Despite disclosure of a record amount of 'undeclared' funds during the first three quarters of the current fiscal year (FY), the government may discontinue the softest-ever black money whitening provision in the next FY.

Business leaders and economists have been highly critical of the provision since its incorporation in the budget for the current FY.

Sources concerned said the finance minister might propose withdrawal of the opportunity in the budget for Fiscal Year (FY) 2021-22, scheduled to be announced on June 3 next.

Officials said they have received the instructions not to include the provision in the Finance Bill for the FY 2022.

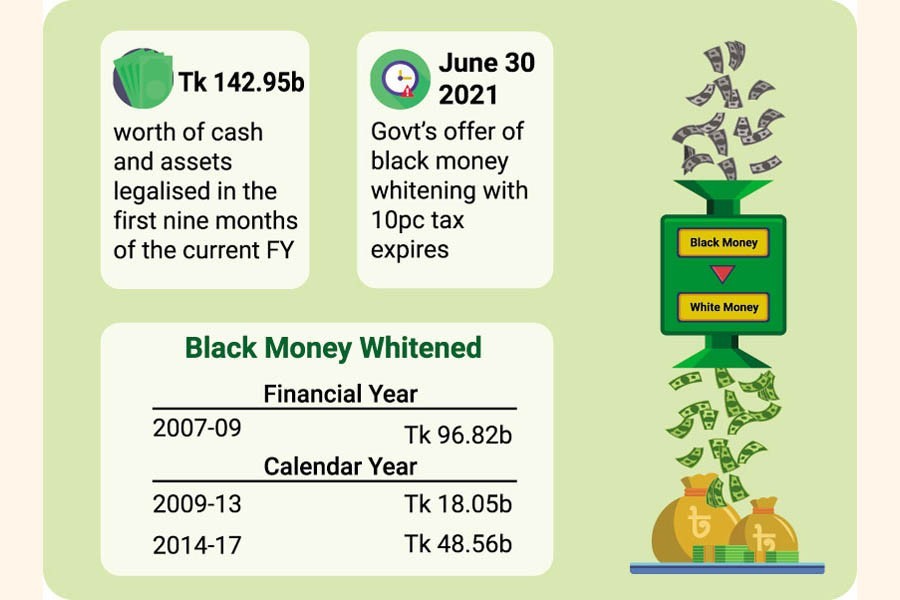

The ongoing opportunity is due to expire on June 30, 2021.

Officials, however, said things might go otherwise if directives came from the government high-ups.

In the budget for current FY 2020-21, the government offered the black money whitening opportunity paying tax only at 10 per cent flat rate.

Under the opportunity, people are allowed to invest their undisclosed money anywhere including cash, dividend, share, debentures, etc.

The government has received a significant amount of revenue this year from the holders of undeclared funds.

However, economists and businessmen have been criticising the fiscal measure since it discriminates against the honest taxpayers.

They said tax evaders were availing the opportunity paying tax at lower rate while regular taxpayers were paying tax at higher rates.

Such provision discourages the honest taxpayers to pay tax regularly, they added.

Meanwhile, officials said, the disclosure of income under the opportunity has already broken all previous records this fiscal.

In the first nine months of the current FY, some 10,034 people legalised cash and assets worth Tk 142.95 billion under the scheme. The NBR received Tk 14.39 billion in taxes against the disclosure.

Of them, a total of 9,693 people legalised Tk 138.60 billion mainly in cash, fixed deposit receipts, saving certificates and assets. They have paid Tk 13.90 billion taxes against the disclosure.

Also, some 341 people legalised Tk 4.35 billion through investment in capital market and paid Tk 490 million in taxes.

Thus, the very objective of brining the untaxed funds in the real sectors of the economy has remained unmet as most funds have been in the forms of cash, FDR and savings certificate, experts said.

The holders of those have got away by paying tax at nominal rate of 10 per cent.

Under the existing black money whitening scheme, taxmen or other appropriate agencies do not ask any question about the source of the disclosed money.

The existing two provisions - 'special tax treatment in respect of investment in securities' and 'special tax treatment in respect of undisclosed property, cash, etc' - in the Income Tax Ordinance 1984, if decided so, will be scrapped in the upcoming budget.

However, the regular scheme of legalising undisclosed money through investment in economic zones and hi-tech parks and through investment in construction and purchase of building and apartment will remain unchanged in the next budget.

As per Income Tax Ordinance-1984, the tax rate is 10 per cent for legalisation of untaxed money through investment in economic zones and hi-tech parks within June 2024, while the tax rates range between Tk 300 and Tk 5,000 a square metre for land, building and apartment based on the location.

Officials said the provision of voluntary disclosure of income paying 10 per cent penal tax in addition to normal tax rate may remain unchanged in the upcoming FY.

Officials said taxpayers can disclose their undeclared income anytime availing the opportunity where tax rate is higher than that of the regular taxpayers.