Savings deposits in Bangladesh's banks have ballooned in recent years notwithstanding the pandemic and lower rates of interest, as, economists believe, investment activity slowed.

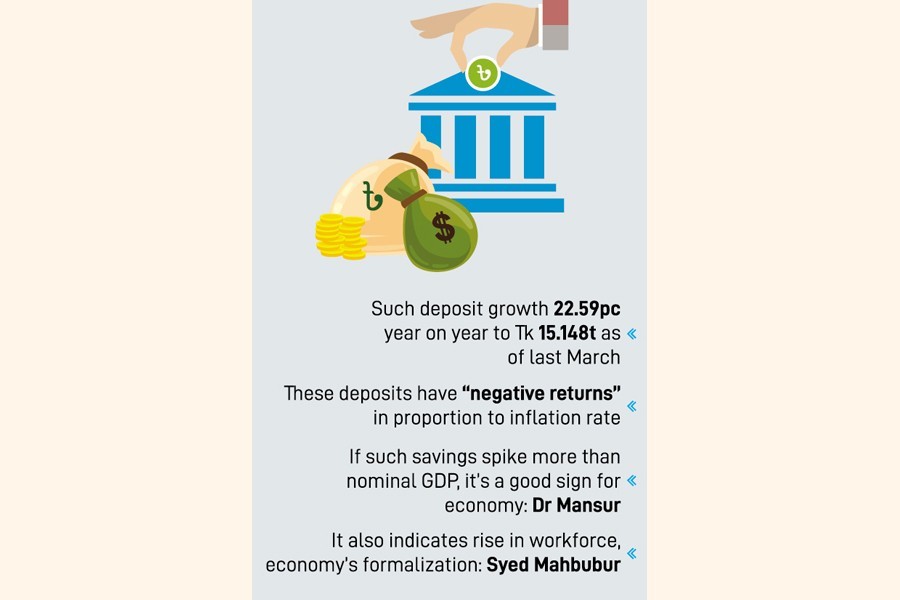

Such deposit accumulation is one of the key sources of banks' funds that grew by 22.59 per cent in March 2022 on a year-on-year basis. It was 20.18 per cent in March in 2020 and 19.97 per cent in the same period in 2019.

Consequently, the average deposit per account also rose to Tk 33,000 in March 2022. It was Tk 31,000 in 2021 and Tk 27,000 both in 2020 and in 2019.

People familiar with the matters in the financial sector and economists told the FE that the main reason behind the surge is economic growth.

But some argue that this is rising as there are limited spaces for investment and that these deposits have "negative returns" in proportion to inflation rate.

Deposit in these accounts generally emanates from individuals. These also are demand deposits as people can withdraw that anytime.

Dr Ahsan H. Mansur, executive director at the private think-tank PRI says the economy is growing and people have money in their hand, leading to deposit surges.

"People trust mostly the banks…the cash in their hand goes into savings accounts and fixed accounts," he told the FE.

Fixed accounts or time deposits remained almost stagnant at around 45 per cent in recent years.

Dr Mansur, however, thinks if the rate of deposit savings spikes more than the nominal GDP, it will also be a good sign for the economy.

The growth in the total deposits in 2022 was around 15 per cent. The nominal GDP is around 13 per cent.

The Centre for Policy Dialogue (CPD), another private think-tank in Bangladesh, observes that parking money in banks is no longer attractive as surging inflation is eating away 2.2 per cent of savings in real terms, effectively discouraging depositors.

"The real interest rate on bank deposits has reached an unprecedented stage in the recent past, causing the value of the savings of ordinary people to be depleted," said CPD Executive Director Fahmida Khatun in June last while presenting the state of Bangladesh economy in 2021-22---an independent analysis by the think- tank.

Bankers say that this rise is due to the rise of the middle-income class and the expansion of the workforce.

"The middle-income group of people is on the rise and this is, to my mind, is a key reason," says Syed Mahbubur Rahman, managing director and CEO at Mutual Trust Bank (MTB).

It also indicates the rise in working forces and formalization of the economy, he adds.

He, however, cites another key reason emerging in recent years: higher inflow of remittances.

Bangladesh's remittance inflow during the first and second waves of the Covid-19 pandemic rose significantly as, many believe, unofficial channels of sending money almost shattered as people's movements were restricted.

A study conducted by the Bangladesh Institute of Bank Management (BIBM) shows that stagnation in hundi activity, an illegal cross-border financial transaction, during the Covid-19 lockdowns pushed the remittance inflow up.

However, this growth in savings is a good source of funds for the banks as procurement cost is lower.

If banks have adequate liquidity, they can invest in creating employment and further growth.

"Investment opportunity may increase if banks have adequate liquidity," says Md Shaheen Iqbal, a deputy managing director at the SME-focused BRAC Bank.

The total deposit in the country's 61 banks was Tk 15.148 trillion as of March 2022. The number of total accounts in the sector was 127.35 million during the period.