Bangladesh prime minister’s Private Industry and Investment Adviser Salman F Rahman has said the austerity measures initiated by the government and the central banks to rein in a bullish trend of import since the beginning of the second half of last fiscal year are paying dividends as import costs have shrunk to $6 billion from over $8 billion a month, bdnews24.com reports.

Goods worth $83.68 billion, or $6.97 billion average per month, were imported into Bangladesh through letters of credit, or LCs, in the recently concluded fiscal year, which is a massive 46 per cent jump from the previous fiscal year, according to updated import data released by Bangladesh Bank last week.

Importers in Bangladesh had opened LCs worth $92.23 billion, or $7.68 billion average per month, to import goods in the fiscal year 2021-22, which is 37.59 per cent more than the previous fiscal year.

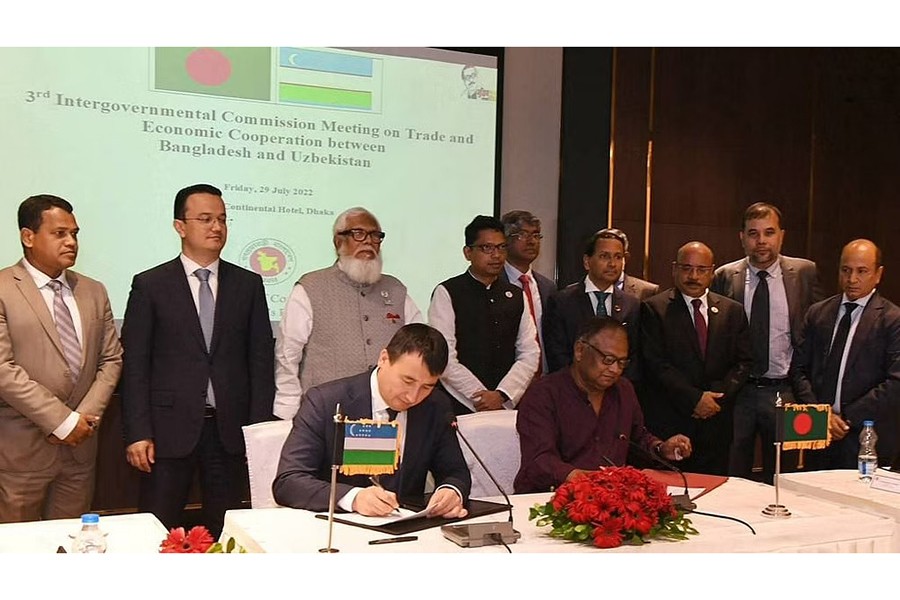

“It [imports] used to be $8 billion a month, which came down to $7 billion last month and $6 billion this month. I believe our issues will be resolved pretty soon," he said while speaking to journalists after a meeting with a visiting delegation team of Uzbekistan at a hotel in Dhaka on Friday.

"The prime minister [Sheikh Hasina] took proactive initiatives to protect the economy in pandemic times and she did the same when the dollar prices began skyrocketing. Alongside, Bangladesh Bank has taken initiatives to reduce imports at the right time.”

Salman, a top industrialist, believes Dhaka’s attempt to secure a $4.5 billion loan from the International Monetary Fund, or IMF, is a part of the process.

He also said the greenback is strengthening against all currencies due to the US Federal Reserve’s policy reversal of raising the interest rate, which Salman believes will hurt the American economy in the long run.

“The Fed [Federal Reserve] is raising the interest rate to avoid a recession. I don’t think it will help [the American economy] in the end. They could go into recession by raising interest rates. We’re already seeing signs of that. The bullish trend of soaring dollar prices will stabilise by the end of this year," Salman projected.

Bangladesh taka has been on a freefall against US dollars since April as soon as the information of a depleted foreign exchange reserve came out.

As soon as the economy picked up after the post-pandemic reopening, the import costs soared massively and the depletion took place due to a large gap between the amounts paid for imports through letters of credit and the cumulative inflow of foreign exchanges via exports and remittances.

For the first couple of months, the central bank imposed tight controls on the dollar exchange rate, with a system called “managed exchange rate or floor rate.” But eventually, it backed off and reintroduced a floating exchange rate system.

However, the increase in the US dollar prices has essentially kept the rate of the taka being devalued, even with the reinstatement of the floating system.

Analysts believe since the main supplier of the US dollars, Bangladesh Bank, is increasing the price for selling the greenback to the local banks, it is unlikely that the price of the US dollars will go down anytime soon.

The devaluations somewhat put the kerb currency market into a spiral, as dollar prices soared significantly. At one point last month, exchangers outside of the formal banking system were selling a dollar for over Tk 112, the highest in Bangladesh’s history.

As a result of it, analysts said, banks struggled to supply adequate US dollars for the payment of import costs, and the situation simultaneously prompted exporters to delay the encashment of their earnings resulting in a demand-supply mismatch.

Then in mid-April, Bangladesh Bank tightened the import. The government also introduced an array of austerity measures to reduce expenses.

ON EXPORT & STOCK MARKET

The founder and incumbent vice-chairman of Beximco Group, however, sounded a warning for Bangladeshi exporters that the gloomy economic situation may degenerate into a full-blown recession in Europe and the US, which may significantly hurt export from Bangladesh.

Salman believes it is high time exporters looked for alternative markets.

He hailed the 'timely' move to fix the floor price in the capital market to prevent continuous decline.

“Bangladesh’s stock markets do not have that kind of depth like other stock markets in the world. In a matured market, 80 per cent of investors are institutional while the rest are retail investors.

“Our market has the opposite picture, which means due to the lack of depth and stability, retail investors quickly panic,” he offered.