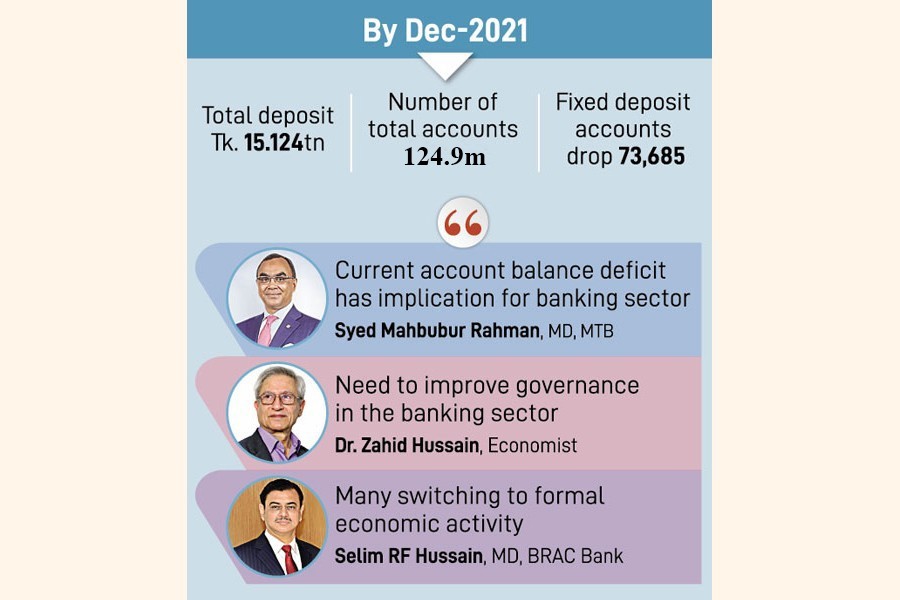

Bangladesh's banks received over Tk 15.124 trillion in deposits in 2021, up 10 per cent year on year, as savers crowd in banking sector for reasons that may include lack of better options.

People deposit their savings with the banks although interest rates have been cut down, which signifies that they, especially the middle-class people, have little alternative options to put their money in, economists say. They say a stable, rewarding stock market could be a substitute.

The number of accounts, mainly consisting of current, savings and fixed deposit, also grew nearly 8.0 per cent to 124.9 million in the year under review.

The number of fixed-deposit accounts, however, dropped by 73,685 accounts in 2021.

But the amount of deposits under time-deposit category grew nearly 9.0 per cent to Tk 6748.07 billion. FDR or Fixed Deposit Receipt is the biggest component in the banking sector, grabbing around 44 per cent of total deposits.

The volume of savings, the biggest one in terms of accounts in the banking sector, stood at Tk 3389.42 billion at the end of December of 2021. The total number of savings accounts stood at the end of December at 101.95 million, up 8.68 per cent over 2020.

The number of current accounts surged to 6.88 million, up by more than half a million or 502,157 accounts.

Current-account amounts stood at Tk 1372.95 billion, 14.8-per cent up at the end of December 2020.

The data prepared by the central bank show the overall performance of the banking sector.

Bankers told the FE that the overall growth was on many counts: economic recovery, higher remittances and switching to formal economic activities, stimulus funds and Bangladesh Bank refinancing.

"There are many people who are switching towards formal transactions and it is one of key reasons," says Selim RF Hussain, managing director and CEO at the SME-focused BRAC Bank, a leading privately owned commercial bank.

Such banks attract most of the deposits in the country's banking sector.

Mr Hussain also says the growth of the SMEs was double-digit one after the second half of the calendar year.

"We had two lockdowns in the last year, so first half of the year saw poor transactions, but after the second half it was fantastic..."

Syed Mahbur Rahman, managing director and CEO at the Mutual Trust Bank, told the FE that at the end December the amount attracted by banks was okay. But the present situation is slightly worse.

"The current-account balance now surfaced too deficit so it has implications on the banking sector," he comments.

Dr Zahid Hussain, an independent economist of Bangladesh, told the FE that people have still much confidence in the banking sector but there is room to improve the governance, especially in the state-owned banks.

"The non-performing loans and other issues should be addressed otherwise the banking sector will not attract such deposit in the future," he notes.