Resource mobilisation from both internal and external sources remains a key challenge for the government to finance a big new budget outlined Tuesday apace with Bangladesh's aspired economic growth, economists and finance officials say.

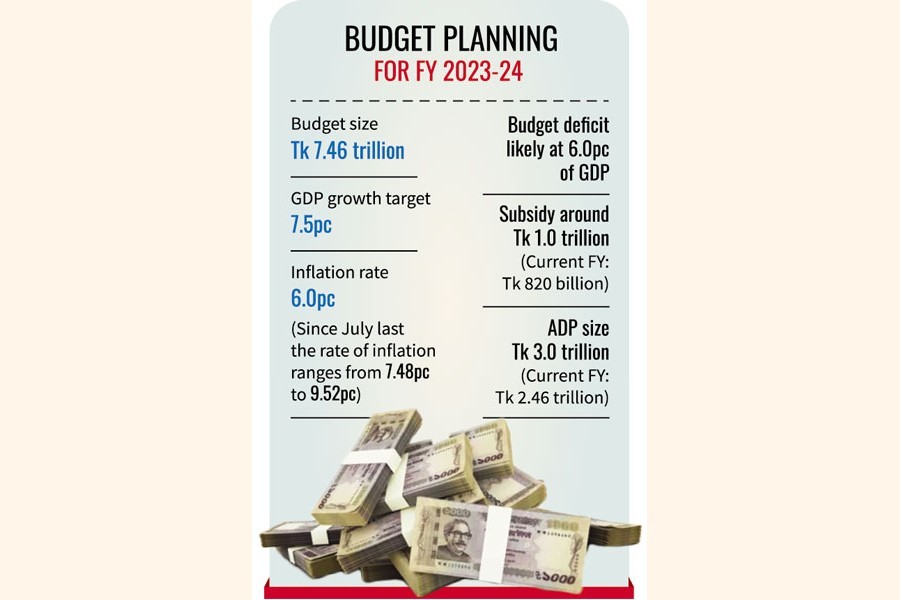

Keeping such challenges in mind and next general election in sights, the government sketched out the national budget for fiscal year 2023-24 with a total outlay of Tk 7.46 trillion and gross domestic product (GDP) growth target set at 7.5 per cent, officials said.

The committee for coordination on fiscal, monetary, and currency-exchange affairs, headed by Finance Minister AHM Mustafa Kamal, also set a target to hold inflation in check at around 6.0 per cent in a descent from the recent zenith fuelled by global and local price rises.

On the other side of the macroeconomic scales, a less-than-expected level of resources mobilisation might widen the overall budget deficit to 6.0 per cent in terms of the country's GDP, officials emerging from the meeting told the FE.

Also, the planners guesstimated that the subsidy requirement for the next fiscal year might cross Tk 1.0 trillion in a sharp rise from present year's Tk 820 billion.

About the development-expenditure portion of the total budget the meeting issued a direction for the officials concerned to prepare a Tk 3.0-trillion annual development programme (ADP) -- substantially higher too from present fiscal's Tk 2.46 trillion.

Keeping in mind the resource constraints in the wake of the prevailing world and domestic situations, the officials have been asked "to give priority to projects which are essentially needed and keep away the less-important ones in fund allocation", sources said.

As commodity prices are bettering the economy, pushing people into severe hardship, the meeting also asked measures for keeping money circulation under control so that inflation can be contained to some extent.

Since July this year, the rate of inflation remained very high, between 7.48 per cent and 9.52 per cent, and officials as well as economists see no immediate possibility of cooling of the heat consumers are now feeling.

The meeting also discussed larger subsidy, high inflation, exchange-rate volatility, and lower inflow of remittance as challenges facing both the present and next year's budget, sources said.

"Also keeping in mind the revenue-mobilisation challenges," officials said, "the meeting asked for setting the revenue-earning target almost similar to the current budget."

In the current budget the total tax-revenue target is Tk 3.88 trillion while non-tax revenue target Tk 450 billion.

According to the sources, the finance minister at the meeting asked for further cuts on the unnecessary public-sector spending as prolonged war between Russia and Ukraine has squeezed external trade and thus government's earnings.

The dwindling foreign-currency-reserve situation also figured high in discussion and the coordination meeting asked for further measures to raise the reserve position, sources said.

Contacted for his view of the budgeting, Dr M. Masrur Reaz, chairman of Policy Exchange of Bangladesh, said the country was still facing inflationary pressure and it would continue throughout 2023, though lessened to some extent.

He notes that, historically, Bangladesh wants to keep budget deficit between 5.0 per cent and 5.5 per cent which at this moment needs to be kept lower than that.

"One more year we need to contain aggregate internal demand to lower inflationary pressure," he says, adding that higher budget deficit indicates higher spending which would not help in managing inflation.

Raising budget inflation would not be a right approach.

Mr Masrur Reaz feels that 7.5-percent growth target is not feasible yet because the energy- market instability will result in continuation of heated LNG market and thus gas and electricity supply will continue facing disruptions.

He said production in factories will face disturbance while, despite the lessening of dollar demand, import may not increase significantly. Moreover, the European-market recession may continue throughout next year and thus questions are there from where this growth can be achieved.

"Making such a big target is not logical," he says.

Instead of setting high growth target, he suggests, efforts need to be given for macroeconomic stability and resolving the ongoing economic problems.