The depleting coronavirus incidence in Bangladesh makes the majority of businesses hopeful about a moderate-to-strong economic recovery during the concluding quarter of 2021, according to a survey.

As per the Business Confidence Index (BCI), designed in the survey, the ratio of confident businesses jumped to 60.67 per cent for the final quarter (October-December) of the calendar year from 52.31 per cent in the previous quarter (July-September).

However, the surveyors somewhat expressed scepticism regarding overall increased business confidence as the survey was conducted prior to the off-the-cuff fuel-price hike.

The findings of the survey, conducted this past October, were disseminated Wednesday at a webinar titled 'Covid-19 and Business Confidence in Bangladesh: Findings from the 6th Round of a Nationwide Firm-Level Survey'.

The sixth edition of the survey was carried out by South Asian Network on Economic Modelling (SANEM), which has done it every three months since July 2020, covering about 500 business entities from micro to large in size.

Presenting the study findings at the virtual event, SANEM executive director Dr Selim Raihan mentioned an array of triggers for a strong rebound.

Faster recovery is observed in restaurant, RMG, textile, and light engineering, leather, pharmaceuticals, transport, ICT financial services, and other services sectors when a year-on-year comparison is made, he said.

At the same time, sectors like food, real estate, and manufacturing, other than the aforementioned ones, are a bit less optimistic about recovery during the ongoing quarter.

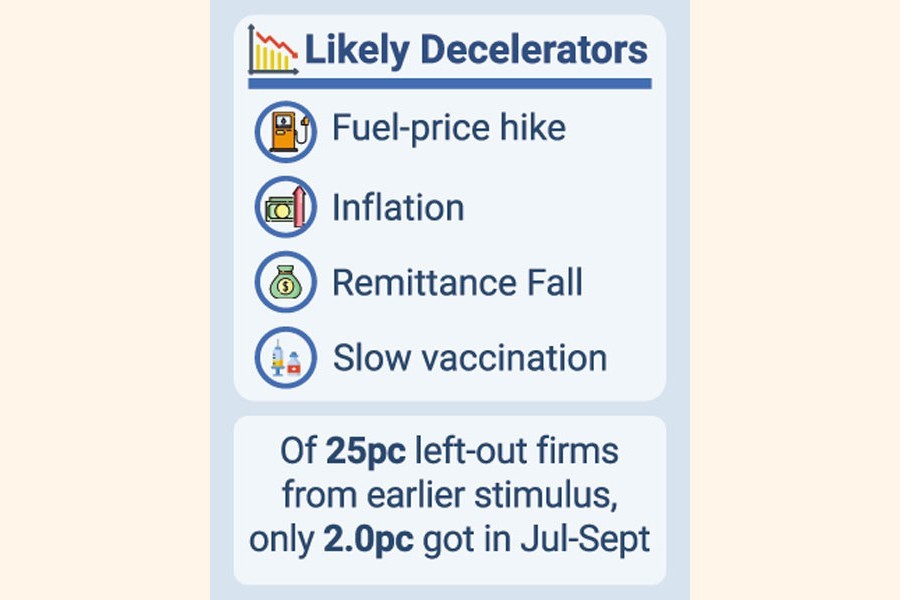

However, he said: "The survey was conducted before the recent fuel-price hike which might have a negative impact on overall business confidence as it will increase the cost of doing business in almost all sectors."

The clear picture would be visible in the next round of survey scheduled to take place in January next, he told the audience virtually.

Terming the current state of economic recovery quite encouraging when compared between July-Sept and Oct-Dec quarters of 2021, he said about 21 per cent of the respondents are hopeful about strong economic recovery which was 9.0 per cent during the last quarter.

Meanwhile, about 52 per cent of the respondents foresee moderate recovery in this Oct-Dec quarter, up 27 per cent from the previous quarter.

Besides, in the last quarter, about 64 per cent had predicted weak recovery which impressively decreased to 27 per cent for the ongoing quarter, Dr Raihan said.

Responding to what extent firms were able to recover their business since March 2020, the participants in the survey noted the recovery rate increased to 56.8 per cent in September 2021 (compared to March 2020) as the economy reopened in full steam in the middle of July-September 2021 quarter.

Due to the second wave of the COVID-19 pandemic, firms' internal recovery rate went down to 34.9 per cent in July 2021 (compared to March 2020) from 57.4 per cent in April 2021 (compared to March 2020).

In case of availing stimulus packages, 25 per cent of the firms who did not get any in the earlier round (fifth round) attempted to avail the funds during the July-Sept tranche but only 2.0 per cent of them succeeded.

Problems faced in availing or pursuing the stimulus package include lengthy procedure, bank-related complexities, understanding the procedure, insufficient amount, bribes etc, the survey shows.

To observe the business environment, SANEM has constructed another index namely Enabling Business Environment Index (EBI) that showed the business environment slightly worsening than the previous round (the score moves down to 52.8 from 53.5).

To cope with the corona-induced shock 46.2 per cent of the businesses have availed loan of which 77.5 per cent availed from formal sector (like banks) and 22.5 per cent from informal sectors.

Dr Raihan concluded with a succinct line that despite the good recovery trend in the economy, there are emerging challenges to be faced due to recent fuel-price raise, inflationary pressure, decreasing remittances, any new Covid wave, and slow vaccine rollout.