Bangladesh's balance-of-payments (BoP) deficit widened to nearly US$3.45 billion in the July-September quarter of the current fiscal year, casting further strain on the country's falling foreign-currency reserves, according to latest official data.

The high-frequency macroeconomic data released Thursday by the central bank of Bangladesh show that all three key accounts under the BoP flagship shrank during the first quarter or Q1 of the fiscal.

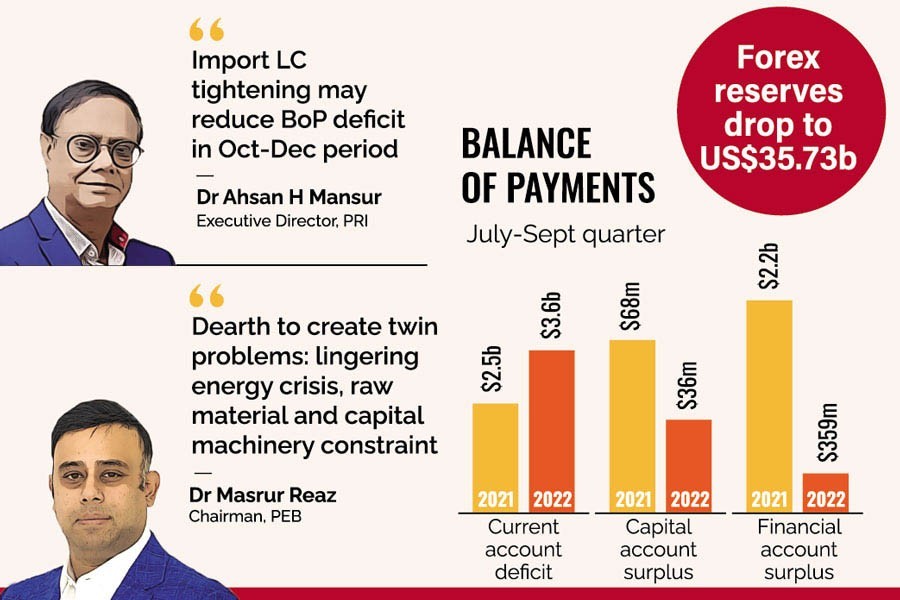

Current account accounted for a higher deficit of U$3.6 billion in the period. It was a $2.5 billion in deficit during the same period a year before.

Capital account, which usually remains a smidgen, dropped to $36 million during the July-September period. It was $68 million during Q1 of the last fiscal year.

Financial account, which usually remains in the positive territory and is believed to be one of the stable pillars for Bangladesh, also shows a significant drop. The financial account net inflow was $359 million during the period-down from $2.2 billion during the same period of last fiscal.

Economists contacted by the Financial Express said the deficit is largely due to the higher deficit in the current account.

They also said the BoP deficit would decrease in the next quarter in October-December period as import payments may be contained largely due to the belt-tightening measures adopted by the Bangladesh Bank under a government austerity plan aimed at navigating a global dearth.

Dr Ahsan H. Mansur, executive director of the Policy Research Institute of Bangladesh (PRI), says:

"The outflow of funds made in July-September actually stemmed from the January-March period."

He means that payments or settlement were made in July-September period against those letters of credit opened in the January-March period.

The number or volume of the opening of LCs has been falling, he told the FE, adding that this will help reduce the BoP deficit in the next quarter or October-December period.

On funding from the multilateral lending institutions, for example, the IMF (International Monetary Fund) and the World Bank, Dr Mansur says funds may come at the end of January once the IMF concludes its mission successfully.

D. M. Masrur Reaz, an economist and chairman of Policy Exchange of Bangladesh, says oil and gas prices have risen further since early 2022 and the country's current-account gap would come under further strain as it will cause money to flow out of the country.

"I believe that the current-account deficit is set to remain large over coming months."

He says the financial-account inflow is falling as many believe the local currency, BDT, remains volatile in exchange with foreign currencies.

The taka value has dropped around 10 per cent since June last on the forex market.

However, Dr Reaz notes that the import payment has been restrained to some extent following the central bank measures to control imports.

During the quarter under review, import growth was nearly 12 per cent. And the export receipt also was as much at 12 per cent.

"I think export should have surged more as the global economy has opened up fully after a long period of having covid-19-related restrictions," he says.

The remittance inflow was nearly 5.0 per cent during the period, but it has been falling over the past few months.

One senior official familiar with the developments at the Bangladesh Bank told the FE that the existing health of the BoP would recoup after getting the loans from the multilateral lenders which are now in negotiations.

Wishing not to be named, he also said that they believe that the export would remain buoyant despite the global uncertainty, especially in Europe.

Under impact of the imbalances Bangladesh's foreign-currency reserves sand on a slope despite the government austerity measures to withstand the headwinds blowing from the volatile global economic order, officials say.

The crunch of foreign currencies, particularly the greenback, worsened because of higher import payments against falling export earnings and remittance inflows, according to them.

In the last three days until November 2, the forex reserves had dropped by around US$ 100 million to reach US$ 35.73 billion from US$ 35.80 billion that was recorded on October 31st, 2022, according to the weekly statistics of Bangladesh Bank.

Even, a year back (November 2, 2021), the size of the reserves was US$ 46.48 billion. The figure had peaked to a record-high US$48 billion in August 2021. Since then, there has been a slide.

There is a fear of further plummeting of the forex reserves by more than US$ 1.0 billion in the next couple of weeks to clear payments of ACU (Asian Clearing Union) liabilities worth over a billion dollars.

Seeking anonymity, a BB official said the reserves continue dropping even after various austerity measures taken by the central to protect the dollar coffers. Falling trend in remittance and export earnings puts extra pressure on the reserves.

"The reserve is set to drop further as there is an ACU liability of more than US$ 1.0 billion that needs to be paid in the next few weeks," he adds.

The country witnessed fall in remittance inflow in the just-past October with a total earning of US$ 1.52 billion, down by 7.37 percentage points year on year, as expatriates sent $1.64 billion in the same period of 2021. Even remittance recorded a 24.4-percent monthly fall in September as well.

Export is another prime source through which the country earns significant volume of foreign currencies but its trend is not going well as the country's single-month merchandise-export earnings in October this year declined 7.85 per cent to US$ 4.35 billion, year on year, mainly because of the economic slowdown in the European Union caused by the Russia-Ukraine war.

Bangladesh received $4.72 billion in October 2021. The October'22 earnings also fell short of the target by 12.87 per cent, according to Export Promotion Bureau (EPB) data.

On the other hand, the volume of LC settlements went up by 26.57 per cent to US$ 20.69 billion in the Q3 of the calendar year as US$ 16.35 billion was recorded in the same period last year.

When contacted, chairman of local think-tank Policy Exchange of Bangladesh Dr M. Masrur Reaz said the BB formed the Export Development Fund with US$8 billion from the reserves. It calculates this fund while counting the reserves.

"But actual volume of reserves is less than US$ 27 billion through which the country can meet import bills for three and a half months, which is a concern," he observes.

As a result, the government imposed restrictions on opening LCs even for essential commodities.

Mr. Reaz feels the dollar dearth would cause two problems - continuation of the energy crisis and bad impact on import of raw materials and capital machinery for industrial outputs. "If possible disturbance in industrial output could affect employment and wage negatively, it will be an area of severe concern for all of us," he says.

To overcome the vicious cycle of the possible economic shocks, the economist suggests taking necessary measures to make sure that the country can get the promised loan of US$4.5 billion from the International Monetary Fund (IMF), US$ 1.0 billion each from the World Bank and the Asian Development Bank (ADB) as there is no sign in sight of getting large volume of dollars from remittance and export.