Higher growth through economic rebound on higher spending by holding fired-up inflation in check features a Tk 6.78-trillion new budget the government announced Thursday.

With inflationary pressure on the economy, the government proposes to ramp up spending on agriculture, food, and power sectors in terms of allocations and subsidies alongside enhancement in social safety-net recipes to make the inflation tolerable.

Finance Minister AHM Mustafa Kamal came up with the announcements on the sectors, among others, in the annual budget presented in parliament.

The new budgetary calculations come amid erosion of real income through surges in food and non-food price rises, increase in unemployment, and a rise in the poor.

The budget for the next financial year (FY 2022-23) presented through visual arts accommodates concerns of the Russia-Ukraine war and its adverse impacts on nine essential commodities calling it "imported inflation".

Speaker Ms Shirin Sharmin Chaudhury presided over the session while President Abdul Hamid and Leader of the House and Prime Minister Sheikh Hasina, among others, joined the session.

Kamal's response appears to be a mammoth spending plan as a part of attaining 7.5-percent economic growth. The spending marginally ups the country's steep fiscal deficit-the gap between how much the government earns and how much it spends.

Private-sector enterprises may greet the budget with an open arm because of the tax sops offered to them by the finance minister. The corporate tax both for listed and non-listed firms has been proposed to drop 2.5 per cent, on average.

The formalisation process of the economy is also a part of Kamal's budget speech as it has reduced the corporate tax for One-Person Company (OPC) among other steps taken in the budget to this end.

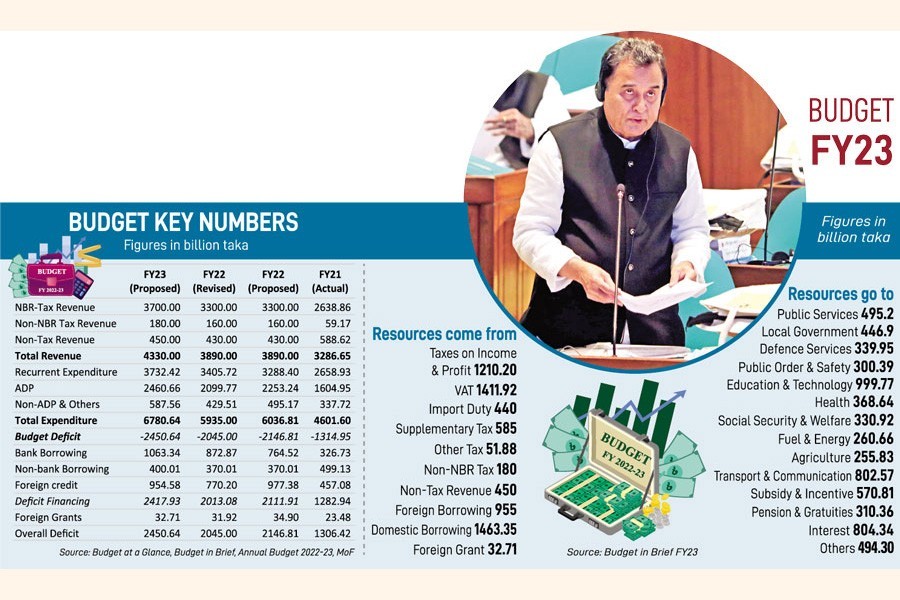

The budget outlay of Tk 6.78 trillion comprises operating budget worth Tk 4.32 trillion and development budget Tk 2.46 trillion. The total size of the budget is equivalent to 15.2 per cent of the GDP or gross domestic product.

To match inflow and outflow of funds, the budget deficit is projected at 5.5 per cent of the GDP. The government plans to borrow funds, equivalent to 2.2 per cent of the GDP from external sources. Experts view this as high when consider in absolute figures and this may add fuel to the flames of inflation.

The budget, however, lacks austerity measures in tune with global uncertainty and higher inflationary pressures from both home and abroad.

The financing from the banking sector has been widened which may create the crowding-out effect on the economy at a time when private-sector investment should pick up as a result of the receding of the coronavirus pandemic.

Despite the pandemic dying down, the finance minister is favouring continuing the stimulus packages announced shortly after the outbreak of the covid-19 in early 2020 to further accelerate the pace of economic rebound.

The targeted NBR tax mobilisation looks a bit ambitious when the actual performance of the tax mobilisation is considered for the fiscal year 2020-21, which was just 75 per cent of the target.

Yet reaching this target might prove difficult since the National Board of Revenue (NBR) is unlikely to achieve even the revised target of Tk 3.30 trillion set for the outgoing FY 2021-22.

The finance minister, however, says in his budget speech that the tax-to-GDP ratio suggests stopping special orders for exemptions unless there is an extraordinary situation.

No changes were announced in income-tax rates or slabs, particularly for the lower-strata taxpayers who find it difficult to make two ends meet amid phenomenal price rises.

However, the budget rationalised the NBR taxes in some cases. For the facilitation of the Fourth Industrial Revolution or 4IR and startups favorable tax policy has been proposed.

The finance minister, however, uttered the same voice about the automation process of the taxation system to expedite gearing up revenue mobilisation although it never achieves a cent-percent target on the matter.

In the wake of global financial crunch, the new budget proposes import of luxury and dispensable goods to be restrained and under/over-invoicing to be cautiously monitored to reduce the current-account deficits and build a good foreign- exchange buffer.

In cobbling the budget the government takes into account six challenges: (a) containing inflation and enhancing domestic investment, financing additional subsidies, required for the increased price of gas, power, and fertiliser on the international market (b) utilising funds available through foreign assistance and ensuring timely completion of high-priority projects of ministries/divisions (c) ensuring timely completion of projects in education and health sectors (d) increasing collection of local value-added tax and raising the number of individual taxpayers (e) maintaining stability of the exchange rate of taka and (f) keeping foreign-exchange reserves at a comfortable level.

The size of interest payments against government borrowings has been bulging to nearly over 19 per cent of the operating budget.

Government policy measures and allocations concerning education, human-resource development, communications, agriculture, and safety net in the proposed budget have been issues of special interest because of the inflation and promoting trade and commerce.

The social safety-net programmes have been proposed to be 16.75 per cent of the budget size or 2.55 per cent of the GDP, which widened many services along with spikes in cash.

The priority of this budget would be to improve the livelihood of people at all levels, continue with uninterrupted economic development and employment generation, and contain inflation in parallel to addressing economic effects originating from covid-19 and the Russia-Ukraine conflict.

After top prioritisation of inflation taming, it, however, focuses on agriculture as second-highest- priority sector because of its importance in ensuring food security in trying times.

It considers as the third-priority sector human resource development, including health, education, and skills development.

The finance minister says, "The government will continue to allocate for the development of human resources, including health, education and skills development, with a view to building a better Bangladesh by 2041."

The fourth priority is to boost domestic investment, increase exports and promote export diversification.

Its fifth priority is job creation and rural development. In addition, tackling the effects of climate change will be one of the priorities.

The budget rightly seeks to promote environment-related business including tax reduction in the green enterprises.

After many years of injecting funds into the state-owned banks, the finance minister this time says the government has now taken a stance to "get out of the culture".

He says the government encourages state-owned banks to redesign their business models and conduct banking activities accordingly.

After many years, the government says that a new act will be formulated to introduce universal pension system as the private sector which employs around 85 per cent of the employment does not have any post-employment benefit.