Former governor of Bangladesh Bank Dr Mohammed Farashuddin on Thursday said the country's private commercial banks are dictating banking policies.

He also held responsible the domination of private banks for not having a competitive environment in the banking sector and urged the central bank to think about ways and means for ensuring a competitive environment in the banks in the new normal.

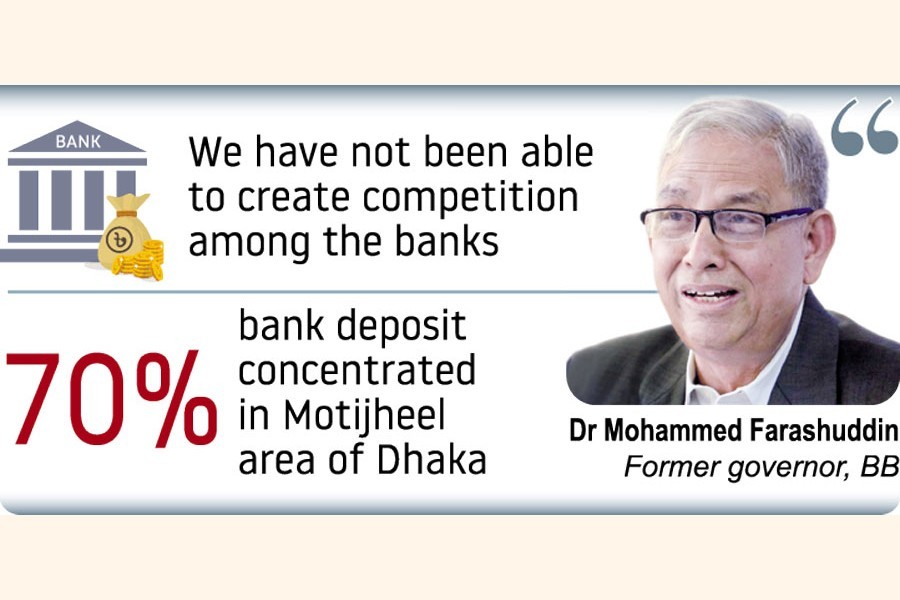

"We have been failing in one duty…. we have not been able to create competition among the banks," Dr Farashuddin said while speaking as the chief guest at a webinar.

"So, the cartel formed by private bank owners is dictating interested policy. They (private bank owners) are actually spoiling many of good fruits of the reform," he added.

Bangladesh Institute of Bank Management (BIBM) organised the webinar on "central banking in the new normal" jointly with Asia School of Business (in collaboration with MIT Sloan Management).

Dr Farashuddin said the central bank should create an environment so that merger and acquisitions and competition among banks prevail.

Branches and head offices of banks should not be concentrated in capital Dhaka, they should have dispersed across the country, he added.

"70 per cent bank deposit concentrated in Motijheel area of Dhaka. It is not the number of bank that matters, the matter is the number of branches."

The former governor of Bangladesh Bank further said branches should be dispersed across the bank so that they can cover more people.

It is easy to blame nationalized commercial banks, but real assessment will find different picture, he said, adding that waiving interest rates of willful defaulters should not continue.

"The government should refrain from moral hazard- laden waiving interest rates…profits of the banks are out of the deposits of the common people like us, and from there, willful defaulters' interest is waived ... this is not done."

Mr Farashuddin said multiple exchange rates should not be continued. "Incentives on remittance and exports brought good results but these policies' implication might not be good."

Presenting a keynote paper, Global Perspective Professor Hans Genberg of ABS, Malaysia said focus on monetary stability is not enough in new normal, the focus also should be given on financial stability.

Stressing the need for policy interactions to create compatibility, he said using multiple instruments to achieve multiple objectives require coordination and discipline.

BIBM Professor Barkat-e-Khuda said the government and central bank responded in the right time for the pandemic-induced economy.

Monetary policy needs short, medium and long-term focus and target for the economic recovery, he noted.

BIBM Professor Shah Md Ahsan Habib presented a keynote paper at the webinar.

He said the government of Bangladesh initiated preventive measures actively from early February even before identifying any confirmed Covid-19 case.

"Supportive and accommodative central bank policy needed to attain the essential goals of liquidity injection in the economy, quick economic recovery, and supporting the vulnerable and covid-19 affected segments."

Stressing on aligning banking services with the government's move to promote priority sectors and adjusting portfolios for sustainability, he said new economic opportunities have been created in sectors like pharma and food; technology firms, online platforms; technology-driven transformations.

Professor Habib also said fear of the second wave of Covid-19 is resulting in uncertainty in recent days. "For upcoming months, it may not be any specific policy stance; rather it should be a dynamic approach of central banking to respond to the changing scenario," he said.

Executive Director of Bangladesh Bank Md Habibur Rahman said the central bank always has to be ready for existing pandemic-like situation.

"Central banks are at risk of losing control of reserve money and ultimately over inflation in the new normal for which the central bank is mandated for."

The concept of independence of central bank will be significantly diluted in the post-Covid new normal, he added.

Professor of ABS, Malaysia Anella Munro said it will be very much difficult in recovery phase of Covid-19 if the government is not prudent in fiscal policies.

She also said the central bank might need to increase interest rate in the recovery phase and the central bank must go as much digital as it could to supervise the digitally transformed services.

Executive Director of Bangladesh Bank Lila Rashid, Agrani Bank Limited Managing Director Mohammad Shams-Ul-Islam, President and Dean of ABS, Malaysia Professor Charles Fine, Director General Md Akhtaruzzaman also spoke at the webinar.