Bangladesh's real GDP growth may slow to 6.5 per cent in the next fiscal year (FY 2022-23), says a global rating agency that attributes the slowdown to a slew of headwinds.

In the process of rebound from the pandemic shocks, meanwhile, the official statistical agency has projected a robust growth at 7.2 per cent for the outgoing FY2021-22.

"We had previously expected growth to come in at 7.7 per cent in FY23 and 5.8 per cent in FY22. But Bangladesh's growth is likely to slow due to the myriad headwinds facing the economy," Fitch Solutions now forecasts on the economy.

It says the latest revision made on May 31 came after the Bangladesh Bureau of Statistics released its latest GDP (gross domestic product) data rebased to FY2015-16 and provided new provisional figures for FY2021-22 that project the economy to expand by 7.2 per cent during the 12-month period, up from a rebased 6.9-percent growth print in FY21.

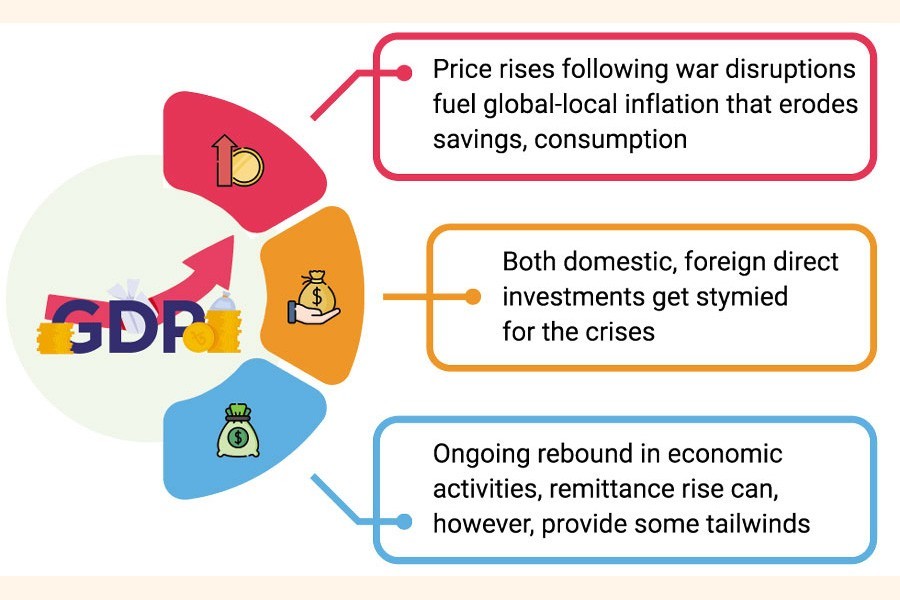

Although growth will be supported by some tailwinds, like the continued easing of covid-19 restrictions over the coming quarters, it notes, high base effects and the myriad headwinds facing the economy suggest that the growth on balance could slow in FY23.

The latest Fitch forecast says: "We see three headwinds facing the Bangladeshi economy over the coming quarters. First, commodity prices have surged further since late February owing to the outbreak of the Russia-Ukraine war and we expect prices to stay elevated through end-2022 before moderating slightly in 2023. This has put upside pressure on inflation globally and eroded consumer purchasing power."

The impact is more acute in Bangladesh than in developed markets, as food and energy account for around 62.0 per cent of its CPI basket, the second-highest in the region behind Thailand.

Given Bangladesh's low level of GDP per capita, this will likely significantly weigh on discretionary spending and therefore private consumption in the economy.

Indeed, inflation in Bangladesh climbed higher to 6.3 per cent in April, from 6.2 per cent in the previous month, and was the highest since October 2020.

The second is that investment in Bangladesh is likely to slow due to high commodity prices. Bangladesh is a net importer of energy and commodities - higher commodity prices will lead to a higher import bill and weigh on savings and therefore investment, it notes.

Higher inflation induced by higher commodity prices has pushed central banks around the world to tighten their monetary policy.

Although Bangladesh Bank has so far maintained an accommodative monetary-policy stance, external credit conditions have still tightened and this will likely lead to slowdown in foreign direct investment.

Lastly, says the Fitch on the drags, "We believe that the slowing global economic backdrop will also weigh on Bangladesh's economy, though the impact on growth is less significant than on other export-oriented economies like Thailand and Vietnam,"

Risks to outlook: "Risks to our growth forecast are balanced. On the upside, a strong recovery in remittances due to faster growth in the Gulf Cooperation Council (GCC) group of countries could be supportive of Bangladesh's growth. Remittance inflows accounted about 6.0 per cent of GDP in FY21 according to our estimates, of which around 55 per cent is derived from the GCC countries."

On the downside, the emergence of a more transmissible, deadlier, and vaccine-resistant covid variant could cause the government to implement restrictions again to prevent the healthcare system from being overwhelmed.

In addition, a further escalation of the Russia-Ukraine war and/or wider lockdowns in China could further disrupt supply chains and weigh on Bangladesh's export-oriented manufacturing sector.

This report from Fitch Solutions Country Risk and Industry Research is a product of Fitch Solutions Group Ltd, UK Company ('FSG'). FSG is an affiliate of Fitch Ratings Inc. ('Fitch Ratings').