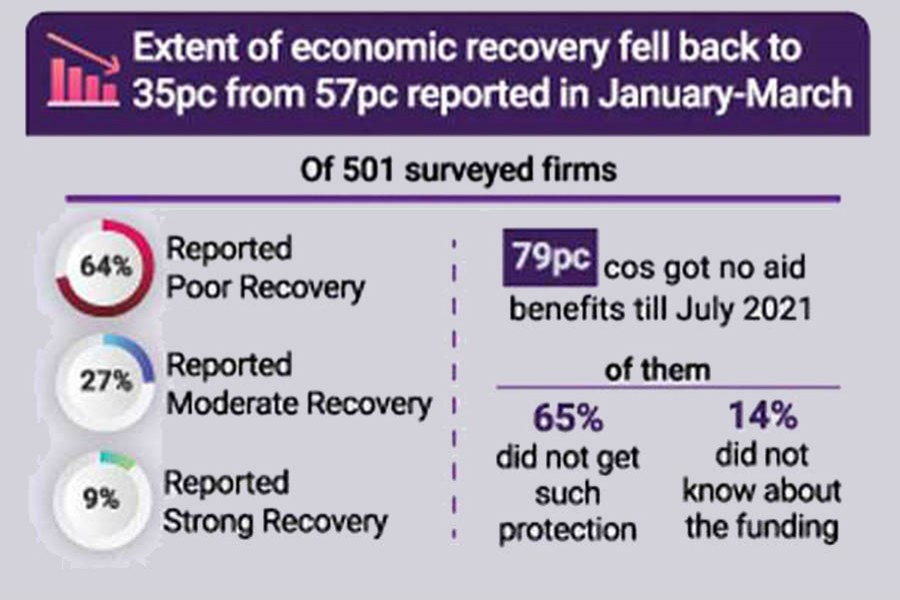

The lockdown enforced to control the second wave of coronavirus transmission has slowed down the business-recovery process in Bangladesh as 64 per cent of the firms registered poor rebound from the pandemic disruptions during April-June period of this year, according to a survey that also shows ways of an economic recovery.

The fifth quarter since the virus hit the economy was too bad for business when only 9.0 per cent of 501 surveyed firms reported strong recovery while 27 per cent maintained moderate turnaround.

During that period of headwind blowing in and out of the country, the extent of economic recovery from the covid-induced losses fell back to 35 per cent from 57 per cent that was reported in the previous quarter (January-March).

Regarding recovery by firm sizes, micro-and small industries were the worst performers while large units were the least, show the survey findings while listing the triggers heading off trade and business from depressions.

Foreign remittances, export of goods and services, banks' credits to the private sector and vaccination programmes are amongst major factors that are contributing to the overall economic recovery, said the research organisation.

The not-so-sound health of the businesses came out in the fifth round of quarterly Business Confidence Index (BCI) released Saturday by The South Asian Network on Economic Modeling (Sanem).

The Sanem, in collaboration with Asia Foundation, initiated the quarterly survey among 501 firms in the manufacturing and services sector in the wake of the world and Bangladesh reeling out of the worst health emergency in a century that is posed by the pandemic of coronavirus and its delta variant in particular.

In terms of stimulus coming as government bailout packages, the survey says, 79 per cent of companies had not got the benefits until July 2021. Of them, 65 per cent did not get such financial protection while 14 per cent did not know about the special funding arrangement.

During the period of survey, only 20 of the 348 approached firms managed to receive stimulus package for the first time, but small and medium enterprises accounted for only 4.0 per cent.

In terms of sectors accessing stimulus packages, readymade garment with 52 per cent topped the list followed by textile (36 per cent) and leather (30 per cent) while wholesale trading, ICT, restaurant, real estate and transport were the least recipients.

SANEM Executive Director and Dhaka University Professor Dr Selim Raihan virtually shared the survey findings that were based on the interviews of the owners as well as the representatives of 309 micro-and small, 142 large and 50 medium industries.

He said the business-recovery trend further slowed down in the fifth quarter while disbursement of stimulus funds to the pandemic-affected industries progressed at a poor pace.

He said those who received supports from the government incentive packages are in a better state compared to those who didn't.

"A total of 29 per cent of respondents complained about being faced with bribe demands and 47 others preferred not to respond to this question, while 24 per cent said they were not asked for a bribe," he added.

He further mentioned that 42 per cent of those who reported bribery claims belong to small-and medium-sized enterprises.

Dr Raihan discussed some factors which contribute to the overall economic recovery, such as foreign remittance, export status, vaccinations, bank credit to the private sectors, stimulus package and its disbursement.

Another important finding came up during the survey when the firms were asked about the extent of recovery of their business since March 2020 when the global pandemic invaded Bangladesh, too.

On average, 57 per cent of their business recovered by March 2021 compared to March 2020, which unfortunately shrank to 35 per cent during June 2021.

"Thus, recovery has deteriorated on average and a significant variation is seen regarding this when we look at the firm sizes: micro-and small enterprises have suffered most with a drastic reduction from the previous 46.9 per cent to 28.3 per cent," he said.

Talking about the firms' coping strategies during the three months, he said 65.6 per cent of the respondents depended on own savings as the majority of the firms did not benefit from the stimulus packages.

Some 28.1 per cent were relying on borrowing or loans, employee-layoff contributed 19 per cent while stimulus was helping 17.8 percent respondents, according to him.

He said the pandemic seems to be continuing for a longer period of time and the businesspeople realised that they need to move forward alongside the virus.

He suggested adopting area-specific and sector-specific protocols in consultation with the stakeholders instead of administration-developed protocols for better results in the rebound process.

"We've learnt many things over the last one and a half years in fighting the virus. We must design such protocols from our lessons," he said.

The most encouraging part of the latest round of survey was business confidence ticking up following relaxation of the lockdowns.

Measured on a scale of 0 to100, Sanem said Business Confidence Index (BCI) improved to 49.74 in July-September period of this year from 41.39 in the April-June period.

A confidence level below 50 reflects deterioration in the outlook, while a reading above 50 indicates an improvement.

"The improvement is visible for all of the sub-components. This improvement in business confidence shows a hope to revive the private sector," Mr Raihan concluded.