Finance Minister AHM Mustafa Kamal claimed Thursday Bangladeshi depositors get higher returns than they should as compared to the gains in other countries, thus deflating a different view.

"In other countries depositors get no returns rather they need to pay interest for keeping money in banks," the minister said, as critics point out the impact of inflation on the receipts.

He was replying to newsmen's queries after two virtual cabinet meetings on economic affairs and government purchase.

Amid concerns over waning returns for depositors, the central bank recently asked the scheduled banks not to lower the interest rate on term deposits compared to three months' average inflation rate.

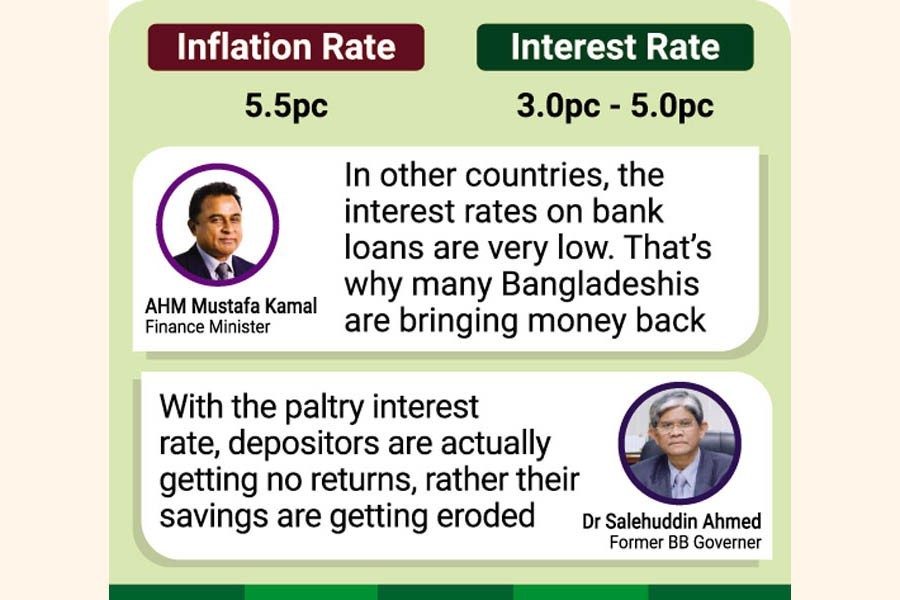

The minister was asked how much the depositors actually get against their savings when the bank interest is between 3.0 and 5.0 per cent and the rate of inflation is around 5.5 per cent.

Mr Kamal said in other countries the interest rates on bank loans are very low. "That's why many Bangladeshi citizens staying abroad are bringing money back to the country in investing here."

The government set the maximum lending rate at 9.0 per cent and deposit rate at 6.0 per cent back in April 2020 in a bid to provide low-cost funds to businesses.

He said production cost of goods of Bangladesh's business competitors abroad is less since they get low-cost loans. Their operational costs thus also low and they become more competitive than Bangladeshi businesses.

"We have lowered the interest rates here taking into consideration all these things," he added.

He said the prime minister had worked on it for a long period, and "I believe a realistic rate, what it should be, is set as interest rate of bank loans".

Kamal thinks that if the interest rates are set higher than the current ones, depositors may not get it properly. "Because, in that case, the volume of non-performing loans will go up and the huge amount of loans may need to be written off."

Due to low interest, he said, presently the volume of non-performing loans is less and also loans do not need to be written off like in the past.

On Thursday, an online publication namely 'Banking Almanac' was published online where economists and a former central-bank governor were present. At the event they also discussed that the rates of returns against bank deposit are very poor.

They further discussed that, on the contrary, the banks which are listed in share markets are paying dividend at the rate of 20 per cent to 30 per cent which is "inconsistent".

Experts say such big-sized dividends are paid to make the bank shareholders beneficiary, especially the major shareholders and the directors.

When his attention was drawn on this issue, Mr Kamal said the state of the country's private-sector banks is now better off than in the past and their balance sheet this year is "very healthy".

And they made good profits, thus providing handsome cash dividend, which they were avoiding to pay in the past rather was providing stock dividends, he said.

Mr Kamal said even the state-owned banks in the past were relying on government refinancing schemes.

But, during the last couple of years, there is no such provision for them. They have been asked to make earnings to spend money and they are doing so, he said, adding that both the public-and private-sector banks are in good position.

Replying on bubble on the bourses, the minister said the regulator is supposed to look after it.

The basic foundation of Bangladesh's stock market is the country's economy. "When the country's economy does well, the stock market will also remain at high," he said.

Contacted, former central-bank governor Dr Salehuddin Ahmed said with the paltry interest the depositors are actually getting no returns rather their savings are getting eroded.

"In whatever ways you define the inflation rate, on point-to-point basis or average in three months, depositors get nothing from banks if you make a comparison," he said. "They are keeping Tk 100 in banks which one year later is turning Tk 97," said the former governor.

Mr Ahmed suggests coming out from the 9.0 percent and 6.0 percent interest-rate formula and let the market decide it.

Besides, he also suggested lowering the spread between the lending and deposit rates, and to lessen the operational expenditure and bad debts to pay the depositors higher returns.