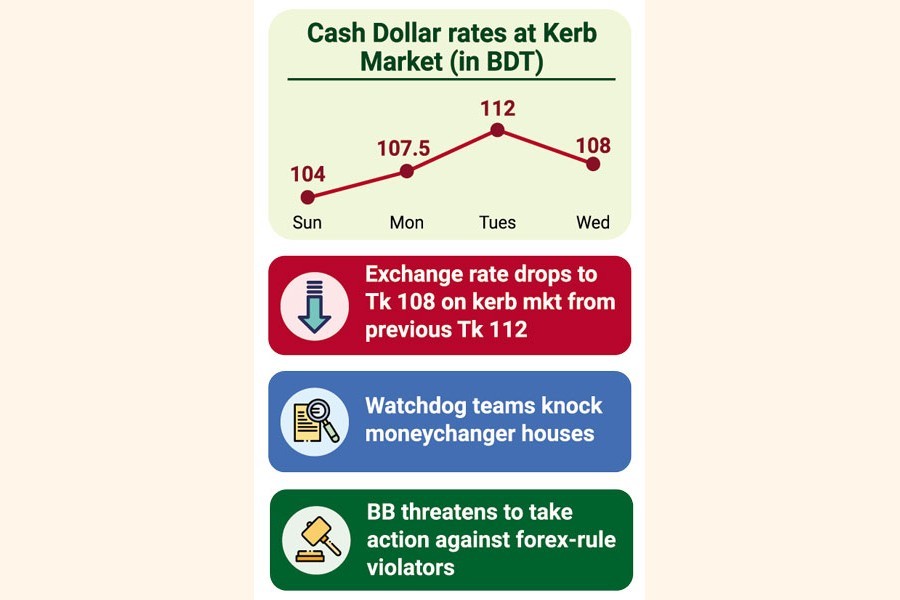

An eventual policing drive against suspected manipulators brought down the overheating cash-dollar price on the open market that hit Tk 112 Tuesday amid growing concerns about Bangladesh's foreign-exchange reserves.

Market operators said the exchange rate of the US currency came down to Tk 108 Wednesday on the kerb market, as the central bank launched the spot monitoring.

The Bangladesh Bank (BB) set ten teams that conducted drives at different moneychanger houses in Dhaka a day after the dollar price showed a quirky rise, giving economists and analysts to talk why and how.

Sources said the crackdown would continue Thursday (today), the day before the weekend, in the regulator's bid to tame the wayward market.

"We'll take actions against moneychangers if found in gross violation of the existing rules and regulations," Md. Serajul Islam, spokesperson for the central bank, told the FE.

Currently, the central bank is empowered to suspend the licence of a moneychanger anytime, without assigning any reason, in case of violation of any rules and regulations governing foreign-exchange transactions.

Earlier, the BB had amended the order for moneychangers aiming to ensure enforcement of such rules and regulations properly.

The moneychangers now submit the transaction reports of only four major currencies - US dollar (USD), Pound Sterling, Euro and Japanese Yen - on a monthly basis to their commercial banks concerned in line with the BB directives.

The commercial banks have already been asked to submit their monthly statements by the 15th of each month to the relevant departments of the central bank.

Currently, 238 moneychangers are operating across the country.

"We sold the cash US dollar at Tk 108 Wednesday," Money Changers' Association of Bangladesh President A K M Ismail Haq told the FE, without elaboration.

A demand-supply mismatch of the US dollar on the money market is the main cause behind the rising trend in cash-dollar rates recently, according to traders.

They say cash dollar is mainly used for medical treatment, education and business purposes.

Sources, however, say the rate of cash dollar normally increases when illegal transactions like smuggling and under-invoicing go up.

And such tricks, according to economists, are related to fund flight from the country that results in erosion of reserves.

However, the central bank continued providing its foreign-currency support to the scheduled banks for managing the forex-market volatility.

It sold $90 million more directly to different banks at market rate on Wednesday to help them meet the growing demand for the greenback.

On Tuesday, the central bank sold $50 million to two state-owned commercial banks on the same ground.

The US dollar was quoted at Tk 94.70 each on the inter-bank market Wednesday, unchanged from the previous level, according to the operators.

The US dollar was quoted at a maximum of Tk 94.75 for the sale of bills for collection, generally known as BC, on the day, unchanged from the previous working day.

Some banks, however, traded the greenback at rates ranging between Tk 94.75 and Tk 105 to their customers for settling import-payment obligations, ignoring their announced rates, they added.

The BB has so far injected $1.08 billion from the reserves directly into commercial banks as liquidity support for settling their import-payment obligations in the current fiscal year (FY), 2022-23.

In FY'22, the central bank sold $7.62 billion from the reserves to the banks for the same purposes.

Bangladesh's forex reserves came down to $39.49 billion on Wednesday from $39.60 billion of the previous day - following higher sales of the greenback from the reserves to feed the market.