Parliament approved on Saturday the finance bill-2019 with a few amendments suggested by the lawmakers.

Some 10 lawmakers proposed to elicit public opinion on the bill, but that was rejected by voice vote.

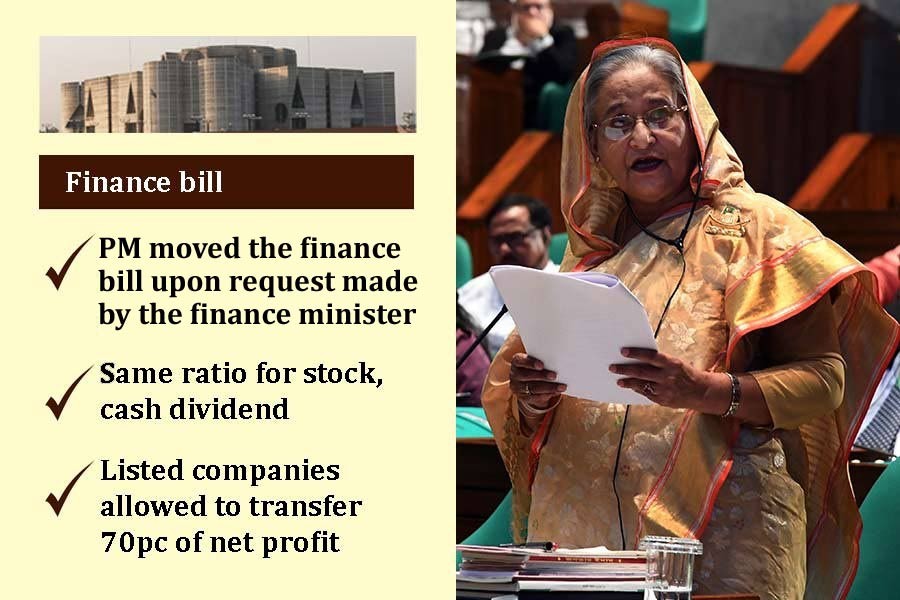

Prime Minister Sheikh Hasina moved the finance bill upon request made by the finance minister AHM Mustafa Kamal.

It may be mentioned that Prime Minister also placed the national budget on June 13 in parliament due to the indisposition of the finance minister.

On cash dividend, Sheikh Hasina said the government wanted to encourage cash dividend to boost the capital market but financial institutions objected it on many grounds.

She said from now on, the ratio of stock dividend and cash dividend will be same and if the stock dividend becomes higher than the cash dividend then 10 per cent tax shall be payable on the full amount.

On the retained earnings, the premier said listed companies can transfer up to 70 per cent of their net profits as reserve or surplus.

They will have to pay a 10 per cent dividend on the remaining 30 per cent. She said if any company fails to do so then 10 per cent tax shall be payable each year.

The bill said, “In any income year the total of retained earnings, any reserve or other equity … except paid up capital exceeded 50 per cent of the paid up capital of a company registered in the country and listed to any stock exchange in Bangladesh, tax shall be payable at the rate of 15 per cent on the amount of such excess of the company in the aforesaid income year.”

About the textile industry, the premier said VAT on cotton at a fixed rate of Tk 4.0 each kilograme will be imposed instead of proposed VAT at the rate of 5.0 per cent.

She said poor people are involved with the textile industry and the government considered the welfare of the poor.

She said the interest of local paper mills and gas-producing companies should be protected.

She said the companies who do not produce in the country but secure the bond facility and in such cases the tax rates will be rationalised.

However, the premier accepted at least 27 points presented by the lawmakers.

Turning to new VAT, she said even if local industries pay consumption tax at the rate of 15 per cent, they can get rebate later.

Speaking on the bill, Mr Kamal said the budget has been prepared in a simple way as it has not imposed any tax, but has increased the purview of tax net.

Mr Kamal said the budget has been framed under the guidance of the Prime Minister.

He said this budget is not intended to be for a single fiscal year, but it will lay the foundation for all the future fiscal blueprints, which would help the country achieve the developed nation status by 2041.

The finance minister said Bangladesh has the lowest debt-to GDP ratio in the world as the country’s percentage of loan is only 34 per cent, compared with China’s 285 per cent.

Speaking on the finance bill, deputy opposition leader Begum Rowshan Ershad said there is a scope for whitening undisclosed money in every country.

“Our businessmen should be given the same facility,” she said.

She said if the government allows undisclosed money to be legalised, the investment will increase. “If not, there will be capital flight.”

Lawmaker Begum Rowshan Ara Mannan said Bangladesh is a unique country where borrowers do not need to repay.

She said a total of Tk 432.1 billion loans have turned into defaulted in 39 months.

Mukabbir Khan said there are 40 million people in the middle income bracket, but tax collection remains poor.

Begum Rumin Farhana said the economy is witnessing “looting” as the volume of deposits held by Bangladeshis in Swiss banks swelled by Tk 13 billion over the past year.

In response, the premier said it climbed due to the “nomination trade by BNP.”