Digitisation of payments would boost gross domestic product (GDP) by 1.7 per cent, an addition of $6.2 billion (Tk 500.58 billion) annually to the economy of Bangladesh.

The United Nations-based Better Than Cash Alliance and its member Bangladesh's flagship programme a2i gave the information in their publications, launched on Wednesday, according to BSS.

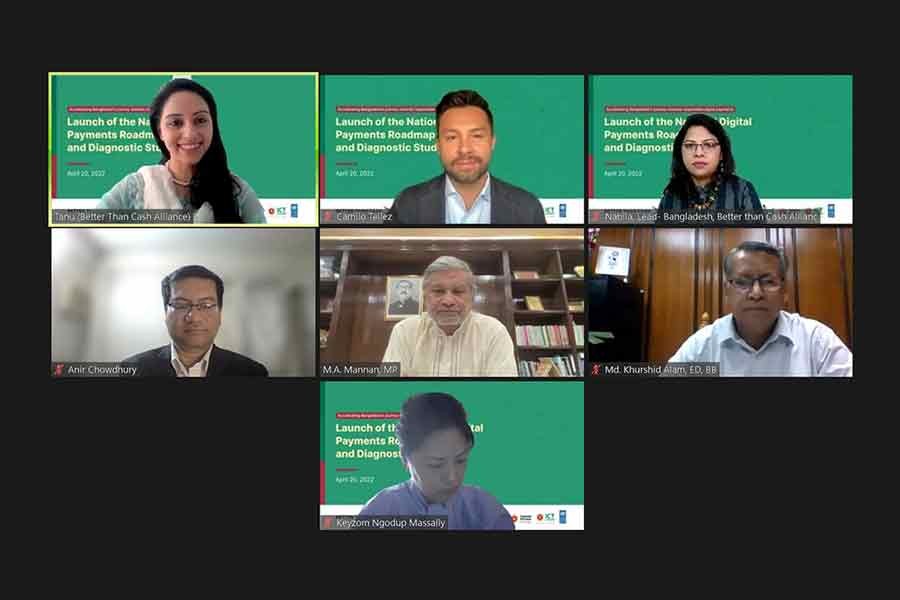

Two publications, titled 'National Digital Payments Roadmap, Bangladesh 2022-2025' and 'Measuring progress to scale: Responsible digital payments in Bangladesh', were launched on Wednesday, reports BSS.

The publications pointed out that 53 per cent of the $6.2 billion will come from digitising just 30 per cent of micro-merchant transactions in the retail sector; 45 per cent from digitising credit disbursements in the agricultural sector; and the remaining from scaling digital wages in the informal ready-made garments (RMG) sector.

Responsible payments digitisation in these sectors, crucially prioritising women, will help accelerate progress towards the Sustainable Development Goals by 2030.

Since joining the Better Than Cash Alliance in 2015, reports suggest that Bangladesh has made significant progress in moving towards a digital economy. Based on the reports, the government has released the National Digital Payments Roadmap 2022-2025.

The roadmap identifies 22 solutions to build a safe, interoperable, and inclusive digital payments ecosystem over the next three years in the ready-made garment (RMG), retail, agriculture, health, and education sectors.

Planning Minister MA Mannan joined the launching event virtually. He said that Bangladesh's economy has grown significantly over the last 13 years.

"We are moving forward towards being recognised as one of the top 25 economies in the world by 2035. By 2030, we want to achieve the Sustainable Development Goals (SDGs), and by 2041, we want to transform into a fully developed state."

Policy Advisor of the a2i programme Anir Chowdhury they are working to build a reliable and inclusive digital infrastructure that will serve as the foundation on which digital payments and services can be built.

Anir Chowdhury discussed the importance of the report and the role it will play.

Camilo Tellez, Deputy Managing Director at the Better Than Cash Alliance, said Bangladesh has achieved remarkable progress towards the Digital Bangladesh vision.

“Digital transactions have grown from 5 per cent to 20 per cent in 5 years - an impressive four-fold increase," Camilo Tellez said.

The deputy managing director at the Better Than Cash Alliance also talked about the UN's policy on Digital Payments adding to his previous statement.