A total of 2.6 million or 52.41 per cent of the taxpayers remained non-respondent to the mandatory provision of submission of income tax returns by the stipulated time, prompting the National Board of Revenue (NBR) to think for its strict enforcement.

Of the 5.0 million Taxpayers Identification Number (TIN)-holders, some 2.4 million submitted their income tax returns in the current fiscal year (FY).

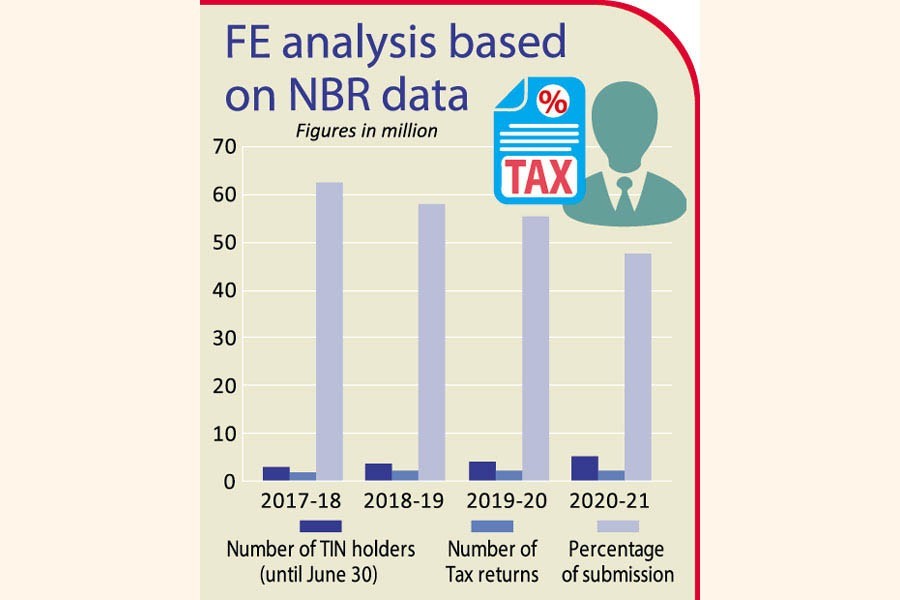

According to an analysis of the FE, submission of tax returns by individual taxpayers dropped this year.

Some 54 per cent of the TIN-holders submitted tax returns in the previous FY, which dropped to 47 per cent in the current FY.

The NBR officials said tax return submission is mandatory for the taxpayers, who obtained TIN until June 30, 2020.

Some 50,72,000 TIN-holders were supposed to submit tax returns by December 31, 2020, as per the fiscal provision devised in the national budget for FY 2020-21.

In FY 2019-20, of the 4.0 million TIN-holders, some 2.2 million submitted their tax returns.

Taking to the FE, Hafiz Ahmed Murshed, NBR Member (tax administration and human resource management), said they would send show-cause notice to the non-compliant taxpayers, asking reasons for non-filing of returns.

He, however, said the tax authority would take legal actions against those non-respondent taxpayers, who obtained TIN last year or submitted returns that year.

"There is no scope to consider the non-compliance in a flexible manner for the Covid-19 pandemic, as the NBR extended the time for submission of tax returns by one month to facilitate the taxpayers."

The last date of tax return submission by individual taxpayers was November 30. But the NBR extended it until December 31, 2020 following requests of the taxpayers, tax lawyers and other stakeholders concerned.

Mr Murshed said many of the taxpayers obtained TIN for different purposes, as it is mandatory for availing services from various public and private entities.

"We will seek explanation through sending notices to the taxpayers, who neither submitted tax returns nor sought individual time extension within the deadline," he concluded.

Under the existing income tax ordinance, taxpayers have to pay 2.0 per cent monthly interest in addition to normal payable taxes for not submission of returns within the deadline.

The penalty is also applicable for those, who submit petitions seeking additional time.

Tax return submission ratio in the country has been poor for years despite different measures devised by the NBR.

Officials said the coronavirus outbreak may be one of the major reasons for poor tax return submission, as many people avoided gathering in the tax offices.

Also, some people lost their job in the pandemic, while income of many declined significantly.

Economists, however, suggested the NBR to take stern measures against the non-filers, and endorsed its step to serve show-cause notice for non-compliance.

Former finance adviser Dr Mirza Azizul Islam said fear-factor usually works among people to come under tax-net.

"A strong enforcement of the law for non-compliance is needed to bring all TIN-holders under tax-net."

The NBR can trace the defaulter TIN-holders and ask them for explaining the reasons for not filing tax returns, he added.

Dr Ahsan H Mansur, Executive Director of the Policy Research Institute (PRI), said the NBR should refrain from scrutiny of the paid tax for the first three years of filing returns for encouraging people to submit returns.

The taxmen can easily trace the taxpayers' activities through their National Identity Card (NID), which is linked with land and other offices.

"The NBR has no database to find out the non-compliant taxpayers."

Dr Mansur opined that the NBR should have an automated system to generate such show-cause notice automatically after expiry of the deadline for tax return submission.

Regarding people's job loss and decline of income, he noted that they could file nil tax returns, as return submission has been made mandatory for all TIN-holders.