Industries are again worried about their future as business activities have slowed down in the second quarter of 2021 following a strong resurgence of the Covid-19, according to a survey.

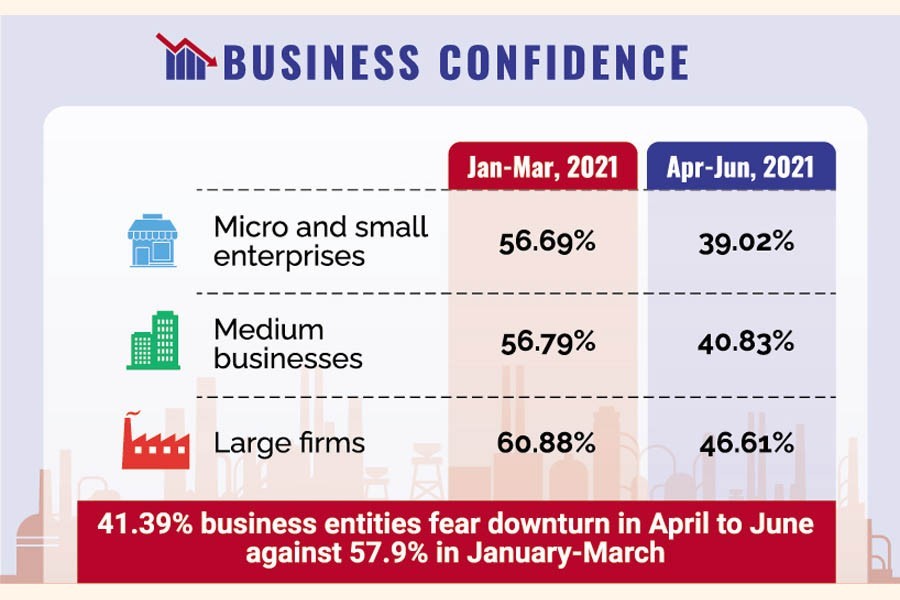

As per the Business Confidence Index (BCI), calculated in the survey, the number of confident business entities dropped to 41.39 per cent in the second quarter (April-June) of 2021 from 57.90 per cent in the previous quarter (January-March).

The findings of the survey, unveiled on Sunday, also showed that the sectors like RMG, textiles, pharmaceuticals, food processing, and financial institutions saw faster recovery during two previous quarters. Leather, light engineering, restaurant, transport and real estate sectors, however, witnessed a slower recovery.

The findings of the survey, conducted in April 2021, were published at a webinar titled "Covid-19 and Business Confidence in Bangladesh: Findings from the 4th round of a Nationwide Firm-Level Survey."

South Asian Network on Economic Modeling (SANEM) in collaboration with the Asia Foundation conducted the survey and organised the webinar to disseminate the findings.

Presided over by SANEM Executive Director Dr Selim Raihan, Asia Foundation Country Representative in Bangladesh Kazi Faisal Bin Seraj, former Lead Economist at the World Bank (WB) Bangladesh office Dr Zahid Hussain and Dhaka Chamber of Commerce & Industry (DCCI) President Rizwan Rahman spoke at the programme.

In his presentation, Dr Raihan said the confidence level varied between three groups of businesses--- large, medium and small. The erosion of confidence among micro and small enterprises is more than the medium and large enterprises.

About 39.02 per cent of the micro and small enterprises, are now confident about their business in upcoming months. Nearly 57 per cent of them were found to be confident in the previous quarter.

Of the medium businesses, the confidence level is positive for 40.83 per cent. It was 56.79 per cent during the January-March period of this year.

On the other hand, 46.61 per cent of large firms are still confident enough about their business. It was 60.88 per cent in the immediate past quarter, the SANEM executive director said.

The BCI is calculated by analysing six components of business--sales/exports, profitability, investment, employment, wage and business cost.

The survey showed that except for business cost, businesses are somewhat recovering from the disruptions caused by the pandemic in five other components.

To understand the business entities' dissatisfaction over the cost of business, Dr Raihan said, the SANEM has constructed the Enabling Business Environment Index (EBI) which revealed that the pandemic-time cost of business management hasn't yet reached the previous level.

The majority of firms cited complex taxation, higher property registration fees, corruption, lack of skilled workers, poor trade logistics, access to finance and Covid management as the key reasons for higher business cost, he said.

The survey also showed that before the fresh surge in Covid-19 transmission or the second wave of the pandemic, 34 per cent of the businesses witnessed strong recovery while 52 per cent moderate recovery and 14 per cent were at weak recovery stage.

In last one month, the perception of recovery changed sharply as was evident from the businesses' response. Currently, 67 per cent of the firms anticipate a weak recovery while 31 per cent a moderate one. Only 2.0 per cent hope for a strong recovery.

Speaking at the programme, Dr Zahid Hussain said since the middle of the last year, the country's economy has been in the midst of a recovery phase. But the trend is not the same for all sectors.

It is evident that the large firms are at an advantageous stage compared to the micro and small enterprises, he said, adding that the size of a firm, its location, performance history, and export status are the reasons that have been influencing their performance during the pandemic.

The former WB economist said the firms that have greater enterprise-level capacity to comply with the Covid-19 protocols, including wearing of masks, maintaining hygiene, working from home, are expected to perform better than other firms.

He mentioned that this offers a possible explanation behind why firms in the financial sector, garment, ICT, pharmaceuticals have performed better than the firms in other sectors.

He also pointed out that large firms often have more influence and power, leading to better bargaining power and hence, giving them better access to stimulus packages.

The DCCI president underlined the importance of the upcoming national budget and said it is expected to play a critical role in reshaping the business confidence.

Mentioning slower economic growth and private-sector investment in the country, he said revenue collection during the current fiscal is far behind the target which will eventually lead to mounting pressure on existing taxpayers.

"Corruption needs to be controlled and the tax system should be fully automated to accelerate revenue collection," he said.

Mr Rizwan further suggested that the central bank and the monetary institutions formulate strict guidelines for the banking sector to ensure that loans are disbursed to small and micro-enterprises.

Integration of digital technologies in SMEs is also required for rehabilitation and recovery from the pandemic, he said.

Building confidence of local businesses is mandatory to increase the flow of foreign direct investments (FDIs), he added.

The 4th round of the survey was conducted on 500 business entities--253 from the manufacturing sector and 250 from the service sector--during the period between April 6 and April 18 this year.