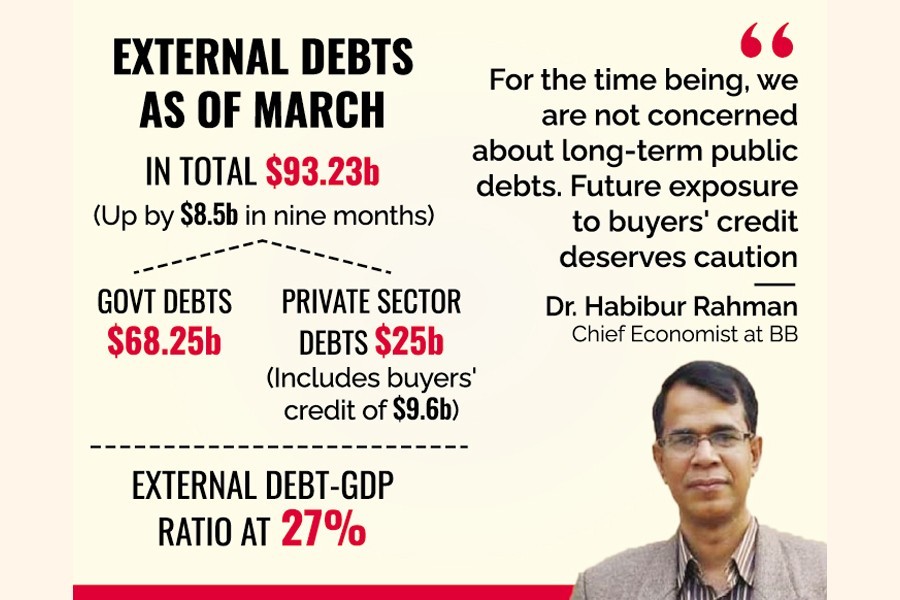

Commercial borrowings under the private sector increased significantly by $6.3 billion to nearly $25.0 billion during the nine- month period of the immediate-past fiscal year.

Of the commercial borrowings, buyer's credit has increased rapidly, to $9.6 billion, up by nearly $4.0 billion, to March. This is followed by foreign back-to-back letter of credit amounting to over $1.2 billion or up by $263 million during the nine months ending June last.

However, Bangladesh's total external debts rose by $8.5 billion in nine months to March to a total of $93.23 billion in a continuous rise that casts unwelcome effects on its foreign-exchange reserves.

Such a picture came up in a publication of the central bank which compiles the data from SoEs, private enterprises, nationalized commercial banks, and the economic relations division.

Foreign debt is money borrowed by government, corporation or private households from another country's government or private lenders.

The total external debt-to-GDP ratio now stood at nearly 27 per cent at the end of March 2022.

However, general government borrowings remained in a safe zone as most of the debts are long- term ones.

General government borrowing in March stood at $68.25 billion, up by $ 5.37 billion since June last.

Of the total government borrowings, more than 83 per cent spawned from long-term concessional debts.

Dr Habibur Rahman, the chief economist at Bangladesh Bank, told the FE that the public debt is mostly long-term and "that's why this is not a headache".

But he concedes that servicing is an issue. "For the time being, we are not concerned about the government debt position."

He mentions that Bangladesh's earnings remained high and potential to repay the debts.

Dr Rahman, however, feels that future limit or exposure related to buyer's credit should be thought of.

"Although buyer's credit is cheaper but at a time when the repayment is considered, this is an issue," the central bank chief economist told the FE.

Dr Zahid Hussain, former lead economist at the World Bank, told the FE that external debt has implications on the reserves or foreign-exchange rates.

He thinks "it is time to review the private-sector borrowing as the rate of interest or cost of funds may surge after the pandemic".

Bangladesh's foreign-debt composition has progressively been changing from concessional loans from multilateral lenders to costlier bilateral credits.

"And the bilateral loans are coming at a higher interest rate and shorter grace and repayment periods due to Bangladesh's graduation from the low-income bracket," Dr Hussain says.

The observations from the economists come, incidentally, at a time when many countries are in pains for running out of reserves of the trading currency -- the US dollar.