Economic stability in Bangladesh is not comfortable anymore because of some macroeconomic problems, policy think-tank CPD says and offers a set of recommendations for the government to follow.

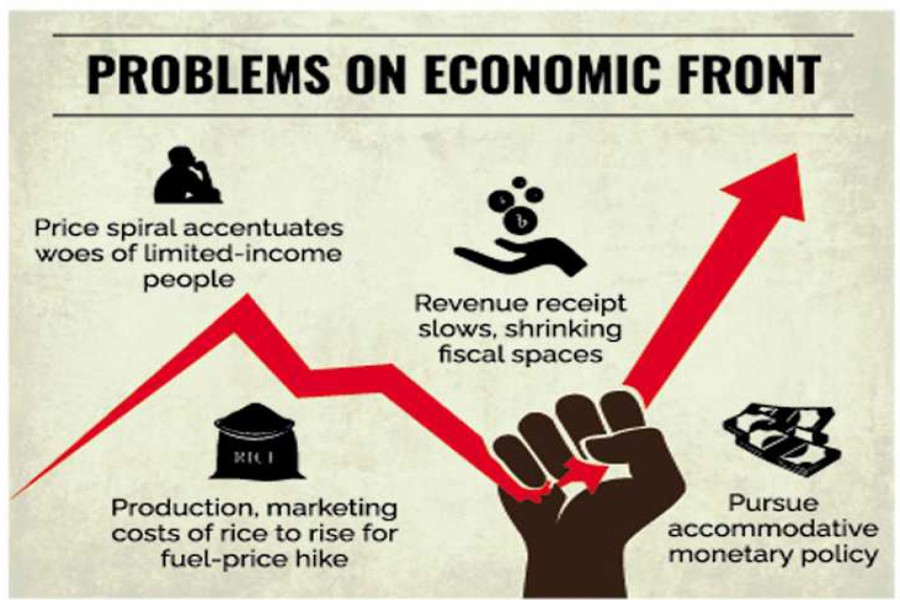

In its latest review unveiled Thursday, the Centre for Policy Dialogue noted that prices of essentials are on the rise, much to the woes of limited-income- bracket people.

The revenue mobilization remained much slower than targeted, leading to the shrinking of fiscal spaces.

Price upturn on the international market is one of the key reasons behind the price surges at home. Also, the domestic market is lacking in good governance, leading to abnormal spikes in prices of goods on the local market.

Executive Director of CPD Dr Fahmida Khatun said the rate of inflation in October was 5.3 per cent officially but actual price surge on the domestic market was much higher.

On role of the Competition Commission as regards market control, Dr Khatun says the institution should be strengthened further in order to ensure competition in the economy.

Export in terms of value remained above the target. But there are some concerns as the export receipts depend on the volumes of exports, not prices, the economist noted.

The CPD, Bangladesh's one of the oldest private think-tanks, thinks the government ought to opt for a focused and targeted fiscal policy reinforced by an accommodative monetary policy considering macroeconomic development.

It suggests reducing diesel prices in order to cut down crop cultivation and transportation costs. "Otherwise, the inflationary pressure will be much intensified," it cautions.

The CPD noted that the government increased prices of diesel by 23 per cent to Tk 80 per litre although use of the petroleum is widespread in agricultural production, transportation and rice milling.

Consequently, production and marketing costs of rice are likely to go up.

It stands for continuing the 2.0-per cent cash incentives to the remittance senders in order to dissuade transfers of money through informal channels.

The CPD economists were speaking at a media briefing on its first reading of the state of Bangladesh economy for the fiscal year 2021-22 at its office in Dhaka. The ED, Fahmida Khatun, was moderator.

Creating fiscal space is very important as the tax-GDP ratio has shrunk further as a result of GDP rebasing, said Dr Mustafizur Rahman, one of the distinguished fellows at the CPD.

Extraction of the surplus from Bangladesh Petroleum Corporation (BPC) has created problems, he comments.

BPC has deposited its surplus funds into government exchequer as per the new law. "BPC could handle the price rise of fuels on the market if it had adequate funds, but the surplus was given to the national exchequer," Dr Rahman says.

"So, such fund extraction from such organizations should be reviewed," the economist suggests.

Institutional capacity should be strengthened. "The economic risk will increase unless institutional efficiency is ensured," he says.

And the cost of doing business will be growing unless the institutions, including ports, are improved.

He says there is much external fund follow, but much of it is meant for project support. "The government cannot spend such funds for its budget deficit."

In stocks-related observations, the CPD says the securities regulator - BSEC -- should make it mandatory to tag TIN numbers and bank account numbers with the BOE account.

The BSEC should be more cautious regarding the Sukuk bond trading.

And market-related manipulation needs to be addressed by the BSEC "immediately".

CPD's director (research) Dr Khandker Golam Moazzem said that the prices of essentials increased much higher than the international levels. "Some big groups have been cashing in on the price hike on the international market," he says, indicating possible act of oligopoly.