The size of the banks' non-performing loans (NPLs) shrank further at the end of the fourth quarter of 2020.

The suspension of the usual practice of classifying loans that had been put into effect by the central bank in March last year following the outbreak of Covid-19 was largely responsible for the shrinking of the NPL.

The Bangladesh Bank (BB) has started preparing a consolidated statement of non-performing loans (NPLs) covering both domestic and offshore banking units from the final quarter of the last calendar year, officials said.

The share of NPLs in the total outstanding loans came down to 7.66 per cent as of December 31 in 2020 from 8.89 per cent a year before, according to a consolidated statement of such loans.

"Such consolidated statement of classified loans will be continued in the coming quarters in line with our policy on offshore banking operations," a senior central banker told the FE on Tuesday.

Earlier on February 25 last year, the Bangladesh Bank (BB) brought the offshore banking operations in Bangladesh under regulations by issuing the policy.

In the past, the central bank was not empowered fully to monitor and supervise the offshore banking unit (OBU) operations closely due to legal constraints.

On the other hand, the share of classified loans in the total outstanding loans came down to 8.06 per cent as of December 31 in 2020 from 9.32 per cent in the same period of the previous calendar year, according to the statement that excludes the offshore banking operations.

The central bank earlier prepared two statements of classified loans separately for domestic banking units and offshore banking units, they explained.

The classified loans cover substandard, doubtful and bad/loss portions of total outstanding credit, which reached Tk 11587.75 billion as of December 31 on a consolidated basis.

But the amount was Tk 10957.73 billion excluding offshore banking operations.

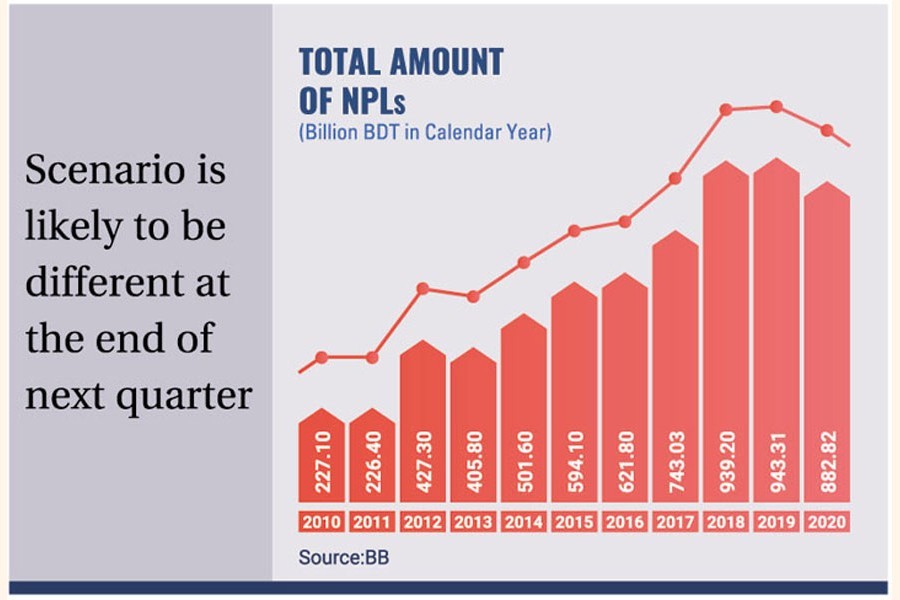

The amount of NPLs fell by more than 6.0 per cent or Tk 60.49 billion to Tk 882.82 billion excluding offshore banking operations as of December 31 from Tk 943.31 billion a year ago, the latest BB data showed.

Talking to the FE, BB spokesperson Md Serajul Islam said loan moratorium facility from January 01 to December 31 has helped reduce the amount of classified loans in the banking sector.

Mr Islam, also a BB executive director, said fresh loans have also contributed to squeezing the volume of NPLs in 2020.

Senior bankers, however, said the real picture of defaulted loans would surface from the first quarter (Q1) of the current calendar year.

The banks were not allowed to classify loans adversely until December 31, 2020, in line with the BB's directives, they added.

The BB asked the scheduled banks not to be harsh while classifying loans to help businessmen offset the adverse impact of the pandemic on their businesses.

"Recovery and rescheduling of loans have helped reduce the amount of NPLs in 2020," Pubali Bank managing director and CEO MA Halim Chowdhury told the FE.

He said the amount of defaulted loans may increase in Q1 of 2021 if the central bank does not provide any policy support to this end.

The volume of defaulted loans with six state-owned commercial banks came down to Tk 422.74 billion, excluding offshore banking operations, in the final quarter of 2020 from Tk 439.94 billion a year before.

On the other hand, the volume of NPLs with 42 private commercial banks fell to Tk 399.16 billion as of December 31 from Tk 4417.74 billion in the Q4 of 2019.

The classified loans of nine foreign commercial banks came down to Tk 20.32 billion in Q4 of 2020 from Tk 21.04 billion a year before.

However, the classified loans with two development finance institutions remained unchanged at Tk 40.62 billion as of December 31 last year.