Bangladesh's top bankers are going to suggest the central bank to let the local currency depreciate further by nearly Tk 2.0 against the US dollar to manage the intractable foreign-exchange market.

The decision was made at a joint meeting of the Association of Bankers, Bangladesh (ABB) and Bangladesh Foreign Exchange Dealers' Association (BAFEDA) at the central bank headquarters in Dhaka on Thursday, meeting sources said.

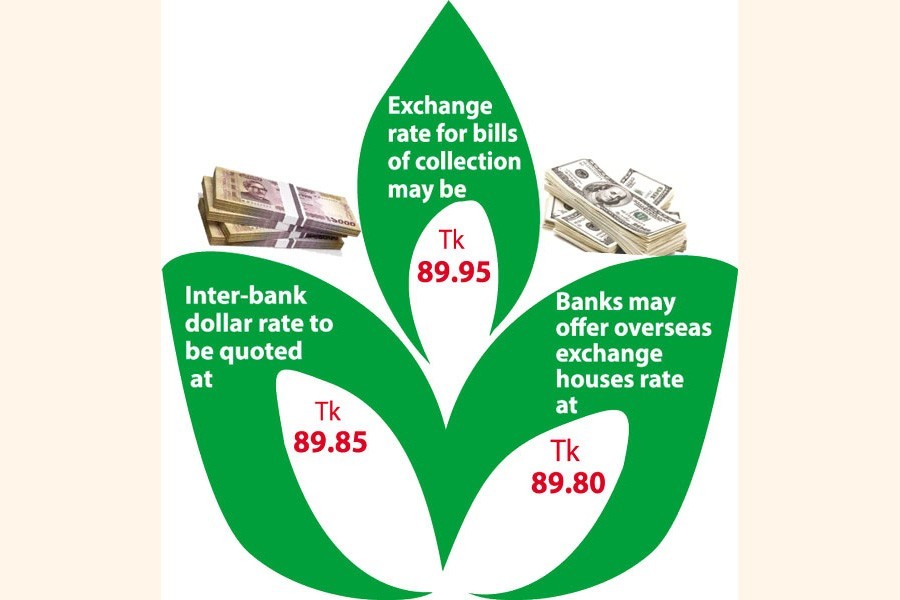

As per the initial decisions, the exchange rate for the sale of bills for collection, generally known as BC, particularly for imports, may be re-fixed at Tk 89.95 instead of the existing level of Tk 88.00 while the US dollar is likely to be quoted at Tk 89.85 each on the inter-bank market instead of Tk 87.90.

The Bangladesh Taka (BDT) will lose its value worth Tk 4.05 or 4.72 per cent in the slide since January 2022 if the local currency depreciates in line with the bankers' recommendation.

In the meantime, the local currency lost its value by Tk 2.10 or 2.45 per cent during the period under review. The dollar was traded at Tk 85.80 on January 08 last.

Besides, all the authorized dealer (AD) banks may be allowed to offer maximum Tk 89.80 to the overseas exchange houses engaged in remitting money for receiving remittances from abroad.

However, the banks may offer maximum Tk 88.95 instead of Tk 87.00 for purchasing export proceeds from the exporters.

The ABB-BAFEDA duo is expected to submit the recommendations to the central bank on Sunday, the sources added.

They also expect the central bank to execute the recommendations after examining its possible impact on the economy.

The ongoing inflationary pressure on the economy will be considered before implementation of the recommendations, according to the sources.

Talking to reporters, Selim R. F. Hussain, chairman of the ABB, said they would submit their recommendations to the central bank on Sunday.

Without divulging any recommendations, Mr Hussain, also managing director (MD) and chief executive officer (CEO) of BRAC Bank, said it would help bring stability in the country's forex market.

Earlier in the day, the central bank asked all the AD banks not to encash export proceeds of other banks' clients to help curb volatility on the market.

On the other hand, exporters will have to encash value-added portion out of their export proceeds by the next working day after completing regulatory processes.

The instructions were given at a tripartite meeting held at the same venue on the day with BB governor Fazle Kabir in the chair.

"A notification is likely to be issued shortly in this connection," a BB senior official told the FE, without elaborating.

The issues of quoting rates to the overseas exchange houses engaged in remitting money alongside avoiding encashment of export proceeds of other banks' clients were discussed at the joint meeting prominently.

The BB, however, warned the banks to act rationally on the market by complying with existing rules and regulations.

The banks have also been asked to submit reports relating to foreign- exchange transactions to the central bank properly, according to the BB officials.

At the meeting, the central bank assured the bankers that the BB would provide foreign-currency liquidity support to the scheduled banks continuously for settling their import-payment obligations.

"We'll continue our foreign-currency liquidity support to the banks in line with market requirement," Md Serajul Islam, BB's spokesperson, told the reporters after the meeting.

As part of the remedial move, the central bank sold $20 million directly to a start-owned commercial bank on Thursday to help in settling import payments.

The central bank has so far sold $5.83 billion from the reserves directly to the commercial banks as liquidity support for settling their import-payment obligations in the current fiscal year (FY), 2021-22.

Bangladesh's forex market sees volatility mainly due to higher outflow of foreign exchange following 'hefty growth' in import payments compared to the inflow in the last few months.