The National Board of Revenue (NBR), on Monday, ruled out any possibility to cut import taxes on rice and edible oil despite the recent price spiral of these two essential commodities.

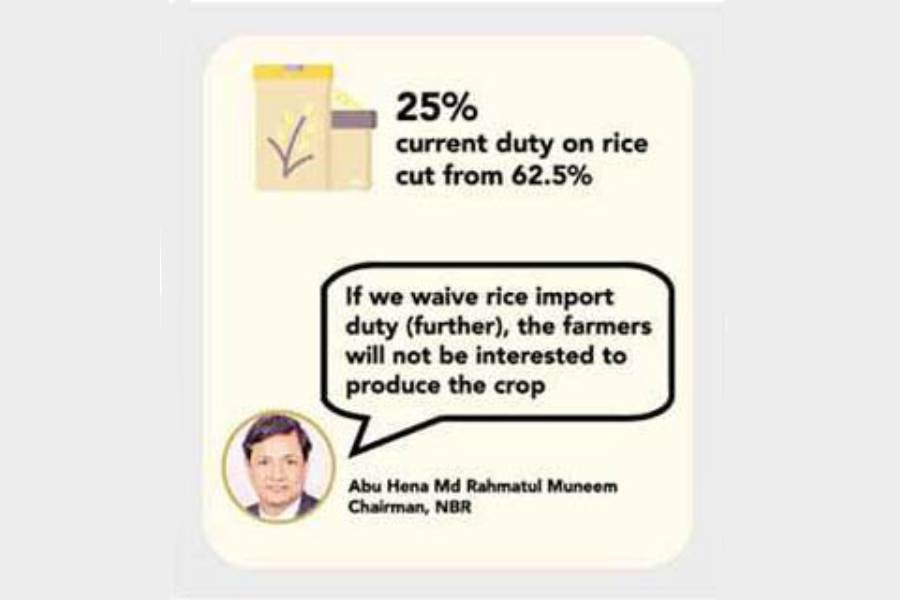

The NBR Chairman Abu Hena Md Rahmatul Muneem said the board will not consider further reduction of duty on rice import for the sake of protecting interest of farmers.

The duty on rice import has recently been cut to 25 per cent from 62.5 per cent through issuing gazette notification.

Speaking at a press briefing on the occasion of International Customs Day 2021 (January 26) on the NBR premises, he said the farmers are already getting discouraged to produce rice, as they are not getting fair prices due to its import at cheaper rates.

"If we waive rice import duty (further), the farmers will not be interested to produce the crop."

The customs authority does not focus on revenue collection only, but also considers local production, environment and other issues.

Local production of essential commodities will be affected, if the NBR cuts import duty of these produces, he added.

On edible oil, the NBR chairman opined that people have enough capacity to purchase the item that is needed in small quantity in cooking.

"We have to keep in mind that increase in import duty can protect producers of oil seeds."

Mr Muneem said the theme of this year's International Customs Day is 'Customs bolstering recovery, renewal and resilience for a sustainable supply chain'.

The customs administrations of 183 countries across the world, who are members of the World Customs Organisation (WCO), will observe the International Customs Day today (Tuesday).

The NBR will hold seminar, hand over WCO Certificate of Merit 2021, and arrange opinion exchange meetings today.

Responding to a query, the NBR chairman said expediting delivery of import-export goods from ports not only depends on the customs authority, as many other entities are involved in this process.

"Currently, clearance processes of many of those entities are done through manual system, causing delay in customs clearance process."

Under the National Single Window (NSW) project, the NBR is trying to automate the clearance process.

Some of the importers, including those of car and other vehicles, are reluctant to take delivery of their imported goods from the ports, he noted.

Syed Golam Kibria, the NBR member (customs policy and ICT), said around 60 per cent of the products can be delivered within a day from the ports by the customs authority, if any compliance issues regarding the import policy and certification of other departments concerned are not needed. Around 70 per cent of the consignments are released in two days.

Khondaker Muhammad Aminur Rahman, member (customs audit, modernisation and international trade), said the customs authority cannot start its activities to release imported goods until the clearing and forwarding (C&F) agents concerned submit bill of entry.

"We have found that around 40 per cent of the bills of entry are being submitted on the tenth day of arrival of goods."

To improve the situation, the NBR has made submitting bill of entry mandatory within 72 hours of import, otherwise they will have to face penalty and pay fines, he noted.

"We have taken all necessary steps to reduce the required time for delivery of products from the ports."

After introduction of the NSW, the process of product delivery will be accelerated without any human interaction, he concluded.

The NBR chairman said the government has launched a number of mordanisation steps for its Customs Wing, including Authorised Economic Operator (AEO), National Enquiry Point (NEP), pre-arrival processing, advance ruling, time release study, e-auction, non-intrusive inspection, and advance passenger information, etc.

During the July-December period of this fiscal year, 2020-21, the NBR collected Tk 1.10 trillion tax revenue, registering some 4.10 per cent growth over the corresponding period last year. However, the target for the period was Tk 1.41 trillion.

Mr Muneem expressed his optimism over achieving significant progress on meeting this year's revenue collection target of Tk 3.30 trillion, as Covid-19 vaccine has already arrived in the country.

On AEO, he said the importers are yet to achieve confidence of the customs authority to get AEO status. Currently, three companies have received the status to import products through green channel without any scrutiny.