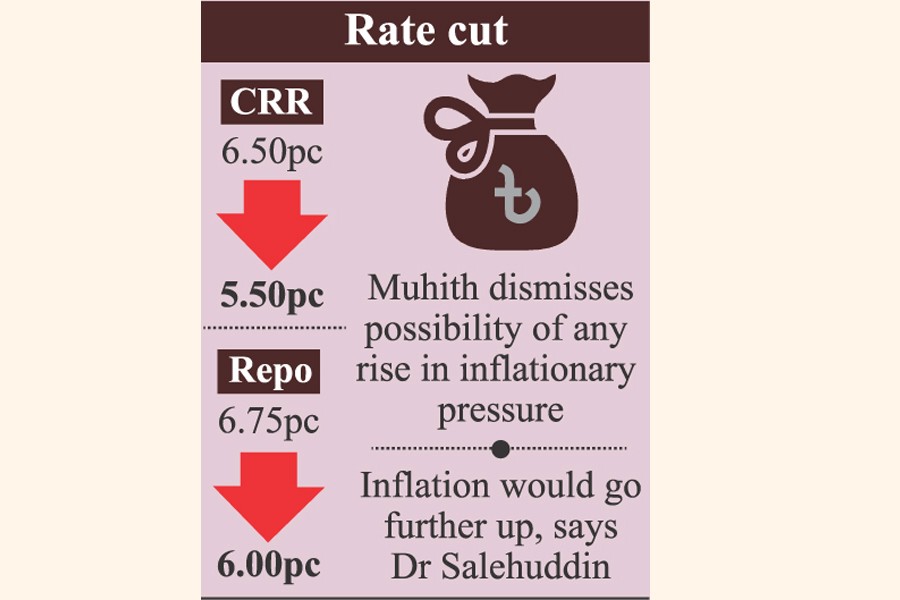

Bangladesh Bank (BB) will slash Cash Reserve Requirement (CRR) of the banks by 1.0 percentage point to 5.50 per cent to help mitigate the present liquidity crunch in the banking system.

The decision was taken at a tripartite meeting of Ministry of Finance, BB and Bangladesh Association of Banks (BAB) in the capital on Sunday.

"After a thorough discussion at the meeting, the decision has been taken to cut CRR by 1.0 per cent until December 31 of this calendar year, subject to reviewing in June," Finance Minister A M A Muhith told reporters after the meeting.

The finance minister ruled out the possibility of any increase in inflationary pressure on the economy following the implementation of the revised CRR.

"Inflation is now under control. It will not increase this year," he made the prediction.

The minister also expects that the move will help bring down the interest rate on lending to single-digit shortly from the existing level.

However, former BB governor Salehuddin Ahmed expressed the concern over slashing of the CRR, saying that it would push inflationary pressure further up.

"Aggressive lending will start again with additional funds and non-performing loans (NPLs) will increase further," Dr. Ahmed said while explaining the impact of revised CRR.

The former governor found the process of slashing CRR was not right one.

The meeting also decided to extend the deadline by three more months to meet the revised limit of advance-deposit ratio (ADR) by the banks.

Under the extended timeframe, the banks, having ADR above the re-fixed limit, are allowed to implement the revised limit of ADR by March 31, 2019, instead of December 31, 2018, the meeting sources said.

On January 30, the central bank slashed ADR limit to help check any possible liquidity pressure on the market due to the banks' 'aggressive' lending.

ADR is re-fixed at 83.50 per cent for all the conventional banks and at 89 per cent for the Shariah-based Islami banks. The existing ratios are 85 per cent and 90 per cent respectively.

On February 20, BB extended the timeframe for the first time by six months to December next for the banks to meet their revised ADR.

On Friday, the government decided to allow the state entities to deposit 50 per cent of their funds with the private commercial banks (PCBs), up from the existing ceiling of 25 per cent, to tackle the ongoing liquidity crunch in the banking system.

A notification was issued in this connection on Sunday, according to the finance minister.

The meeting also decided to cut interest rate on repurchase agreement (repo) by 75 basis points on the same ground, the sources also said.

According to the decision, the interest rate on repo auction will come down to 6.00 per cent from the existing level of 6.75 per cent, they added.

"In line with the latest decision, BB will allow the repo facility to the banks for maximum 28 days instead of the existing seven days," a senior banker told the FE after the meeting.

At the meeting, senior members of BAB urged the regulators to bring down CRR to 3.50 per cent from the existing level of 6.50 per cent.

Currently, the banks must maintain 6.50 per cent CRR with the central bank from their total demand and time liabilities on a bi-weekly basis.

The banks are also allowed to maintain the reserve at 6.00 per cent on daily basis, but the bi-weekly average has to be 6.50 per cent in the end.

The latest moves indicate that the central bank is going back to its expansionary monetary policy measures, as these would help improve liquidity flow to the banking sector, the senior bankers explained.

Following the CRR reduction, the banks will get an additional liquidity of around Tk 100 billion without paying any interest, according to BAB Chairman Nazrul Islam Mazumder.

"A huge amount of fund is now stuck with the central bank in the form of CRR. The fund cannot be invested. It neither plays any role in containing inflation," the BAB chief explained.

He also sought equal distribution of funds, which have been piled up with the public banks, at a cost of fund plus two per cent interest rate.

"It will also help brining down the interest rate on lending to single-digit from the existing level immediately," Mr. Mazumder noted.

Among others, BB Governor Fazle Kabir, Finance Secretary (in-charge) Mohammad Muslim Chowdhury, Senior Secretary of Bank and Financial Institutions Division Md. Eunusur Rahman, Banking Reforms Advisor of BB S K Sur Chowdhury, IFIC Bank Chairman Salman F Rahman, Islami Bank Bangladesh Chairman Arastoo Khan, Premier Bank Chairman H B M Iqbal, and managing directors and chief executive officers of different PCBs including Syed Mahbubur Rahman, chairman of Association of Bankers, Bangladesh (ABB), attended the meeting.