Bangladesh economy, despite showing signs of recovery from the pandemic shocks, sees some emerging challenges stemming mainly from price hike of essential commodities and decreasing remittances.

Such is a latest economic evaluation by an elite trade organisation that also points out recent fresh wave of the pandemic coupled with slow vaccine rollout as another key challenge.

"Despite the recovery trend in the economy, there are emerging challenges to be faced due to recent price rise of essential commodities, decreasing remittances, emerging of any new COVID wave, and slow vaccine rollout," says the Metropolitan Chamber of Commerce and Industry, Dhaka (MCCI).

The country's elite trade body mentions such headwinds in its 'Review of Economic Situation in Bangladesh for October-December 2021 (Q2 of FY22)'.

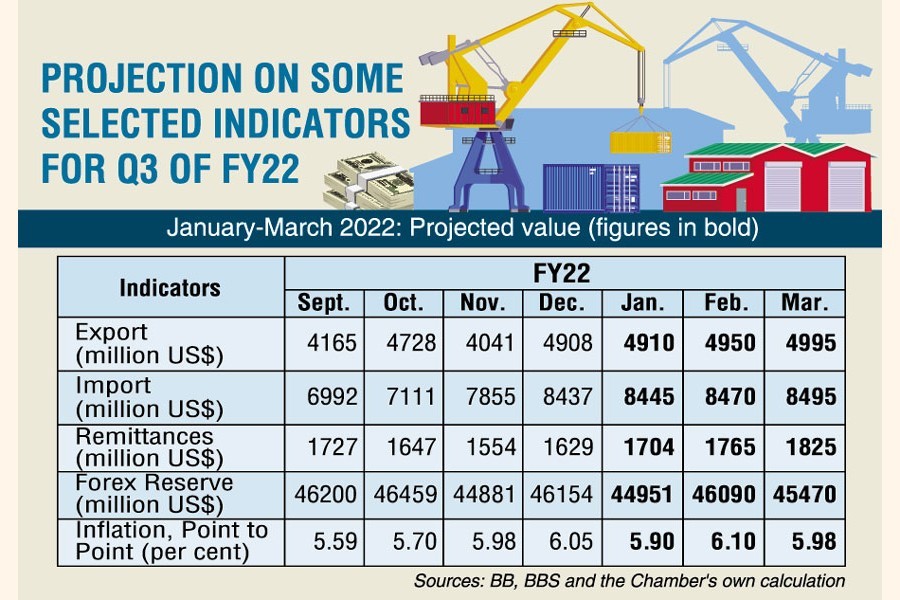

Terming the rising inflation as a major concern, the trade organization projects the rate of point-to-point inflation to rise to 6.10 per cent at the end of this month (February).

The MCCI, however, says the inflation might come down slightly to 5.98 per cent at the end of next month (March).

Meanwhile, after sustaining a rising trend in the last few months, the rate of inflation saw a downturn, to 5.86 per cent, in January, according to latest official data.

However, prices of most of the essentials, including rice, edible oils, onions and lentils, have been on the rise in recent times.

Besides, the government recently hiked the cylindered-LIP by Tk 62 to Tk1240 (per 12kg), creating extra burden on the commoners.

Such price hikes have already put the common people in peril.

Meanwhile, the state-run WASA has recently proposed a 20-per cent raise in its water tariffs.

The MCCI also says Bangladesh's economy is now rebounding from the COVID-19 shocks due to the time-befitting steps of the government alongside implementation of the stimulus packages.

"Economic condition seems to have been gradually improving after the easing of restrictions in late May 2020, supported by the government policies."

During the quarter under review (Q2 of FY22), the major macroeconomic indicators were seen in a satisfactory position.

It says the fiscal framework continues to be weak in view of poor achievements, more specifically, both in terms of revenue mobilisation and public expenditure.

The MCCI also identified "unemployment situation' and low investment as another challenge for the country's economy.

The chamber, however, says robust export earnings facilitated economic recovery in recent times. The export-oriented garment, leather and domestic market-oriented steel, food-processing and transport sectors are running on a full scale.

The inward remittances, however, decreased, which has multiplier effects on other economic sectors, especially the small and medium industry. Foreign- currency reserves are in a satisfactory position and the exchange rate has long remained stable.

On the other hand, some of the economic indicators appear to be less promising than projected earlier, it mentions.

The country's premier trade body has also predicted rises in some of the country's economic parameters in the days ahead.

According to the projections, the country's export earnings would increase to US$ 4.95 billion at the end of this month (February) and exceed $4.99 billion for the month of coming March.

The MCCI projections reveal that the country's import value would also go up to $8.49 billion and 8.495 billion by the end of February and March, 2022 respectively.

Besides, the volume of inward remittance might stand at or even cross $1.76 billion (1765 million) at the end of this month and will reach 1.825 million in the next month, the MCCI projected.

On the other hand, after showing an upturn at the end of this month, the country's foreign-exchange reserves might come down to $ 45.47 billion at the end of next month, according to the MCCI.