All but one stimulus packages under the central bank's initiative are yet to be implemented fully although the deadline of the same will expire on March 31, according to a Bangladesh Bank (BB) report released on Sunday.

The stimulus package that was meant for paying salaries and allowances to the workers-staffs of the active export-oriented industries, particularly readymade garments (RMG), has already been exhausted fully.

A report on Policy Measures of Bangladesh Bank (BB) in Response to the Covid-19 Pandemic revealed the picture about the stimulus packages, according to the report.

BB Governor Fazle Kabir formally released the report in the form of a booklet at a programme at the central bank headquarters in Dhaka. The Chief Economist's Unit of the BB prepared the report, dedicating it to those who have died of the Covid-19.

The government has so far announced a total of 23 stimulus packages -- BB is directly involved with nine - worth Tk 1.24 trillion to offset the adverse impact of the pandemic on various sectors of the economy.

Besides, the BB had announced agricultural loans at 4.0 per cent concessional interest rate in the crops and harvest sector by issuing a circular.

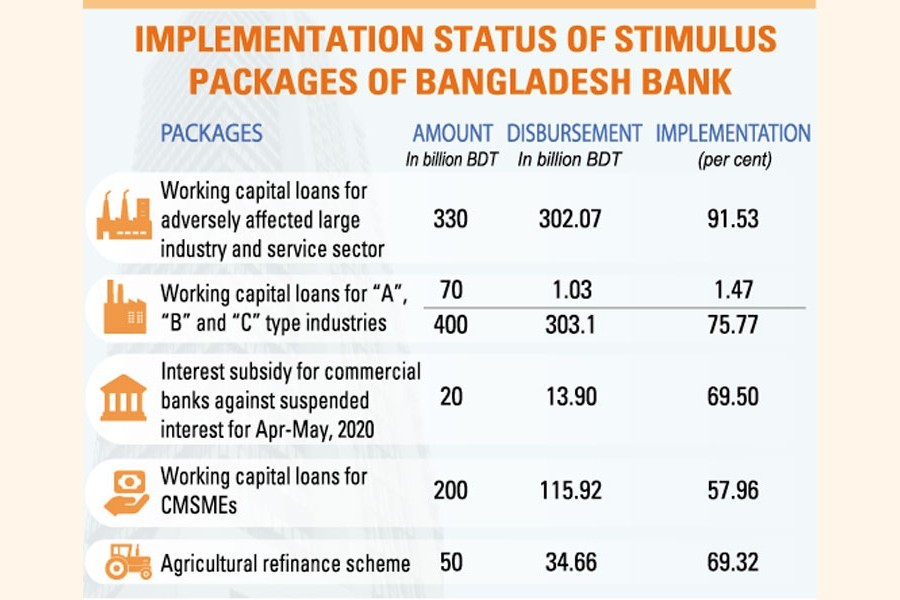

The BB's data showed that the stimulus package for the large industries and services sector has almost been exhausted while nearly 60 per cent was executed in another package for the cottage, micro, small and medium enterprises (CMSMEs) until January 31 last.

During the period, more than Tk 302 billion has been disbursed as working capital under the stimulus package of Tk 330 billion for large borrowers in the industrial and services sector. The implementation rate is 91.53 per cent.

But the banks and non-banking financial institutions (NBFIs) disbursed nearly Tk 116 billion of the stimulus package for the smaller firms, which are nearly 58 per cent of the total allocation of Tk 200 billion.

On the other hand, loans amounting to around Tk 132.43 billion were approved for 83,319 Covid-hit CMSMEs across the country as on February 11, according to the BB's latest monitoring report.

The central bank has already asked the banks to utilise all stimulus packages by March 31 to help revive the economy, battered by the pandemic.

The advice was given at a virtual meeting between the bankers and the central bank governor on January 27.

In his message, the BB governor said the central bank has promptly responded with an expansionary monetary policy stance incorporating a wide range of supportive financial sector policies in sync with the government's stimulus packages and expansionary fiscal policy to counteract the deceleration of the economic growth.

"The main objective of the policy measures is to support faster recovery of the economic growth for sustaining the livelihoods of the people," the central bank chief explained.

Dr Md Habibur Rahman, executive director and chief economist of the BB, said in his editorial note that the stimulus package includes broad-based emergency support to people and firms to protect them from economic fallout, while increasing the coverage of social safety net programmes saving the lives and livelihoods of the vulnerable population segment.

"After bottoming out, the Bangladesh economy has already entered into a recovery phase; thanks to the government's timely and appropriate interventions including the Honorable Prime Minister's announcement of a hefty stimulus package along with the BB's supportive and expansionary policy initiatives," Dr Rahman noted.

He also said: "With all these policy supports along with an effective vaccination programme which has already rolled-out in the country, we can only expect that the economy of Bangladesh will go back on its pre-Covid high growth path soon."