Bangladesh, Malaysia, and Pakistan are expected to be the biggest beneficiaries of the China-led US$1.5 trillion Belt and Road Initiative (BRI), according to a Nomura Group report.

The report also highlights potential risks to both China and countries that reap the benefits of the project, according to a report by www.asiaasset.com.

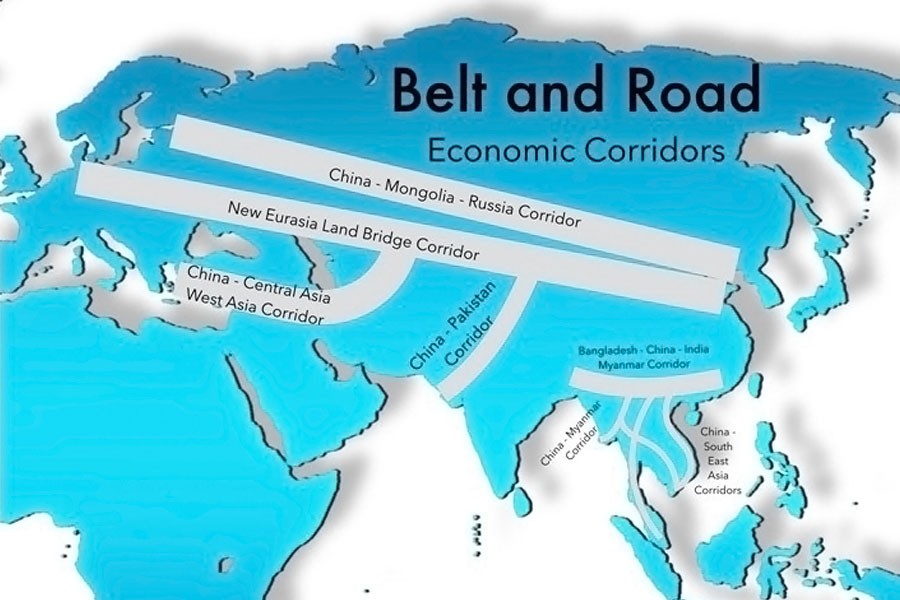

The BRI is a development strategy by the Chinese government involving multiple mega-infrastructure projects to improve connectivity between China and neighbouring regions such as South Asia, Southeast Asia, and parts of Europe.

Tokyo-based Nomura says Pakistan will be the biggest beneficiary in South Asia, thanks to China's $62 billion commitment to the China Pakistan Economic Corridor.

This comprises multiple infrastructure projects, mainly to modernise Pakistan's transportation network and energy infrastructure.

The Chinese investment is equivalent to 20 per cent of Pakistan's 2017 gross domestic product (GDP).

Nomura's April 17 report noted that Bangladesh was set to receive total investment of $38 billion, equivalent to 15 per cent of its 2017 GDP, under the Bangladesh-China-India-Myanmar Corridor.

The project is aimed at improving land, rail, water and air interconnection among the four countries.

In Southeast Asia, Nomura says Malaysia is "well ahead of the pack in securing Chinese investments", with $34.2 billion, or 10 per cent of the country's 2017 GDP, in various BRI-related infrastructure projects.

"However, China and countries receiving investments from China are exposed to multiple risks," according to the report.

For China, the risk is that some BRI projects may have low returns, which will put pressure on the country's financial sectors.

"For the recipients, an increased debt burden, sovereignty issues, execution delays and balance-of-payment risks could come to the fore," the report says.

Nevertheless, Nomura believes risks for China and the beneficiary countries "should be manageable".

Overall, it expects stocks related to infrastructure, financing and consumption to benefit the most from China's BRI investments.

The project is expected to create demand for capital goods and infrastructure, such as in the construction, industrial, telecommunication, transport and utilities sectors.

"Increased financing needs of BRI projects will benefit financials including lenders, exchanges and brokers," the report says.

It also expects the BRI-related infrastructure boom to be positive for contractors throughout Southeast Asia as well as South Korea. Companies that are expected to benefit include Korean heavy equipment manufacturers such as Hyundai Construction Equipment and Doosan Infracore.

The healthcare and tourism industries, mainly in Southeast Asia, are also expected to benefit from improved inter-connectivity.