Corporate tax payment by large taxpayers jumped by over 15 per cent during the just-concluded fiscal year, despite COVID-induced economic devastation.

The growth is the highest in seven years, officials said.

Despite the COVID-19 pandemic, the unit under the National Board of Revenue or NBR managed to collect Tk 201 billion corporate tax in FY 2019-20 versus Tk 174.22 billion the year before.

The achievement comes though corporate tax collection target of LTU was revised upward by Tk 25.85 billion in the last fiscal when tax receipt goal from other sources were scaled down to Tk 3.0 trillion from Tk 3.25 trillion.

Officials said the effective monitoring, audit and motivation by taxmen encouraged the large taxpayers to pay higher taxes on their income.

But economists are unconvinced about the record growth when tax collection in the last quarter through June faced headwinds due to the coronavirus pandemic.

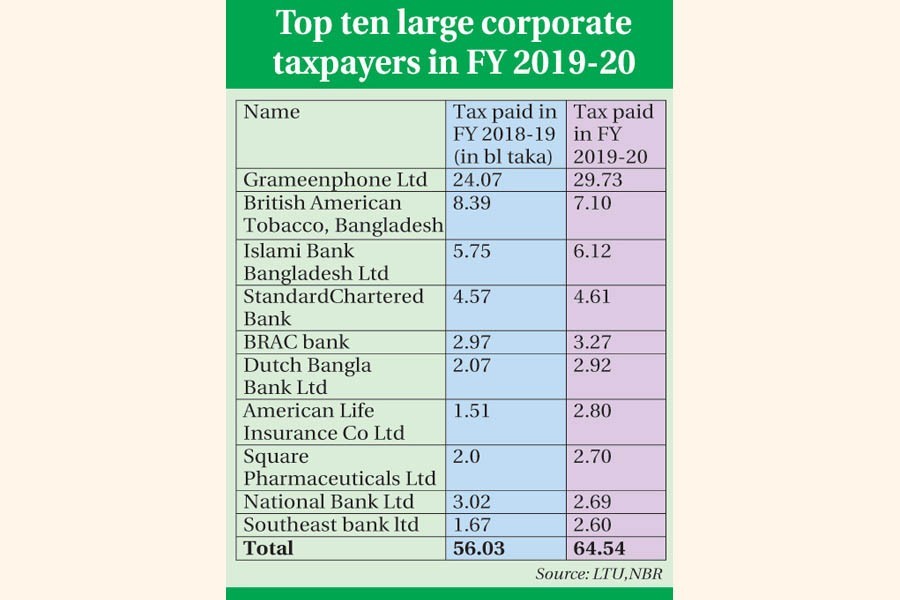

According to statistics, corporate tax payment by Grameenphone, Islami Bank, Standard Chartered Bank, BRAC Bank, Dutch Bangla Bank, MetLife, Square Pharmacuticals, National Bank Limited and Southeast Bank increased in the last fiscal.

Among the top 10 corporate taxpayers last year, six are private banks. Of the banks, operating profits of two decreased in the first half of the year.

Mobile phone operator Grameenphone paid the highest Tk 29.73 billion in tax in FY 20, up by Tk 5.66 billion from the corresponding period of the previous year.

Although tax payment by British American Tobacco Bangladesh decreased, it ranked second in position.

The multinational tobacco maker paid Tk 7.10 billion tax in the last fiscal against Tk 8.39 billion in the previous year.

Islami Bank Bangladesh Limited paid Tk 6.12 billion against Tk 5.75 billion in the corresponding year.

StanChart paid Tk 4.61 billion corporate tax compared with Tk 4.57 billion in last fiscal .

BRAC bank paid Tk 3.27 billion against Tk 2.97 billion in the corresponding period.

Dutch Bangla Bank paid Tk 2.92 billion, followed by MetLife at Tk 2.80 billion.

Square Pharmaceuticals Limited paid Tk 2.69 billion against Tk 2.0 billion the previous fiscal.

National Bank Limited paid Tk 2.69 billion against Tk 2.02 billion in FY 19.

However, operating profit of NBL went down to Tk 2.02 billion in January-July period against Tk 2.68 billion in the same period a year earlier.

Tax payment by Southeast bank also increased to Tk 2.60 billion against Tk 1.67 billion in the previous year.

Operating profit of Southeast bank in January-June period also declined to Tk 3.42 billion against Tk 5.06 billion in the corresponding period of FY'19.

Top 10 corporate taxpayers paid Tk 64.54 billion, which is 32.10 per cent of overall collection of the unit.

Last year, top 10 corporate taxpayers paid a total of Tk 56.03 billion to the public exchequer.

Taking to the FE, former chairman of the Association of Bankers, Bangladesh Syed Mahbubur Rahman, who is managing director and chief executive officer of Mutual Trust Bank Limited, said banks contributed the higher amount of taxes as both operating profits of some banks and deposits increased in this period.

For example, deposits at Islami Bank crossed Tk 1.0 trillion until June 30, 2020 and it received new deposits worth Tk 55 billion in January-June period.

Mr Rahman said strong monitoring of the NBR also helped realise the tax revenue.

Dr Ahsan H Mansur, executive director of the Policy Research Institute or PRI, said in some cases disallowance of expenditure by taxmen might have gone up in the last fiscal.

He said the natural growth of banks also contributed to the higher revenue, but 15.37 per cent growth seems to be "surprising".

Corporate taxpayers have to pay taxes irrespective of profit and loss as per the minimum tax provision in the Income Tax Ordinance-1984, said Dr Mansur, who is chairman of BRAC Bank.

He said the banks also have to pay tax on the amount they provisioned, which is adjusted later after writing off of the bad loan.

LTU commissioner Apurba Kanti Das said the unit saw the impressive growth as an outcome of its motivational programme.

According to NBR data, average growth of revenue collection is 14 per cent during the last five years. The LTU's tax collection growth was around 5.0 to 7.0 per cent during the last seven years.