The central bank has expressed its deep worries over the impact of the ongoing second wave of the Covid-19 on the country's economy.

It said the extension of the lockdown period is likely to slow down the pace of economic recovery.

"… the broad based recovery of economic activities is likely to continue in near future. But headwinds from the second wave of the Covid-19 restrictions may pose some downside risks," according to the latest Bangladesh Bank Quarterly (BBQ).

Recoveries of the Bangladesh economy confronted new headwinds from increasing infection rate of coronavirus and associated restrictions, according to the BBQ's January-March 2021 issue.

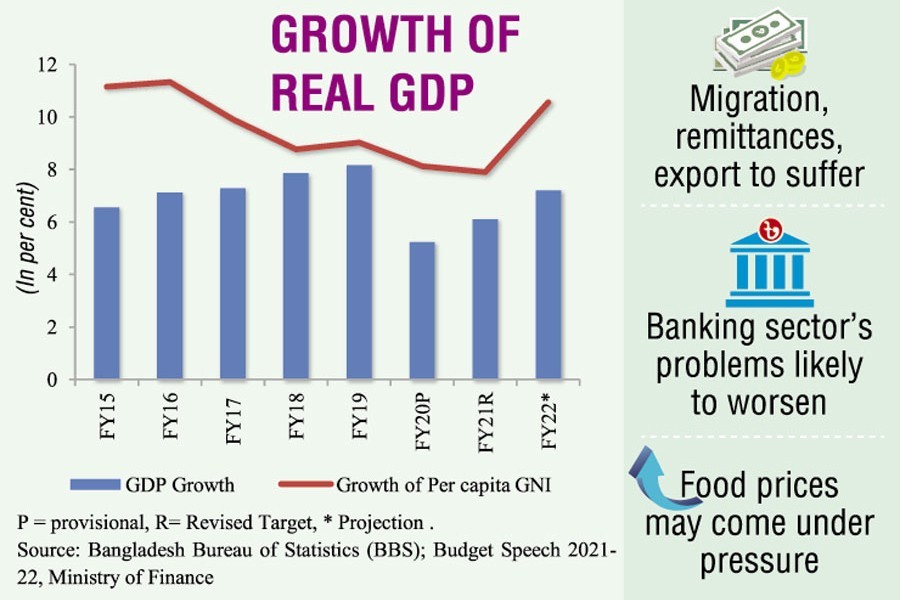

The central bank, however, said the ongoing easy monetary and expansionary fiscal policies along with implementation of stimulus packages may contribute to achieving the targeted real GDP (gross domestic product) growth with a tolerable inflation rate in the fiscal year (FY) 2020-21.

"The travel restrictions from Bangladesh to other countries are likely to dampen migration, remittances and exports to some extent," the BB explained.

The BB observations came against the backdrop of extension of the nationwide restrictions on the movement of people on a number of occasions since April 2021.

The central bank focused on different issues including banking sector, capital market, fiscal sector, money and credit markets and inflationary pressure on the economy.

"The banking sector is expected to encounter further challenges as the second wave of the Covid-19 pandemic is still persistent and dominant which is adversely affecting the entire business environment," it said.

The BB also predicted that the weaker asset quality due to higher level of non-performing loans (NPLs) and poor profitability condition may further worsen the banking sector performances in the coming quarters.

The volume of NPLs grew by more than 7.0 per cent to Tk 950.85 billion during the January-March period of 2021 from Tk 887.34 billion in the preceding quarter despite providing policy support by the central bank in relation to loan classification.

Besides, the loan moratorium facility ended in December, 2020 might put further pressure on the classified loans although the BB has rescheduled payment facilities for the outstanding time and demand loan, it added.

The BBQ also said the central bank has strengthened its inspection and supervision to prevent irregularities in the banking system more efficiently.

"A better surveillance system and cautious credit policy would help improve governance in the banking sector in near future," it noted.

Regarding inflationary pressure, the central bank said a continuous rise in world food inflation, especially rice prices, may put some inflationary pressures on domestic food prices.

Moreover, the global soybean oil price rise might have a significant impact on the domestic edible oil prices, it added.

"A close monitoring is critical to ensure the proper functioning of the supply chain of necessary food items in order to avoid further upward pressure on domestic food inflation," the BB noted.

Despite BB's various policy supports and prevailing low real lending rates, the growth of credit to the private sector improved marginally to 8.79 per cent in March 2021 from 8.37 per cent in December 2020.

"However, it remained far below the programmed safe limit of 14.80 per cent for June 2021, reflecting considerable uncertainty around business and consumer confidence," the BB explained.

Private sector credit growth decreased further to 8.29 per cent in April 2021 on a year-on-year basis from 8.79 per cent a month ago mainly due to the second wave of the Covid-19 pandemic.