Bangladesh's trade deficit widened over threefold in the first quarter (Q1) of the current fiscal year for higher import-payment pressure, officials said, casting its cascading impacts on the economy.

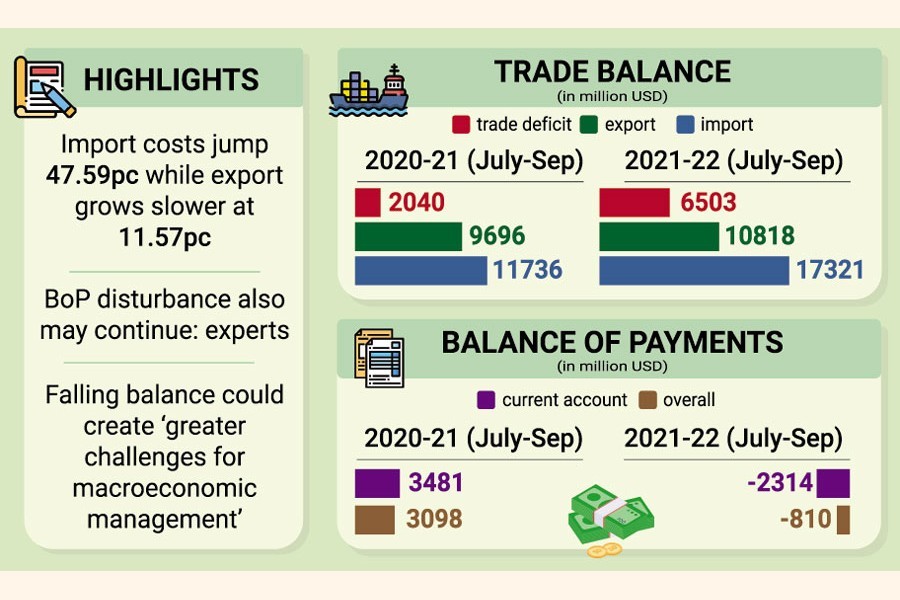

The country's trade imbalance with the rest of the world increased by US$4.46 billion to $6.50 billion during the July-September period of the FY 2021-22, from $2.04 billion in the same period of FY'2, according to the central bank's latest statistics.

The Bangladesh Bank (BB) data show that import expenses jumped 47.59 per cent while export earnings recorded an 11.57-per cent growth in Q1 of FY '22.

The overall import costs stood at $17.32 billion in the July-September period of FY '22 against $11.74 billion in the same period a year before.

On the other hand, export earnings stood at $10.82 billion in Q1 of FY '22 against $9.70 billion in the same period of the previous fiscal.

The country's foreign trade covering import and export increased significantly during the period under review amid gradually-reopening economic activities, both domestic and global, after more than a year of pandemic Covid-19 shocks.

"The foreign trade has picked up in recent months following the reopening of business activities across the country," a BB senior official told the FE while replying to a query.

He adds: "It's a temporary phenomenon. But upward trend in external trade would continue in the coming months."

Talking to the FE, Professor Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue (CPD), said higher prices of essential commodities along with petroleum products on the global market pushed the overall import-payment pressure on the economy.

"Overall imports are price given, not volume given," Professor Rahman said to explain the conundrum regarding latest import trend the country is experiencing.

He predicts that the trade gap may widen further in the months ahead.

Mr Rahman also suggested that the policymakers should take initiatives to keep going the existing robust growth in export earnings.

Meanwhile, the country's current-account deficit deteriorated further in Q1 of FY'22 following higher import-payment obligations and lower inflow of remittances.

The current-account deficit stood at $2.31 billion during the period under review from $1.27 billion a month before. It was $3.48 billion surplus in Q1 of FY'21.

The flow of inward remittances had dropped by 19.44 per cent to $5.41 billion in the first three months of the current fiscal year from $6.71 billion in the same period of FY'21as money transfers through informal channels such as hundi resurfaced after a lull caused by the coronavirus disruptions.

Experts predict that the falling trend in current-account deficit may continue in the coming months if the lower inflow of remittances and higher import expenses persist.

However, the financial account's surplus improved further following higher inflows medium-and long-term loans as well as aid flows, according to the officials.

The financial account's surplus stood at $1.92 billion in Q1 of FY'22 from $1.81 billion a month ago. It was $510 million deficit in Q1 of FY'21.

"Higher inflow of net foreign direct investment (FDI) has also helped achieve higher growth of the financial-account surplus," another BB official noted.

The amount of net FDI rose by 49.34 per cent to $339 million during the period under review from $227 million in the same period of the previous fiscal year.

Actually, the yawning gap in trade as well as the current account reflects the growing imbalance of the country's external account, thus creating mounting pressure on the country's overall balance-of-payments (BoP) status.

The central bank data showed the BoP having posted a negative balance of $810 million in the first three months of the current fiscal year against a positive balance of $3.10 billion in the same period of the last fiscal.

"If the falling trend of BoP continues, it would create greater challenges for macroeconomic management," Professor Rahman said while replying to a query.