except for a couple of schemes that are as old as 10 years.

Projects under both the LoC-II and LoC-III have been struggling.

Some PDs told the FE that one of the major issues affecting the projects includes the complexities in tendering and the irresponsibility of Indian contractors during the implementation phase.

Another key obstacle is the procurement conditions under which Bangladesh is bound to purchase 75 per cent of works, services or goods from the Indian market, they said.

"Bangladesh has to import 75 per cent of the construction material - including bricks and sand - from India. It automatically increases costs. This issue has thrown a wrench into the implementation of many LoC projects," said a PD at the Roads and Highways Department in Dhaka.

Another PD at the Bangladesh Railway (BR) requesting anonymity said sometimes the Indian suppliers submit bids at costs far higher than that estimated by the Bangladeshi procuring entities (government agencies).

"Then we have no way but to cancel the tender. In that case, we need to retender the projects and it eats up huge time in the preliminary stage of procurement," he added.

"We have been requesting the Indian side for relaxing the terms and conditions for the credit deals over the last few years. But those are still pending for settlement. It takes huge time and cost for Bangladesh," the BR official said.

When asked, another ERD official told the FE that the "credit deals revision" would be the key agenda for discussion in order to resolve the crisis and remove hurdles.

"We are hopeful of resolving the complexities," he told the FE.

The Indian credit bears an interest rate of 1.0 per cent with 0.5 per cent commitment fees. It will have to be repaid in 20 years with a five-year grace period.