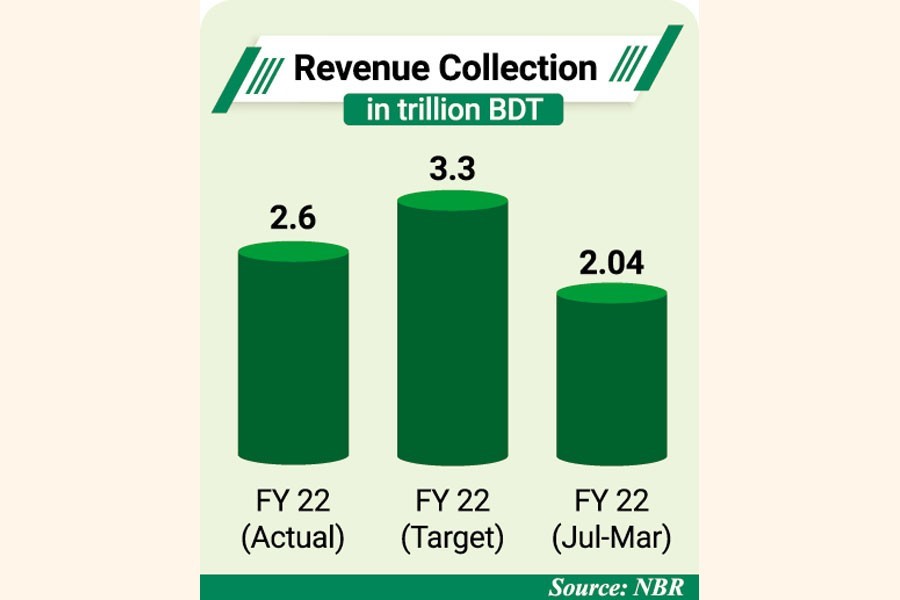

The revenue authority collected Tk 2.04 trillion or 62 per cent of the total tax revenue target for the entire fiscal year (FY) 2021-22 until March - leaving a large task for its last or fourth quarter (Q4) from April to June.

In Q4, the National Board of Revenue (NBR) will have to collect more than Tk 1.25 trillion taxes in the forms of income tax, VAT and customs duty to fulfil its target.

The government set a tax revenue collection target worth Tk 3.30 trillion for FY 22. The NBR has to collect Tk 1.05 trillion income tax, Tk 1.28 trillion VAT, and Tk 956.52 billion customs revenue.

The NBR released the provisional revenue collection data for July-March period of the FY on Monday.

According to the data, the Income Tax Wing collected Tk 636.58 billion taxes until March, while the Customs Wing Tk 650.73 billion, and the VAT Wing Tk 752.76 billion.

On an average, the NBR collected Tk 680.02 billion as taxes in each of the quarters from July 1, 2021 to March 31, 2022.

Tax officials said usually tax collection boosts up in the last quarter of the year following speedy implementation of the government's development work.

They expressed optimism to reach close to the target this year, if the economic situation remains stable.

Tax revenue collection grew by 14.45 per cent in the first three quarters of FY 22 compared to that of the previous FY. The average revenue collection growth in the last five years was 14 per cent.

The NBR collected Tk 275.49 billion revenue in the month of March alone.

The original tax revenue collection target remains unchanged to Tk 3.30 trillion in the current FY, although the target is usually revised downward almost every year.

Officials said commodity price hike in the international market helped the tax authority to collect higher revenue from import sources.

The NBR's all three wings are highly dependent on tax revenue at the import stage in the forms of advance income tax (AIT), advance tax (AT), customs duty (CD), supplementary duty (SD), regulatory duty (RD), etc.

The NBR data said tax revenue at the import stage under the Customs Wing grew by 20.53 per cent.

Despite having huge potentials, VAT collection at domestic stage posted a growth below 10 per cent.

Collection of direct tax in the forms of income tax and travel tax grew by 14.09 per cent in the first three quarters.

Towfiqul Islam Khan, Senior Research Fellow of the Centre for Policy Dialogue (CPD), said structural reform is necessary to collect the actual amount of revenue on the basis of potentiality.

"Tax collection grew riding on commodity price hike in the international market this year. It should not dilute focus of the policymakers."

The NBR has to pull out tax exemption measures and intensify its reform initiatives.

Mr Khan, however, said usually the NBR collects higher revenue in the last quarter due to quick implementation of the Annual Development Programme (ADP), but overall tax revenue growth would be no less than 15 per cent.

Implementation of public finance management reform strategy and anti-money laundering measures should be prioritised to check tax evasion and collect revenue properly, he added.