Bangladesh booked the highest-ever single-month export growth of 60.37 per cent, year on year, in October with overall US$4.72-billion income as apparel shipments rebounded from pandemic recession.

Sources in business circles say as readymade garment (RMG) industry kept its wheels rolling, under special arrangements, even amid the coronavirus onslaught, the clothing exporters were happy to make substantial shipments with supply chains restored and a demand surge in the reopening western world.

The country had received $2.94 billion in total from merchandise shipments in October last year, according to the provisional data released Tuesday by the Export Promotion Bureau (EPB).

This past October earnings also overshot the target set for the month by 36.47 per cent.

In October '21, out of the $4.72 billion, the country fetched $3.56 billion from RMG exports.

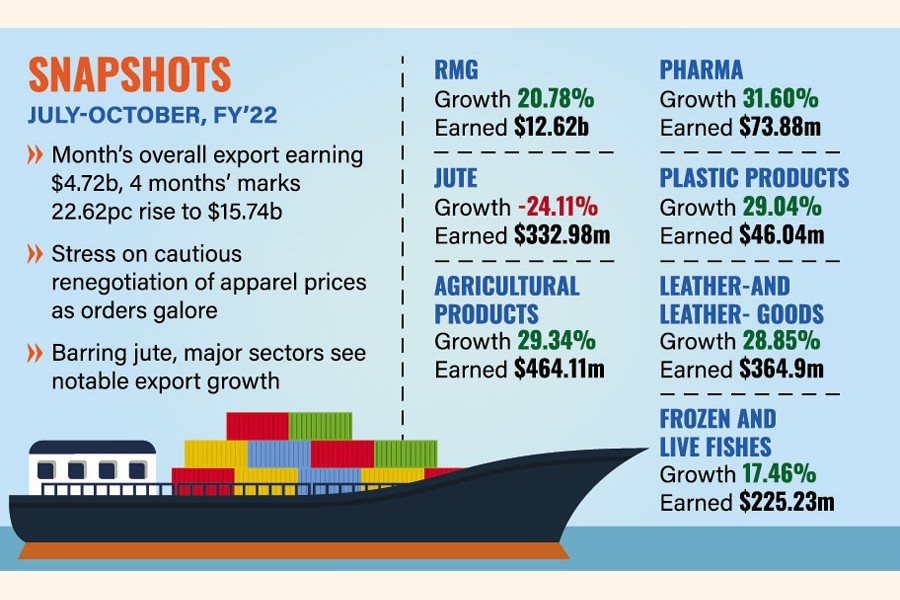

Besides, the overall merchandise exports during the first four months of the current fiscal year, 2021-22, also marked a growth of 22.62 per cent to $15.74 billion.

The July-October earning in 2020-21 fiscal year-which fell into full flash of the pandemic -- was US$12.84 billion. The overall export earnings also surpassed the set target by 13.33 per cent, according to EPB data.

Out of the total $15.74 billion worth of export income during the July-October period, the RMG sector fetched $12.62 billion, recording a 20.78-per cent growth compared to the corresponding period of last fiscal.

The country earned $10.45 billion from apparel exports in the corresponding period of FY'21. The sector's earnings also exceeded the set target by 12.41 per cent.

A breakdown of the clothing-sector performance shows that knitwear subsector of RMG earned $7.21 billion from exports, registering a growth of 24.27 per cent.

Earnings from export of woven garments amounted to $5.41 billion in the last four months, up by 16.41 per cent.

Home-textile exports also recorded 16.52 per cent growth to $ 412.78 million during the first four months of the current fiscal year.

Asked about the turnaround, Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) executive president Mohammad Hatem attributed country's export growth to RMG performance.

"The country has witnessed a significant rise in work orders since last July, which continues to date and will continue in the coming months," he says on an upbeat note about prospect of the main export of Bangladesh that sees a trade upturn particularly for certain setbacks in competing countries.

And the robust bounceback is specially spurred by increased global demand fuelled by improving Covid situation in the western countries.

Prices of raw materials, especially of yarn, also went up significantly following high prices of cotton and other logistic costs like container charges, he explained, adding that raw materials' price hike also pushed the price of locally made apparel items.

"But the price of apparel did not increase in line with the hike in raw- material prices," he said, claiming that yarn prices rose by 80 per cent compared to last year's.

There is no sign of yarn prices going down until June next due to cotton-price hike, he said, adding that garment-export growth might continue in the coming months, notwithstanding.

Talking to the FE, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) vice-president Md Shahidullah Azim explained that covid-led factory shutdowns in Vietnam, closure in India, crisis in Myanmar and the latest electricity crisis in China alongside buyers' previous move to explore China alternative due to its wage hike pushed foreign buyers here into Bangladesh.

"We did not get payments immediately after submitting the required documents--a pre-covid trend. We are facing deferred payment ranging from 120 days to 180 days," he noted.

He, however, said they should not be complacent over the rising trend in work orders. To sustain the growth they need to make timely shipment and maintain the supply chain.

He stressed sustaining the ease-of-doing-business environment.

Echoing Mr Hatem's views, he said CM (cost of making) of garments did not increase though value and volume of apparel went up mainly due to raw materials' high prices and growing demands respectively.

Cotton traders, textile and garment manufacturers recently called upon local exporters to be cautious about price negotiations taking the high global cotton prices into consideration.

They also suggested enhancing their negotiations with buyers for getting fair prices of locally made products instead of 'unhealthy' price- cut practice among exporters, as huge work orders are coming to Bangladesh.

Meanwhile, jute sector that demonstrated positive growth throughout the last fiscal recorded a 24.11-per cent fall in July-October period with earnings of $ 332.98 million, down from $438.78 million.

Earnings from agricultural produce that included vegetables, fruits and dry foods witnessed a growth of about 29.34 per cent. The sector's earnings stood at $464.11 million during the July-October period of FY'22.

Earnings from pharmaceutical exports stood at $73.88 million, marking 31.60 per cent growth.

Bangladesh fetched $364.9 million from leather-and leather-goods exports during the same period, registering a 28.85 per cent growth.

Export earnings from frozen and live fishes increased 17.46 per cent to $225.23 million in the first four months of FY '22.

According to the data, plastic products witnessed a growth of 29.04 per cent to $46.04 million.