Income inequality in Bangladesh goes gaping to worst level after the pandemic as government's direct-tax measure proves futile in addressing the disparity, experts say.

Despite Bangladesh having amongst the highest levels of corporate and income-tax rates in the region, corporate-tax turnover is still low, around 1.6 per cent of GDP, an analysis shows while suggesting budgetary remedies through taxation re-jig.

"Bangladesh has failed to benefit from existing progressive income-taxation structure and a rapid growth of the economy," says a policy memo of RAPID.

Research and Policy Integration for Development (RAPID) recently submitted to the Ministry of Finance (MoF) the policy memo for 2022-23 on ways of 'Using Direct Taxation to Reduce Inequality and Boost Revenue'.

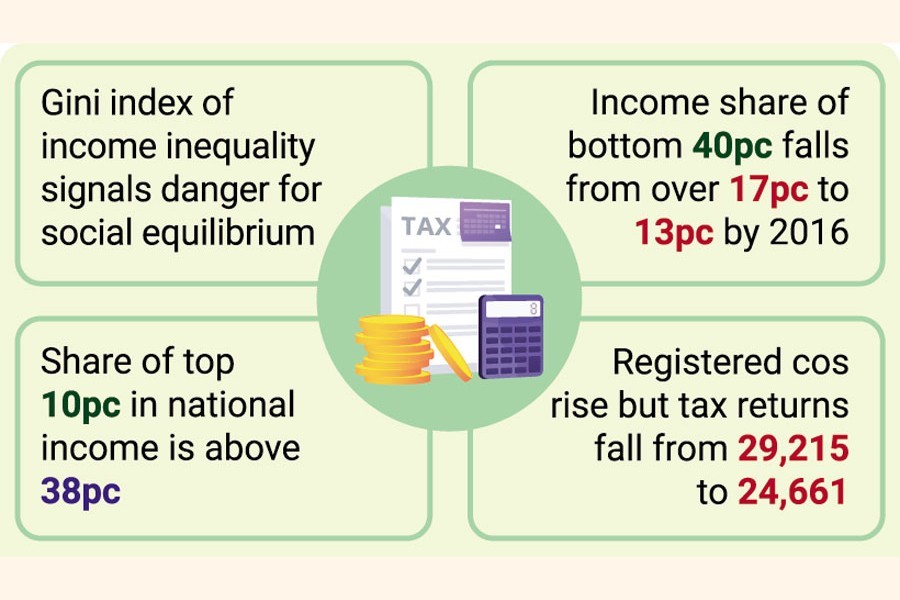

Bangladesh already was in a danger level in Gini index of income inequality before the pandemic as per available study.

A higher Gini index or Gini coefficient indicates greater inequality in a society.

Global inequality, as measured by the Gini index, also has steadily increased over the past few centuries and spiked during the Covid-19 pandemic, says Investopedia.

Citing Households Income Expenditure Survey (HIES) data of Bangladesh Bureau of Statistics (BBS), RAPID Chairman Dr Mohammad Abdur Razzaque, also Research Director of Policy Research Institute (PRI), said the income share of the bottom 40 per cent of the population fell from more than 17 per cent in the 1990s to 13 per cent in 2016.

The same share for the bottom 5.0 per cent declined from 1.03 per cent to just 0.23 per cent.

Although the number of registered companies increased between 2016-17 and 2021-22, the companies submitting returns declined from 29,215 to 24,661, according to RAPID analysis.

Dr Razzaque suggests addressing income inequality through effective direct-tax measures in the budget by restructuring personal-and corporate- income taxes.

Revenue from personal income tax is 1.0 per cent of GDP. It is lower than China's 1.5 per cent, Korea's 5.26 per cent, Mexico's 3.8 per cent and Vietnam's 1.8 per cent, the report says.

Ratio of personal income tax is 8.04 in OECD countries on average while it is 3.6 per cent in Asia-Pacific countries and 3.1 per cent in African countries.

"Between 2012-13 and 2018-19, while per-capita income almost doubled, tax revenue per taxpayer declined," the research shows.

The share of the top 10 per cent in total national income is above 38 per cent and if the group pays income tax at 10 per cent, the income tax-GDP ratio would reach 3.8 per cent.

The analysis reveals only 17 to 26 per cent of personal tax potential is currently utilized.

Revenue-mobilization effort here is dependent on indirect tax. As per the perspective plan 2041, Bangladesh tax-GDP ratio should rise to 17 per cent by 2031 and almost 22 per cent by 2041.

Political-economy factors undermine tax efforts as the NBR issued 926 statutory regulatory orders offering special benefits to target groups between 2015 and 2019.

"Objectives of any taxation reform should not be only about raising revenue but also about dealing with this growing inequality as much as possible," Dr Razzaque remarks.

He recommends rationalization and consolidation of tax exemptions and upward adjustment of highest personal income tax rate to 30 per cent for the well-off.

"Higher-income group of people should pay higher taxes. The government would be able to spend more on social-safety net to reduce income inequality," he says.

Talking to the FE, a senior official of the National Board of Revenue (NBR) said tax exemption eats up 2.8 per cent from tax-GDP ratio but trimming down general-exemption list is a "troublesome task due to pressure of the influential group of people".

"With the budget for upcoming fiscal, the NBR starts to phase out tax incentives from local mobile and refrigerator manufacturers following their enhanced capacity to pay taxes," he added.

The official feels that investment is required on direct tax collection as poor infrastructure and lack of logistics are major barriers to providing better services to the taxpayers.