Government's tightened money-whitening scheme for the current fiscal fails to rope in the hidebound wealth-holders because of high penal taxes charged for the seal of legitimacy.

Economists and tax experts opine against continuation of the controversial fiscal measure in the upcoming budget for the sake of "tax justice" as the government gets a paltry amount of revenue in return.

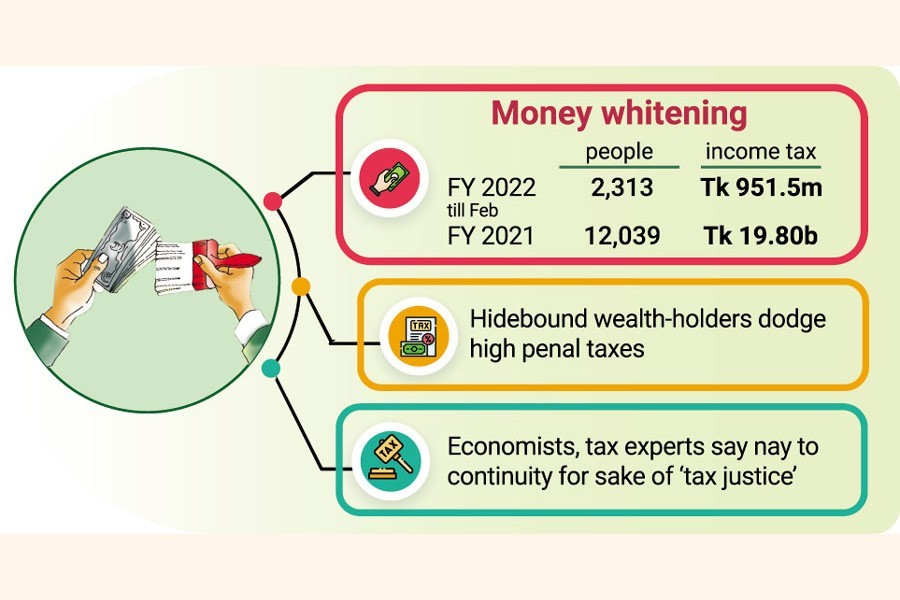

Only 2,313 persons had availed the facility until February this fiscal year paying Tk 951.5 million in income tax, according to a recently compiled data of the National Board of Revenue (NBR).

Last year, the government received a record response -- the highest since independence -- to the money-whitening scheme with some 12,039 people having mainstreamed their undisclosed income by paying Tk 19.80 billion in taxes.

Senior Research Fellow at the Centre for Policy Dialogue (CPD) Towfiqul Islam Khan says such money whitening is neither morally acceptable nor have any significant financial implications.

"It is against tax justice as honest taxpayers get discouraged from paying tax regularly," says the economist, also Coordinator of CPD's Independent Review of Bangladesh's Development (IRBD) programme.

"Instead of such scheme, the government should lay emphasis on combating large-scale tax evasion," he adds.

He feels that strict enforcement of the tax laws can help thwart tax evasion.

In the budget for current FY (2021-22), the government jacked up the tax to 27.5 per cent -- the highest tax rate for individual taxpayers -- for legalising undisclosed income. It was a 10-per cent flat rate last fiscal (FY 2020-21).

As per the Finance Act 2021, no authority will raise any question about sources of the tainted money if it is disclosed under the scheme, which, according to the economists, attracts ill-gotten money to get whitened, discouraging regular tax payment by honest taxpayers.

Following trend of the previous year, the highest response has been received about investment in movable and immovable property, cash etc.

Analysts think infiltration of 'black money' through this open window inflates property prices, sending housing facilities beyond commoners' reach.

In the current FY, until February, some 2,258 taxpayers had paid Tk 922.9 million under section 19AAAAA availing special tax treatment in respect of undisclosed property, cash, savings certificates etc, according to NBR data.

Last FY, the taxmen mopped up Tk 19.40 billion in taxes from 11,755 people who availed the money-whitening opportunity.

Until February, only nine people had invested in new industrial undertakings paying a paltry Tk 90,000 in taxes.

Under Income Tax Ordinance1984, undisclosed money holders can avail the whitening opportunity under three provisions: investment in capital market, land and flats, debenture or other securities.

Under section 19AAAA, 46 people whitened Tk 27 million by investing in stocks on the capital market in the first eight months of the current FY availing special tax treatment in respect of investment in securities.

In the last fiscal, some 284 people whitened money through investing in securities by paying Tk 403 million as taxes.

Under the section, securities mean stocks, shares, mutual-fund units, bonds, debentures and other securities of the companies listed in and approved by the Bangladesh Securities and Exchange Commission and all other government securities and bonds tradable on the capital market.

To legalise money, the securities investors are required to pay the tax within 30 days of such investment.

In case of withdrawal from the capital market within one year of investment, starting from the day of such investment, an additional amount of penalty at a rate of 10 per cent on the withdrawn amount will be payable at the time of assessing the tax files.

Investment under the scheme on securities was poor in the past year, too, compared to other areas as 286 individuals disclosed Tk 4.0 billion.

In the period between 2005-06 and 2019-20, a total of Tk 145.95 billion worth of undisclosed income had been formalised under such fiscal amnesty.

According to the income tax ordinance, investors in new industrial undertakings are allowed to whiten money paying tax at a flat rate of 10 per cent. To attract investment in hi-tech parks and economic zones, the government has kept the same window of opportunity open until June 30, 2024.

Also, there is a permanent provision on voluntary disclosure of income by paying 10-per cent penal tax in addition to the normal rate of tax.