A special scheme on whitening black money heads for hitting the dead end with its tenure expiry as the government may skip it in the upcoming budget, officials say.

The scheme is scheduled to expire on June 30, 2022, with lukewarm response from those who hold the undisclosed money.

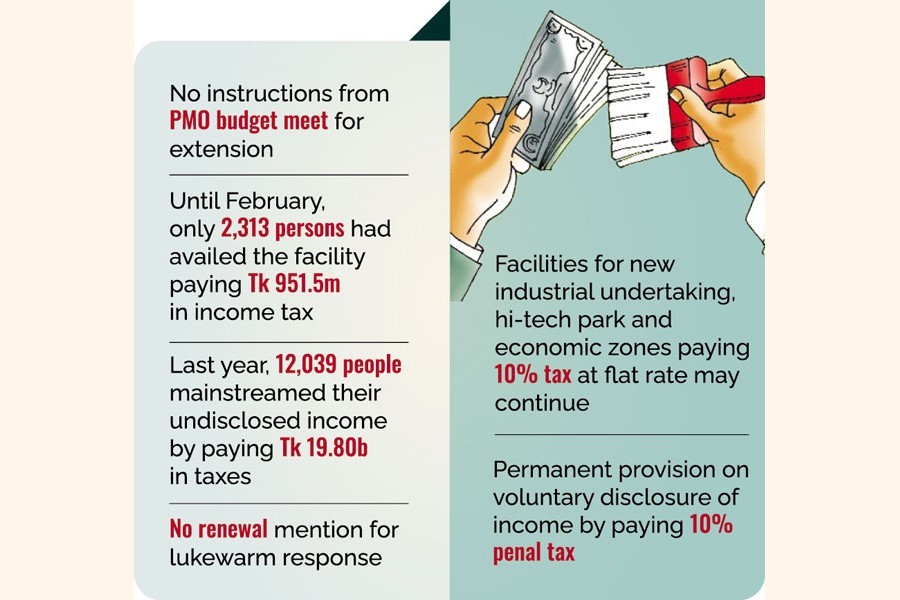

On finalizing the budgetary measures for the financial year (FY) 2022-23, the National Board of Revenue (NBR) held a meeting with the Prime Minister Thursday where no instruction for extension of the facility came, the officials said.

Sources concerned said the tax officials did not propose continuation of the facility and it would expire with the expiry of scheduled time in the Statutory Regulatory Order (SRO).

"So far, no provision on formalizing undisclosed income under the special scheme, on payment of around 27.5-percent tax, has been incorporated into the Finance Bill 2022," says one source.

However, officials said it is a sensitive issue and decision might be changed at any stage to incorporate the controversial provision.

Earlier, economists and tax experts opined against continuity of the fiscal measure in the upcoming budget for the sake of "tax justice" as the government gets a paltry amount of revenue in return.

Until February, only 2,313 persons had availed the facility paying Tk 951.5 million in income tax, NBR data show.

Last year, the government received a record response -- the highest since independence -- to the money-whitening scheme with some 12,039 people having mainstreamed their undisclosed income by paying Tk 19.80 billion in taxes. Tax rate was 10 per cent, a flat rate, in the last fiscal (FY 2020-21).

As per the Finance Act 2021, no authority will raise any question about sources of the tainted money if it is disclosed under cover of the scheme.

Economists say such amnesty attracts ill-gotten money to get whitened, discouraging regular tax payment by honest taxpayers.

Under the fiscal measure in the budget for FY 22, undisclosed money holders can avail the whitening opportunity under three provisions: investment in capital market, land and flats, debenture or other securities.

In the period between 2005-06 and 2019-20, a total of Tk 145.95 billion worth of undisclosed incomes had been formalized under such fiscal amnesty.

However, some of the permanent provisions in the income tax ordinance on disclosing undeclared money may continue like previous FYs.

Facilities for new industrial undertaking, hi-tech park and economic zones paying 10-percent tax at flat rate may continue.

Hi-tech parks and economic zones investors are allowed to enjoy the facility until June 30, 2024.

Also, there is a permanent provision on voluntary disclosure of income by paying 10-percent penal tax in addition to the normal rate of tax.