Classified loans in the banking sector went ballooning in the first half (H1) of the current calendar year despite policy perks coming from the central bank to stem the rot.

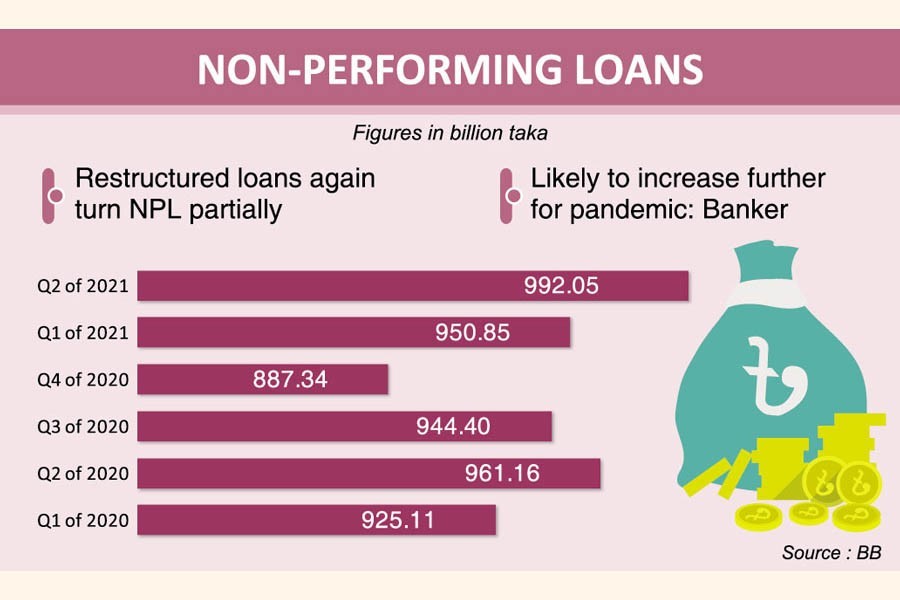

The volume of non-performing loans (NPLs) grew nearly 12 per cent or Tk 104.71 billion to Tk 992.05 billion as on June 30 from Tk 887.34 billion six months before, according Bangladesh Bank (BB) latest statistics.

BB officials, however, said the amount of NPLs increased slightly in the second quarter (Q2) compared to the first quarter (Q1) of this year because of 'soft repayment policy' along with less rescheduling during the period under review.

The volume of NPLs increased by more than 4.0 per cent or Tk 41.20 billion to Tk 992.05 billion as on June 30 from Tk 950.85 billion three months before, the BB data showed.

A portion of restructured large loans has already turned NPL that also pushed up the overall volume of classified loans in the banking system, they explained.

1n 2015, the central bank cleared proposals of 11 business groups for restructuring their large loans worth around Tk 153.26 billion for tidying their accounts.

Talking to the FE, Md Serajul Islam, central bank's spokesperson, said the amount of NPLs increased slightly in the Q2 of 2021 mainly due to higher volume of total outstanding loans in the banking sector.

The amount of outstanding loans rose by more than 3.0 per cent to Tk 12131.64 billion as on June 30 from Tk 11776.59 billion three months ago, according to the central bank's statistics.

"Implementation of the stimulus packages has caused an increase in the amount of outstanding loans in the country's banking system during the period under review," Mr Islam, also a BB executive director, explained.

The share of NPLs also rose to 8.18 per cent of the total outstanding loans in the H1 of 2021 from 7.66 per cent as on December 31, 2020 - as per consolidated statement of classified loans covering both domestic and offshore banking units. It was 8.07 per cent as on March 31, 2021.

Classified loans cover substandard, doubtful and bad/loss portions of the total outstanding credits, which reached Tk 12,131.64 billion as on June 30 on a consolidated basis. It was Tk 11,587.75 billion six months before.

The central bank has started preparing the statement since the final quarter of the last calendar year. Earlier, the BB prepared two statements of classified loans separately for domestic banking units and offshore banking units.

Senior bankers, however, said most of the borrowers enjoyed an eased repayment facility during the period following BB's policy relaxation on loan repayment.

Under the BB policy relaxation, the borrowers were eligible to get three more months' time to repay their due loan installments on the basis of banker-customer relationship because of the second wave of the Covid-19 pandemic.

The borrowers were allowed to clear their installments on continuous, demand and term loans by June 2021, instead of March 2021, on the basis of banker-customer relationship, according to a notification issued by the central bank on March 24, 2021.

Besides, the BB offered a deferral loan-classification facility from January 2020 to December 2020, considering the adverse impact of the Covid-19 pandemic on life and business.

"It is expected due to the ongoing Covid-19 pandemic," former chairman of the Association of Bankers, Bangladesh (ABB) Syed Mahbubur Rahman said while explaining the rising trend of classified loans in Bangladesh.

Mr Rahman, also managing director (MD) and chief executive officer (CEO) of Mutual Trust Bank Limited, said: "It is likely to increase further in the coming quarters."

During the first half of 2021, the total amount of NPLs with six state-owned commercial banks (SoCBs) rose to Tk 438.36 billion from Tk 422.73 billion as on December 31 last. It was Tk 434.50 billion in Q1 of 2021.

On the other hand, the total amount of classified loans with 42 private commercial banks (PCBs) reached Tk 491.91 billion as on June 30 last from Tk 403.61 billion in the final quarter of last year. It was Tk 450.90 billion as on March 31 last. The NPLs from nine foreign commercial banks (FCBs) rose to Tk 24.92 billion during the period under review from Tk 20.38 billion in the Q4 of 2020. It was Tk 24.58 billion in the Q1 of 2021.

The classified loans with two development-finance institutions (DFIs) also came down to Tk 36.85 billion as on June 30 last from Tk 40.61 billion six months before. It was Tk 40.86 in the Q1 of this calendar year.