Parliament on Tuesday passed the Finance Bill-2021, amending a few of its original provisions.

The lawmakers vetted continuation of the controversial opportunity to legalise undeclared income during the next fiscal year (FY 2021-22), however, on terms harder than that of the outgoing fiscal.

In fact, the opportunity is being extended using a number of existing provisions of the Income Ordinance of 1984 and adding a new one.

The existing opportunity to declare the undisclosed money with only 10 per cent flat rate of tax and no question asked by any agency is due to expire today (Wednesday).

Under the new provision, the highest tax rate of 25 per cent along with 5. 0 per cent penal tax will have to be paid on the computed amount of taxes for investment of undisclosed money in the capital market. The same provision will applywhile legalising cash, bank deposits, and investment in savings instruments or certificates.

The section '19AAAA, special tax treatment in respect of investment in securities' would allow undisclosed income in securities.

However, the securities investors will have to pay the 25 per cent tax within 30 days of such investment.

As per the Finance Act-2021, no authority will raise any question about sources of the tainted money if it is disclosed under the scheme.

In case of withdrawal from the capital market within one year of investment, starting from the day of such investment, an additional amount of penalty at a rate of 10 per cent on the withdrawn amount will be payable at the time of assessing the tax files.

Under the provision 19AAAAA, special tax treatment in respect of undisclosed property, cash etc., allows declare the undisclosed movable and immovable properties by paying tax at a rate prescribed by the income tax authority, and with 5.0 per cent penalty.

A fixed tax ranging from Tk 20,000 to Tk 200 per square metre has been imposed on properties and the amount would depend on 13 types of areas, sizes and nature of properties. The tax should be paid through pay orders or automated chalan.

As per the finance act-2021, the black money whitening provisions will not be valid if any proceedings under any provision of the ordinance or any other law have been drawn on or before the day of making such investment.

Under section '19AAAAAA', the taxmen would allow undisclosed money with 10 per cent flat rate of taxes on the sum invested between July 1, 2021 to June 30, 2022.

Officials said the areas of declaring the tainted money remained almost unchanged in the Finance Act-2021 like the one that expires today (Wednesday).

However, a nominal rate of penal tax has been imposed to ensure justice to the regular taxpayers, they said.

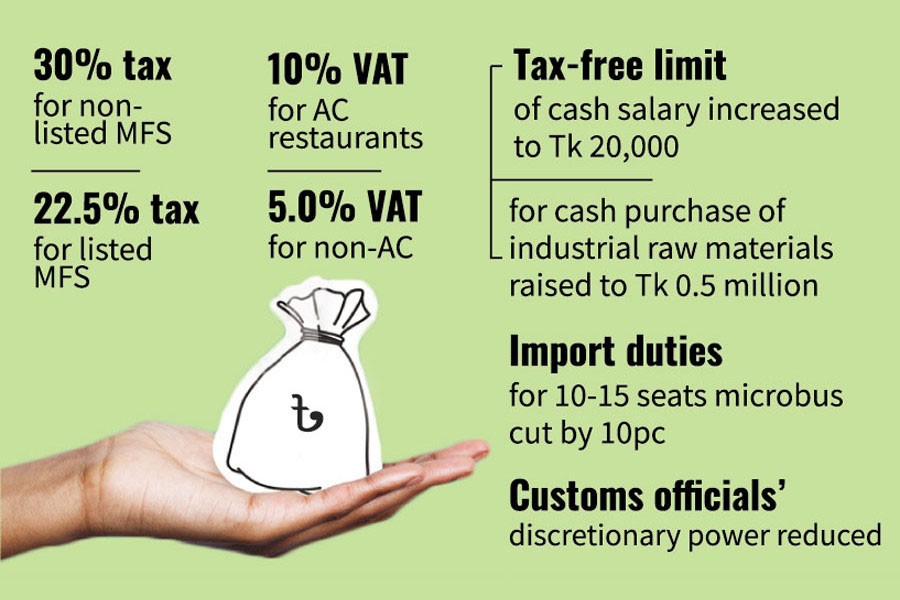

Meanwhile, the tax rate for non-publicly listed Mobile Financial Services (MFS) will be 30 per cent from FY 2021-22 as per the amendments to the proposed bill.

However, the tax rate for listed MFS, if applicable, would be 22.5 per cent, similar to other listed companies.

In the budget proposed for FY 2021-22, the tax rate for MFS was 40 per cent, similar to that of the banks and other financial institutions.

For the upcoming FY, the VAT rate for air-conditioned and non-AC restaurants has been cut to 10 per cent and 5.0 per cent respectively from 15 per cent and 7.5 per cent.

The income tax free allowable limit for payment of salary in cash increased up to Tk 20,000 which was Tk 15,000 in the proposed budget, placed in parliament on June 3 last.

Also, the tax-free allowable limit for cash purchase of industrial raw materials has been raised to Tk 0.5 million from the proposed Tk 50,000.

The proposed measure on submission of annual audited financial statements by the VAT-registered listed companies has been relaxed by allowing them to submit statement of previous FY within six months of the running FY.

The import duties for microbus above 10 seats and up to 15 seats have been cut by 10 per cent in the finance act.

The discretionary power of customs officials was also reduced in the finance act, amending the proposed provisions in the bill.

The proposal for submission of overseas wealth statements by non-resident individual taxpayers has been abolished in the act.

For the e-commerce platform, companies having more than Tk 10 million of annual turnover will be considered as the tax deducting authority, barring some exceptions.