Bangladesh’s import from India recorded a 13 per cent growth in the 2016-17 fiscal year (FY).The increase in import has been reported after a subdued show for two consecutive years.

The growth is attributed to a significant rise in import of equipment and high-value machineries for project implementation in the country.

According to India’s Commerce Ministry, Bangladesh imported $6.8 billion worth of goods in FY17. Total bilateral trade had hit an all-time high of $7.5 billion, up 11 per cent.

Bangladesh is the ninth largest importer of Indian goods, says a report on The Hindu.

According to the India’s Commerce Ministry, Indian exports increased by 4.6 per cent ($6.4 billion) in FY2014-15 and dropped by 6.4 per cent ($6.03 billion) in FY2015-16.

Data confusion

There is, however, difference in trade data between the two neighbouring countries. This is due to difference in accounting period (India follows March to April accounting year, Bangladesh follows July to June) and difference in estimates between Bangladesh’s Bureau of Statistics and the central bank.

According to the Bureau of Statistics, Indian exports dipped in the two preceding years before reporting 16 per cent growth to $5.7 billion during the 11-month period from July 2016 to May 2017.

All statistics, however, show Bangladesh witnessed a marginal dip in exports in 2016-17, after a five-year long growth spell between 2011-12 and 2015-16. While Indian exports meet 11-12 per cent of Bangladesh’s total import needs, India shares less than two per cent of Bangladesh’s export basket, which primarily includes ready-made garments.

According to Selim Raihan, Executive Director of South Asian Network on Economic Modelling (SANEM) and a professor of Dhaka University, India and Bangladesh are yet to optimise trade potential vis-a-vis the significant bilateral cooperation.

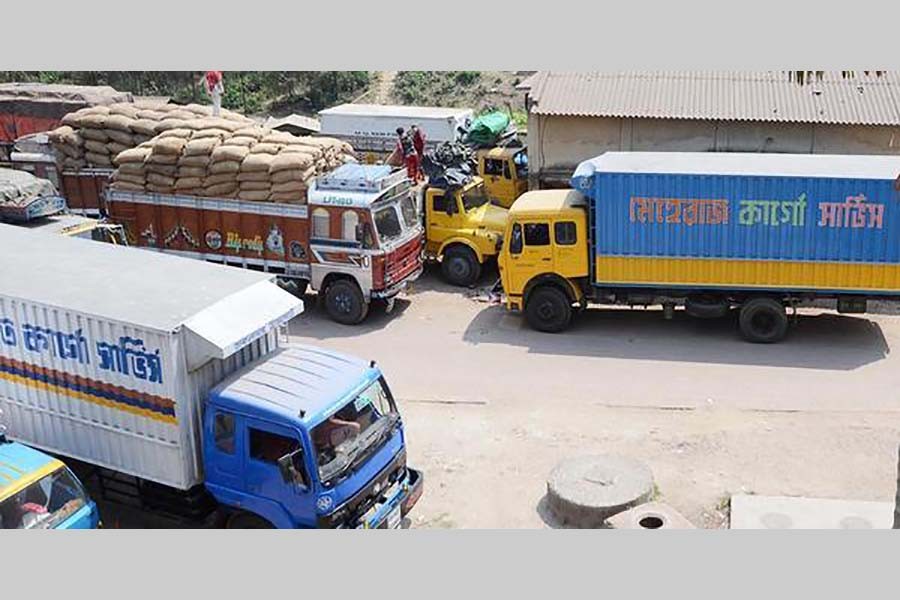

One of the major reasons behind is the poor and costly trade logistics. Nearly half of the total trade (in value terms) is routed through Petrapole-Benapole land border by costly road transport. The non-containerised road cargo undergoes repeated loading and unloading operations at the border.

To add to the woes, the border infrastructure is far from adequate especially on the Bangladeshi side leading to congestion. In a recent study, SANEM indicated that Indian export consignments wait for 17-20 days to complete the customs procedure at the Bangladeshi gate of Benapole.

Poor trade logistics is reducing the price competitiveness of both Indian and Bangladeshi exports. According to Raihan, capacity augmentation at Petrapole-Benapole can increase bilateral trade significantly.

New initiatives

Indian observers believe conversion of road traffic to less costly rail, containerisation of cargo and multi-modal transport can reduce the trade logistics costs.

India recently approved Rs 400 million, in the third line of credit worth $4.5 billion to Dhaka, to help Bangladesh build a transhipment facility at Ishwardi that connects Gede-Darshana rail-link. It will help increase rail cargo by road. A parallel effort is on by both the countries to run container trains between Kolkata and Dhaka.

But the most promising news is from shipping sector. Though India and Bangladesh opened direct shipping last year; the cargo volume didn’t grow to the expected levels due to congestion at Chittagong port in Bangladesh.

In a recent trend, Bangladeshi shipping lines started moving containerised cargo from Kolkata to the inland river port at Pangaon, barely 20 km from Dhaka. The port is equipped with container handling facility. Indian authorities are bullish that popularising this route can reduce trade costs significantly.