Corporate taxpayers might see a cut in their tax rates in the upcoming fiscal year (FY), 2021-22, while individual's tax rates and tax-free ceiling might remain unchanged.

Officials said the corporate tax rates for both listed and non-listed companies might be revised downward by 2.5 percentage points in FY 22. This is likely to be done in meeting the demand from the businesses to attract foreign and local investment.

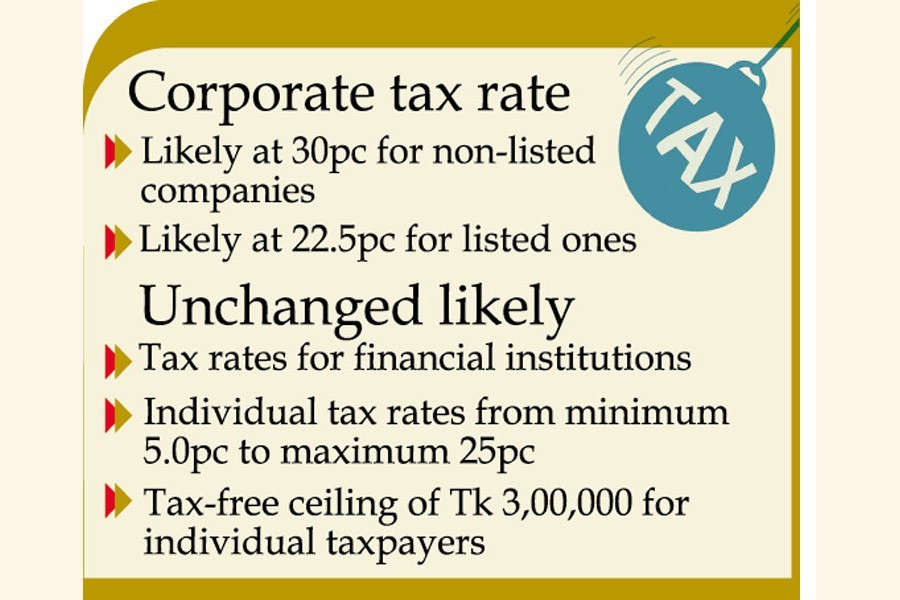

The tax rate for the non-listed companies might be set at 30 per cent, while it might be 22.5 per cent for the listed ones, they added.

However, corporate tax rates for financial institutions, such as banks and non-banking financial institutions, mobile phone operators and tobacco companies might remain unchanged.

The Dhaka Chamber of Commerce and Industry (DCCI), in its pre-budget proposals, demanded a gradual cut in the corporate tax rates, starting from the next FY.

As per the plan, the chamber sought a 2.5 per cent tax cut in FY 2021-22, followed by 5.0 per cent in FY 2022-23, and 7.5 per cent in FY 2023-24.

The corporate tax rates in Bangladesh range between 32.5 per cent and 45 per cent, while the average rate of the tax is 25.2 per cent in India, 29 per cent in Pakistan, 28 per cent in Sri Lanka, and 20 per cent in Vietnam, Indonesia and Myanmar.

Officials also said the government is considering slashing the corporate tax rates to help the businesses survive the onslaught of the pandemic, although the decision might cause loss of a significant amount of revenue for the government.

Currently, corporate income tax rate is 37.5 per cent for banks, insurance companies and other financial institutions that are listed with the capital market, 40 per cent for non-listed banks, 37.5 per cent for merchant banks, 45 per cent for tobacco companies, 45 per cent for non-listed mobile phone operators, and 40 per cent for listed mobile phone operators, 15 per cent for cooperative entities, and 12 per cent for export-oriented ready-made garment factories.

Also, individual tax rates range from minimum 5.0 per cent to maximum 25 per cent, which might remain unchanged in the budget.

The existing tax-free ceiling of Tk 3,00,000 for individual taxpayers might also remain unchanged.

Tax-free threshold is Tk 3,50,000 for women and senior citizens, Tk 4,50,000 for physically challenged people, and Tk 4,75,000 for gazetted war-wounded freedom fighters.

In the current FY budget, the government reduced the lowest income tax rate to 5.0 per cent, and cut the highest income tax rate by 5.0 percentage point.

Earlier, the lowest slab for individual taxpayers was 10 per cent, and the highest slab was 30 per cent.

Officials said they would focus on expanding tax net in the budget rather than increasing tax burden on people.

Currently, there are 6.1 million TIN holders in the country, but only 2.4 million of them submit tax returns regularly.

As per the income tax law, all of the TIN holders have to submit tax returns on mandatory basis, except a few exceptions.

The National Board of Revenue (NBR) took initiative several times to make all TIN holders tax complaint, but the efforts did not see light due to lack of an automated database.