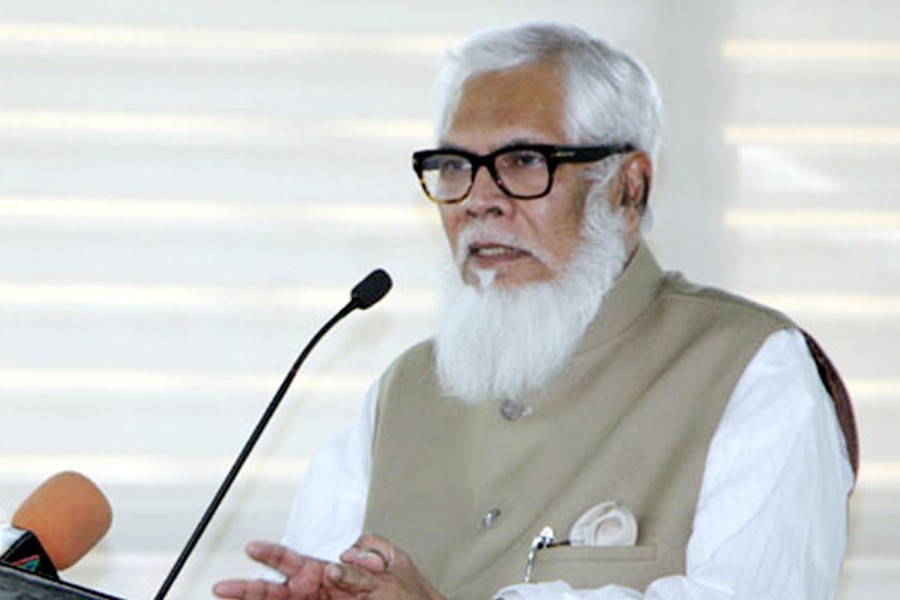

The government is trying to address two big contradictions in the economy - low tax-to-GDP ratio and stock market capitalisation-to- GDP ratio, advisor to the Prime Minister on private industry and investment Salman F Rahman said on Sunday.

Rahman said these two indicators are not compatible with the country's economic growth.

He said the country's economy recorded growth at a rate of more than six per cent during the past one decade, but its tax-GDP ratio is one of the lowest in the region.

"Even, [it is] lower than that of Pakistan and it's really ridiculous. So, what we need to do is to widen the tax net and lower the rate," he said while speaking as the chief guest at a virtual discussion.

American Chamber of Commerce in Bangladesh (AmCham) organised the discussion on 'FDI in priority sector: Value added agriculture processing, digital ecosystem and green capital.'

Lowering rate will not only help raise tax-GDP ratio, but also give some respite to the good taxpayers like foreign investors as most problems faced by overseas investors relate to tax, Rahman said.

Terming the low stock market capitalisation-to- GDP ratio another big contradiction, he said,the Securities and Exchange Commission (SEC) got new set-up and they have been working well to bring back discipline in the market.

"I talked with the SEC chairman the other day and said we should look into the supply-demand areas. We don't have a bond market and we should start working on that. We will be going into the green bond," he added.

AmCham president Syed Ershad Ahmed said there are three Cs that attract global investors in any place - cost of doing business, cost of production and competitiveness.

"The government is working hard on these areas," he observed.

He cited a number of challenges the country needs to address: bureaucratic tangle, port automation and management system, strong financial system, good logistic policies and proper execution of the policies.

Speaking at the discussion, executive chairman of Bangladesh Investment Development Authority Mohammad Sirazul Islam said they gave serious attention to the implementation of policies much to the liking of the investors.

Referring to one stop service, he said a total of 21 services from seven government agencies are available under this system.

"We'll be able to add 20 more services by the end of this year. Our plan is to provide all 154 services from 35 government agencies that the investors require under the digital platform," he said.

Moderating the function, country officer of Citi Bank NA N. Rajashekharan recognised the outstanding contribution of the agriculture sector to the economy.

"Despite floods, weather consideration and COVID-19 pandemic, the sector has grown handsomely and it thus gives a message," he said.

In the virtual panel discussion, the discussants laid emphasis on issues like enhancing knowledge of the farmers about modern farming technology, policies to attract overseas investors and protection of IPR (intellectual property rights).

Country manager of Pepsico Bangladesh Debasish Deb, USTDA senior regional representative - South Asia Mehnaz Ansari, Chairperson of SBK Foundation Sonia Bashir Kabir and IFC senior country officer Nuzhat Anwar, among others, spoke at the discussion.