Bangladesh is a rapidly developing economy facing the challenge of Climate Change. Climate experts have assessed that Bangladesh is among the most vulnerable countries due to Climate Change. With adverse impacts of Climate Change staring in the eye Bangladesh people and its leaders are gearing up to the task.

Our Prime Minister, who chairs the Climate Vulnerability Forum (CVF), has made climate resilient strategies in Bangladesh the fulcrum of our development strategies, as prescribed in the 8th Five-Year Plan (8FYP), Bangladesh Delta Plan 2100, Perspective Plan 2041, and the forthcoming Mujib Climate Prosperity Plan.

Back in 2019, Bangladesh was the first country whose Parliament had declared Climate Change as a “planetary emergency”, an idea promoted by the then Bangladeshi President of the Inter-Parliamentary Union.

It is now established, following in-depth global research on climate and the economy, that we can be ‘green’ and we can grow. Global research by pioneer climate economist, Sir Nicholas Stern (Stern Review on the Economics of Climate Change, 2006), has shown that the long-term benefits of eco-friendly economic growth far outweighs the costs. The conclusion: Greening of the economy does not have to be growth reducing.

The growth dividends of greening the economy is there. South Korea provides an example of options and best practice in this regard. The country is one of the fastest growing economies of the 20th century that transformed from a low-income country to a high- income country, all in a span of 50 years, Greening of the economy over decades required massive investment that had to be financed out of the growth dividends that the rapidly growing Korean economy enjoyed.

South Korea’s exemplary strategy of Green Growth presents an excellent example for other rapidly growing economies like Bangladesh to follow. The lesson clearly is that for achieving sustainable and Green Growth Bangladesh will have to resort to Green Financing.

Bangladesh cannot be left behind in the fight against the ravages of Climate Change. The country is gearing up on both adaptation and mitigation avenues of the climate resilience strategy, all requiring additional financing for investment. Though a small emitter of GHG Bangladesh expressed solidarity with the world community at COP15/COP26 to contain GHG emissions to 2030. Though, as a Least Developed Country (LDC), it was not required to make any commitments, it submitted an Intended Nationally Determined Contribution (INDC) in 2015 that was recently updated as NDC 2021. Bangladesh takes its commitments seriously as current Chair of the Climate Vulnerability Forum (CVF).

The Mujib Climate Prosperity Plan, an aspirational Plan which is about to be launched, shifts Bangladesh’s trajectory from one of vulnerability to resilience to prosperity (VRP). One of the overarching goals of MCPP is to strengthen employment in a green economy, that is climate-resilient, low-carbon, resource efficient and socially inclusive for faster job creation. Both market-based and non-market strategies may be adopted to achieve these goals.

Rapid growth with low-carbon eco-friendly power generation (shifting to renewable energy), industrial production, transportation, agriculture, and waste management, is possible and realistic for leaving a legacy of sustainable living for our next generation.

Bangladesh must set its eyes on a path to net-zero emissions, if not by 2040s, but certainly by 2060s-2070s, in tandem with China and India.

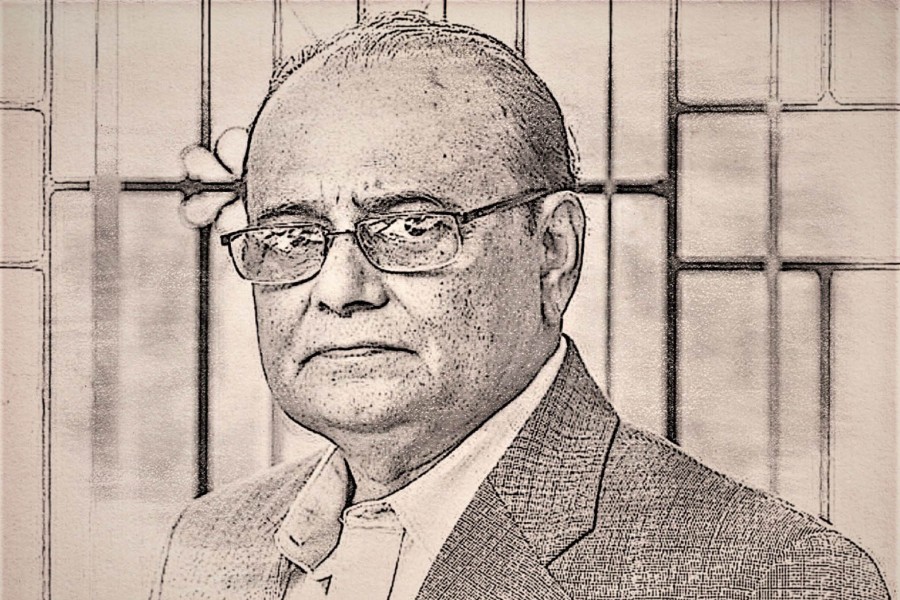

Dr Zaidi Sattar is chairman, Policy Research Institute of Bangladesh (PRI). This is his introductory remarks at PRI-WB Webinar on Green Finance and Investment takes place on Wednesday.