A move is underway to cover the risks associated with fixed-income financial instruments being approved by the securities regulator.

The Bangladesh Securities and Exchange Commission (BSEC) has approved a number of bonds, including perpetual bonds, and preference shares in favour of corporate houses.

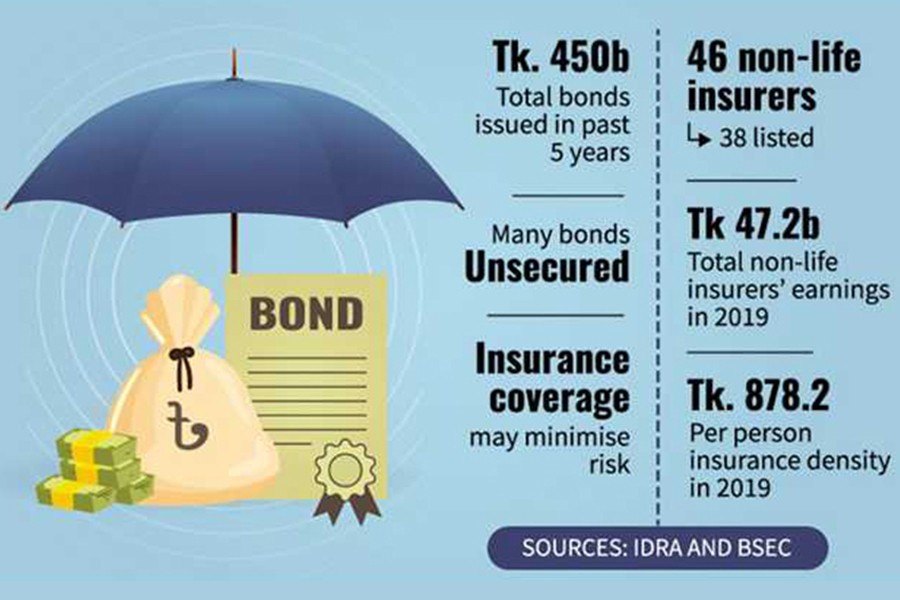

"We have approved bonds worth Tk 450 billion over the last five years," a BSEC official told the FE on Tuesday.

Many non-governmental organisations (NGOs) also raised such funds upon approval by the regulator. The BSEC approved a fund worth Tk. 13.5 billion for BRAC, a leading global non-government organisation, he said.

But the bonds and such other types of instruments are considered not secured, he added.

Officials said that the subordinate or junior bonds are examples of such a market where the investors do not have the priority to get the money back in case of liquidation of a company.

The companies or NGOs, which raise such funds under the fixed-income mechanism, may default and, under such circumstances, the investors might face financial losses, they explained.

The insurance products usually protect the interest of investors in cases when the borrowers default.

Meanwhile, the insurance regulator has undertaken a move to find appropriate insurance products to protect the interest of the investors.

The Insurance Development and Regulatory Authority (IDRA) is scheduled to hold a virtual meeting on the issue with its key stakeholders at 11.30 am tomorrow (Thursday).

Its chairman Dr. M Mosharrof Hossain will preside over the meeting. The BSEC, the Shadharan Bima Corporation (SBC) and other stakeholders are expected to join the meeting.

BSEC spokesperson Rezaul Karim told the FE that a mechanism would be proposed at the meeting that the issuer of any instrument will pay the insurance premium and in case of any default on its part, the relevant insurance companies will settle the claims on its behalf.

Syed Shahriyar Ahsan, managing director at the SBC, told the FE: "I think such funds need to be secured with insurance coverage."

He said that providing risk coverage for the bonds will help spur the bond market in the country as many will show interest in the instruments.

However, Mr Ahsan, who will join the meeting, said that they would need an overseas reinsurance facility on such products. "We're commercial organisations. We'll try to make business by taking risk coverage."

Khairul Bashar Abu Taher Mohammed, CEO at the MTB Capital, said: "This should be analysed properly before launching any such product to cover such funds."

The MTB has involvement in raising funds through issuing preference shares and such other instruments.

"This is a new issue in the financial market and we need to explore the best practices in this regard," said Mr Khairul.

Imam Shaheen, managing director at Asia Insurance, said that it would help them diversify their business and help fetch more revenues. "If the authorities concerned design appropriate products, we must show interest in it as it will help earn more revenues." He said the non-life insurers will get the business if such products are designed.

There are 46 non-life insurance companies, including the state-owned SBC, operating in the country at present.