A Tk100-billion bet is offered for boosting export and foreign-exchange earning as the central bank forms an export pre-finance scheme with the revolving fund under government drive for propping up reserves.

People familiar with the development at the Bangladesh Bank told the FE Sunday that this opens up a new window for the exporters as the dollops of assistance from the existing EDF are dwindling day by day.

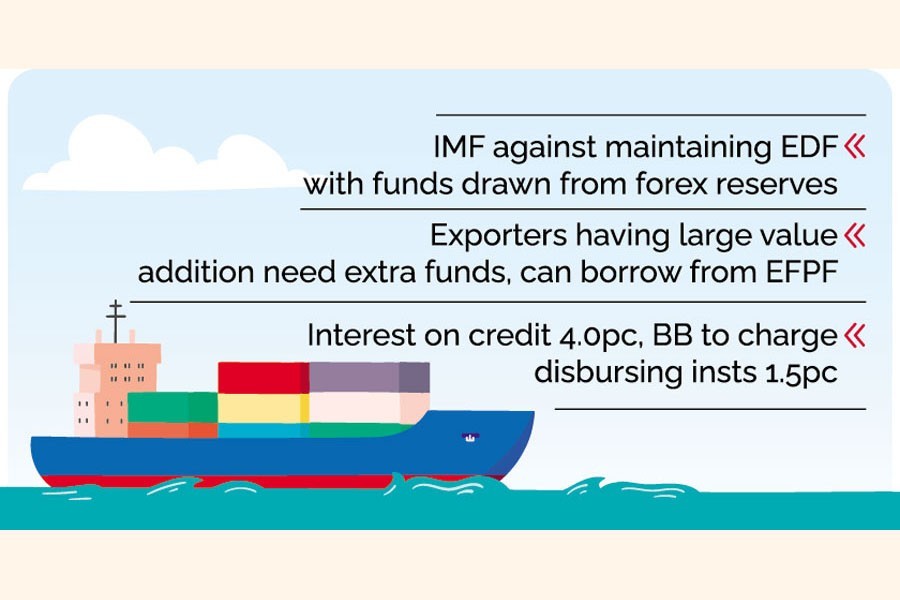

The International Monetary Fund (IMF) has asked the central bank not to maintain the Export Development Fund or EDF with funds drawn from the foreign-exchange reserves, deemed under pressure amid the planet-wide financial crunch. The EDF is now worth US$ 7.0 billion.

The central bank now pursues a policy wherein any inflow from the borrowers is not adding to the EDF further. It means that this way the EDF-fund size will be squeezing gradually.

When contacted, Md. Mezbaul Hoque, an executive director and spokesperson for the central bank, told the FE: "The new scheme is just parallel to the EDF."

Exporters who have large value additions need extra funds and they can take additional resources from this new financing facility.

But, he says, the exporters can also convert the funds to foreign exchange to meet their foreign- currency requirement.

The fund has been named 'Export Facilitation Pre-Finance Fund' and the money is to be given from Bangladesh Bank's own coffer.

To this effect, the central bank's Banking Regulation and Policy Department (BRPD) issued a circular, signed by its director Ms. Maksuda Begum, which says this facility will be extended only for export credit and back-to-back letter of credit.

Loan defaulters will not be eligible to borrow funds from the EFPF scheme.

Interest on funds will be 4.0 per cent per annum at the maximum.

Bangladesh Bank will charge interest at 1.5 per cent on outstanding pre-finance to the participatory financial institutions, namely banks and other financial institutions.

The circular says selection of borrowers, loan sanction, taking securities against loan, disbursement, documentation, determination of debt-equity ratio, proper utilization and monitoring of loan to be ensured by participatory financial institutions on the basis of existing circulars issued by the Bangladesh Bank, their own rules and banker-customer relationship.

Total responsibility and liability regarding the loan risk and loan recovery will be vested in the financial institution.

This fund will not be considered against credit allowed under export order/export credit issued by a shell company.

This latest step comes as part of government efforts to ramp up Bangladesh's falling reserves that hover over $34 billion by official account. However, the recent IMF appraisal mission was reported to have discounted the amount of $7.0 billion transferred from the reserves into the EDF.

Import-cost escalation under pressure from high global inflation fuelled by pandemic disruptions and the Ukraine war caused substantial repletion of the country's forex reserves, warranting belt-tightening on import and spending.