The interest rate spread widened further in December last as the banks cut the deposit rates deeper than that of the lending rates, bankers have said.

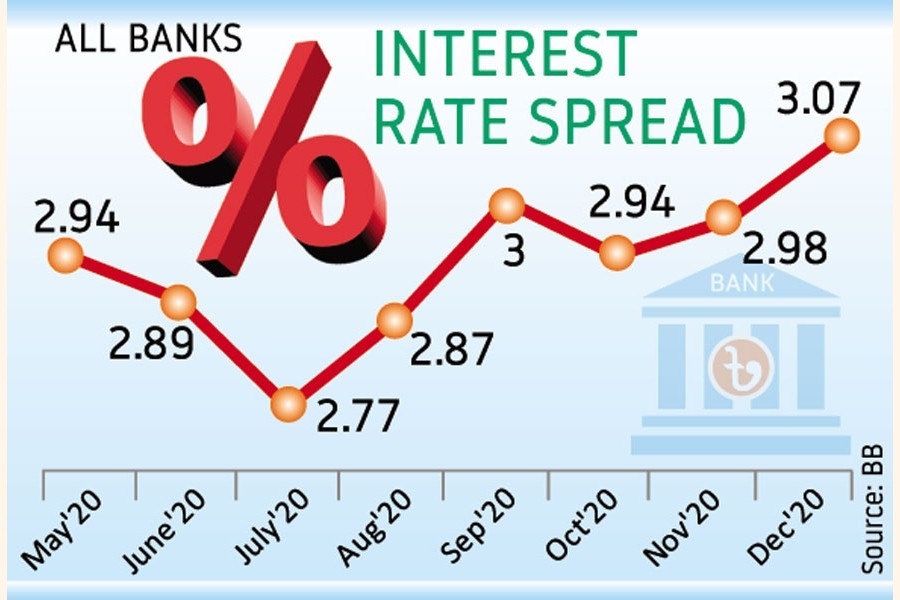

The weighted average spread between the lending and deposit rates rose to 3.07 per cent in December 2020 from 2.98 per cent a month ago. It was 2.94 per cent in October last year.

Senior bankers predicted further fall in interest rates on fresh deposits in the coming months if the upward trend of excess liquidity in the banking system continues.

The banks' excess cash hit an all-time high of Tk 2.04 trillion in December last due to lower private sector credit growth, caused by supply chain disruptions amid the Covid pandemic, they explained.

The growth in credit flow to the private sector came down to 8.37 per cent in December 2020 on a year-on-year basis from 9.20 per cent in July last year.

The bankers said the expansionary monetary policy of the central bank along with implementation of the government's stimulus packages aimed to expedite recovery of the pandemic-hit economy have also pushed up the higher inflow of liquidity in the banking system.

They said most of the banks have slashed their interest rates on all types of deposits because of the higher inflow of liquidity in the market, affecting the savers, particularly small ones significantly.

"We've slashed the deposit rates to minimise our cost of funds," Md Abdul Halim Chowdhury, managing director (MD) and chief executive officer (CEO) of Pubali Bank Limited told the FE.

He said the bank has provided loans to some 'good borrowers' at a rate of around 8.0 per cent instead of 9.0 per cent.

The weighted average interest rate on deposits fell to 4.54 per cent in December last from 4.64 per cent in the previous month while the lending rate came down to 7.61 per cent from 7.62 per cent, according to Bangladesh Bank's (BB) latest statistics.

The average spread of the state-owned commercial banks (SoCBs) was 2.13 per cent in December last while the private commercial banks (PCBs) 3.14 per cent, foreign commercial banks (FCBs) 5.90 per cent and specialised banks (SBs) 1.87 per cent.

Talking to the FE, Syed Mahbubur Rahman, former chairman of the Association of Bankers, Bangladesh (ABB), said the existing trend of the spread may continue in the coming months if the inflow of excess liquidity persists.

In April 2020, the spread dropped significantly to 2.92 per cent from 4.07 per cent in March following implementation of the single-digit interest rate in the banking sector.